ПРИБЫЛЬ ГАЗПРОМА 2 093 МЛРД. РУБ.

ГАЗПРОМ - 28 апреля 2022 - Сегодня ПАО «Газпром» представило прошедшую аудит консолидированную финансовую отчетность за год, закончившийся 31 декабря 2021 года, подготовленную в соответствии с Международными стандартами финансовой отчетности.

В таблице ниже представлены основные показатели консолидированного отчета о совокупном доходе по МСФО за годы, закончившиеся 31 декабря 2021 года и 31 декабря 2020 года. Все суммы в таблице представлены в миллионах российских рублей.

| |

За год, закончившийся

31 декабря

|

| |

2021 года

|

2020 года

|

|

Выручка от продаж

|

10 241 353

|

6 321 559

|

|

Чистый (расход) доход по торговым операциям с сырьевыми товарами на ликвидных торговых площадках Европы

|

(92 397)

|

31 349

|

|

Операционные расходы

|

(7 681 410)

|

(5 665 762)

|

|

Убыток от обесценения финансовых активов

|

(56 285)

|

(72 295)

|

|

Прибыль от продаж

|

2 411 261

|

614 851

|

| |

|

|

|

Финансовые доходы

|

615 167

|

747 400

|

|

Финансовые расходы

|

(499 110)

|

(1 365 518)

|

|

Доля в прибыли ассоциированных организаций и совместных предприятий

|

242 196

|

136 736

|

|

Прибыль до налогообложения

|

2 769 514

|

133 469

|

| |

|

|

|

Расходы по текущему налогу на прибыль

|

(452 817)

|

(75 606)

|

|

(Расходы) доходы по отложенному налогу на прибыль

|

(157 611)

|

104 544

|

|

Налог на прибыль

|

(610 428)

|

28 938

|

| |

|

|

|

Прибыль за год

|

2 159 086

|

162 407

|

| |

|

|

|

Прибыль за год, относящаяся к:

|

|

|

|

Акционерам ПАО «Газпром»

|

2 093 071

|

135 341

|

|

Неконтролирующей доле участия

|

66 015

|

27 066

|

| |

2 159 086

|

162 407

|

Основным фактором, оказавшим влияние на финансовый результат, стало увеличение цен на газ и нефть. Следствием этого стало увеличение выручки от продаж, а также рост расходов на покупные газ и нефть.

Чистая выручка от продажи газа увеличилась на 2 606 694 млн руб., или на 85%, с 3 049 339 млн руб. за год, закончившийся 31 декабря 2020 года, до 5 656 033 млн руб. за год, закончившийся 31 декабря 2021 года.

Чистая выручка от продажи продуктов нефтегазопереработки увеличилась на 796 788 млн руб., или на 44%, за год, закончившийся 31 декабря 2021 года, по сравнению с прошлым годом и составила 2 595 184 млн руб. Увеличение чистой выручки от продажи продуктов нефтегазопереработки в основном связано с ростом средних цен во всех географических сегментах.

Чистая выручка от продажи сырой нефти и газового конденсата увеличилась на 394 799 млн руб., или на 81%, за год, закончившийся 31 декабря 2021 года, по сравнению с прошлым годом и составила 882 148 млн руб. Изменение в основном связано с увеличением чистой выручки от продажи сырой нефти, преимущественно обусловленным ростом средних цен на сырую нефть.

Операционные расходы увеличились на 2 015 648 млн руб., или на 36%, за год, закончившийся 31 декабря 2021 года, по сравнению с прошлым годом.

Основное влияние на рост операционных расходов оказало увеличение расходов по статьям «Покупные газ и нефть» и «Налоги, кроме налога на прибыль».

За год, закончившийся 31 декабря 2021 года, сальдо курсовых разниц, отраженное в составе «Чистого финансового дохода (расхода)», сформировало прибыль в размере 139 944 млн руб. по сравнению с убытком в размере 604 810 млн руб. за прошлый год.

За год, закончившийся 31 декабря 2021 года, величина прибыли, относящейся к акционерам ПАО «Газпром», составила 2 093 071 млн руб.

Приведенный показатель EBITDA (рассчитываемый как сумма операционной прибыли, амортизации, убытка от обесценения или восстановления убытка от обесценения финансовых и нефинансовых активов, за вычетом оценочного резерва под ожидаемые кредитные убытки по дебиторской задолженности и резерва под снижение стоимости авансов выданных и предоплаты) увеличился на 2 220 349 млн руб., или на 151%, за год, закончившийся 31 декабря 2021 года, по сравнению с прошлым годом и составил 3 686 890 млн руб. Данное изменение в основном связано с увеличением выручки от продаж.

Чистая сумма долга (определяемая как сумма краткосрочных кредитов и займов и текущей части долгосрочной задолженности по кредитам и займам, краткосрочных векселей к уплате, долгосрочных кредитов и займов, долгосрочных векселей к уплате за вычетом денежных средств и их эквивалентов) уменьшилась на 1 002 916 млн руб., или на 26%, с 3 872 695 млн руб. по состоянию на 31 декабря 2020 года до 2 869 779 млн руб. по состоянию на 31 декабря 2021 года. Данное изменение в основном связано с увеличением остатков денежных средств и их эквивалентов.

Полная PDF версия

-----

GAZPROM PROFIT RUB 2,093 BLN

GAZPROM - April 28, 2022 - Today PJSC Gazprom issued its audited consolidated financial statements prepared in accordance with International Financial Reporting Standards for the year ended December 31, 2021.

The table below presents the main items of the consolidated statement of comprehensive income prepared in accordance with IFRS for the years ended December 31, 2021 and December 31, 2020. All amounts are presented in millions of Russian Rubles.

| |

Year ended December 31, |

| |

2021

|

2020

|

|

Sales

|

10,241,353

|

6,321,559

|

|

Net (loss) gain from trading activity

|

(92,397)

|

31,349

|

|

Operating expenses

|

(7,681,410)

|

(5,665,762)

|

|

Impairment loss on financial assets

|

(56,285)

|

(72,295)

|

|

Operating profit

|

2,411,261

|

614,851

|

|

|

|

|

|

Finance income

|

615,167

|

747,400

|

|

Finance expenses

|

(499,110)

|

(1,365,518)

|

|

Share of profit of associates and joint ventures

|

242,196

|

136,736

|

|

Profit before profit tax

|

2,769,514

|

133,469

|

|

|

|

|

|

Current profit tax expenses

|

(452,817)

|

(75,606)

|

|

Deferred profit tax (expenses) income

|

(157,611)

|

104,544

|

|

Profit tax

|

(610,428)

|

28,938

|

|

|

|

|

|

Profit for the period

|

2,159,086

|

162,407

|

|

|

|

|

|

Profit for the period attributable to:

|

|

|

|

Owners of PJSC Gazprom

|

2,093,071

|

135,341

|

|

Non-controlling interest

|

66,015

|

27,066

|

|

|

2,159,086

|

162,407

|

The main factor that affected the financial result was an increase in gas and oil prices. This resulted in an increase in sales and an increase in the cost of purchased gas and oil.

Net sales of gas increased by RUB 2,606,694 million, or 85 %, from RUB 3,049,339 for the year ended December 31, 2020 to RUB 5,656,033 million for the year ended December 31, 2021.

Net sales of refined products increased by RUB 796,788 million, or 44 %, for the year ended December 31, 2021 compared to the prior year and amounted to RUB 2,595,184 million. The increase in net sales of refined products was mainly due to an increase in average prices in all geographic segments.

Net sales of crude oil and gas condensate increased by RUB 394,799 million, or 81 %, for the year ended December 31, 2021 compared to the prior year and amounted to RUB 882,148 million. The change was mainly due to an increase in net sales of crude oil primarily caused by an increase in average prices of crude oil.

Operating expenses increased by RUB 2,015,648 million, or 36 %, for the year ended December 31, 2021 compared to the prior year.

The increase in operating expenses was mainly caused by the increase of expenses in the items “Purchased gas and oil” and “Taxes other than on profit”.

The balance of foreign exchange differences reflected within the item “Net finance income (expense)” produced the gain in the amount of RUB 139,944 million for the year ended December 31, 2021 compared to the loss in the amount of RUB 604,810 million for the prior year.

For the year ended December 31, 2021 profit attributable to the owners of PJSC Gazprom amounted to RUB 2,093,071 million.

Adjusted EBITDA (calculated as the sum of operating profit, depreciation, impairment loss or reversal of impairment loss on financial assets and non-financial assets, less changes of allowance for expected credit losses on accounts receivable and impairment allowance on advances paid and prepayments) increased by RUB 2,220,349 million, or 151 %, for the year ended December 31, 2021 compared to the prior year and amounted to RUB 3,686,890 million. This change was mainly due to an increase in sales.

Net debt balance (defined as the sum of short-term borrowings and the current portion of long-term borrowings, short-term promissory notes payable, long-term borrowings, long-term promissory notes payable, less cash and cash equivalents) decreased by RUB 1,002,916 million, or 26 %, from RUB 3,872,695 million as of December 31, 2020 to RUB 2,869,779 million as of December 31, 2021. This change was mainly due to an increase in cash and cash equivalents.

Full PDF version

-----

Earlier:

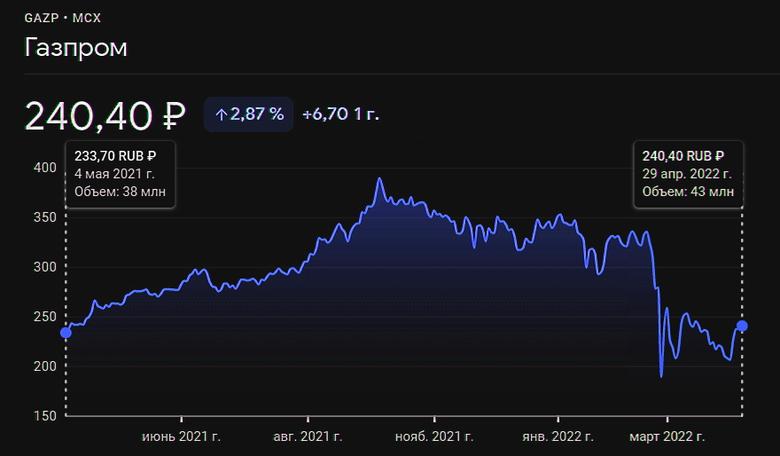

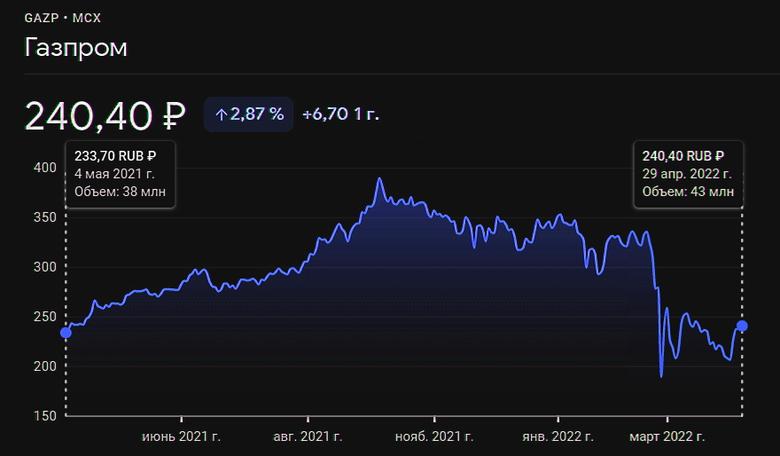

2022, April, 28, 14:05:00

EUROPE PLAN TO PAY IN RUBLES

Gas distributors in Germany, Austria, Hungary and Slovakia are planning to open rouble accounts at Gazprombank in Switzerland in order to satisfy a Russian requirement for payments in its own currency

2022, April, 28, 13:55:00

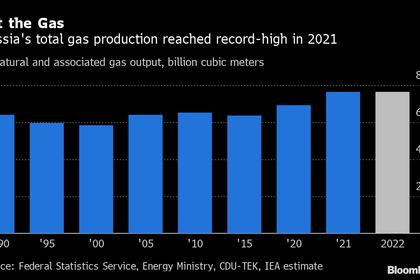

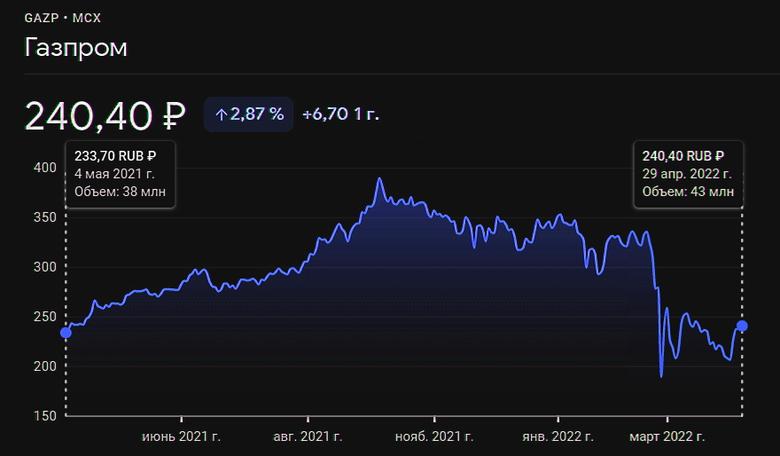

GAZPROM GAS PRODUCTION WILL DOWN

Russia's Economy Ministry expects oil and gas production to fall this year, according to a document seen by Reuters, with gas output declining to 702.4-720.9 bcm from 763.5 bcm in 2021.

2022, April, 27, 11:45:00

EUROPEAN GAS PRICES UP

"As of the end of the business day on April 26, Gazprom Export had not received payments for gas supplies in April from Bulgargaz (Bulgaria) and PGNiG (Poland) in rubles," Gazprom said in a statement.

2022, April, 15, 12:00:00

RUSSIAN GAS IN ROUBLES BREAK SANCTIONS

Putin's decree imposed an obligation on EU gas buyers to open at least two special accounts - one for euros or dollars and one for roubles - with Gazprombank and channel all gas payments through the bank.

2022, April, 11, 13:00:00

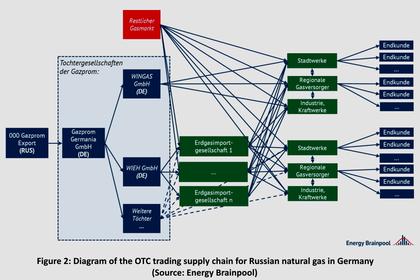

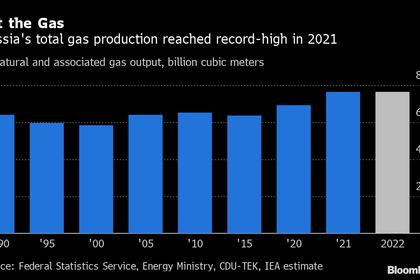

GAZPROM GERMANIA UNDER TRUSTEESHIP

Germany and Europe's dependence on Russian natural gas supplies cannot be eliminated in the short term without considerable economic damage.

2022, March, 28, 11:50:00

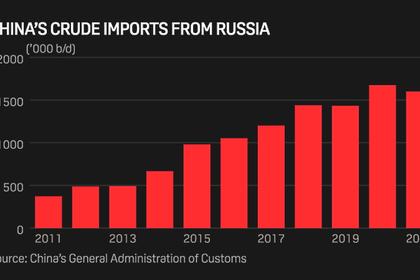

RUSSIAN ASSETS WITHOUT RISKS

"Currently the company's operations and business in Russia are largely running smooth and there are no signs of asset impairment," Sinopec's President Yu Baocai told investors and reporters during a call following its 2021 earnings release.

2022, March, 1, 11:50:00

SHELL LEAVES GAZPROM

The Board of Shell plc (“Shell”) announced its intention to exit its joint ventures with Gazprom and related entities, including its 27.5 percent stake in the Sakhalin-II liquefied natural gas facility, its 50 percent stake in the Salym Petroleum Development and the Gydan energy venture. Shell also intends to end its involvement in the Nord Stream 2 pipeline project.

All Publications »

Tags:

ГАЗПРОМ,

GAZPROM