RUSSIAN OIL DISCOUNTS

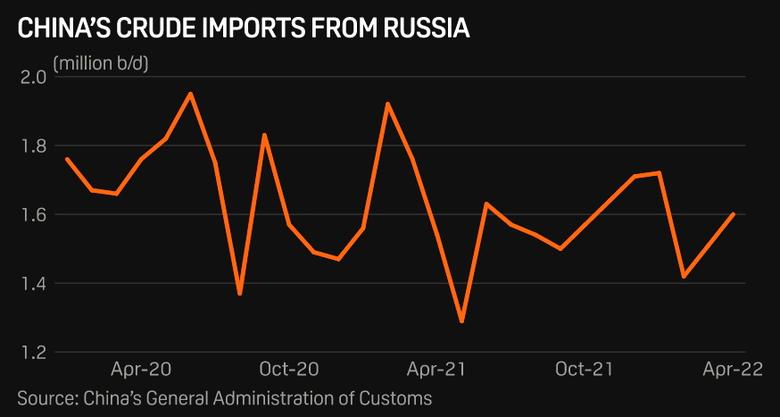

PLATTS - 23 May 2022 - Hefty discounts on Russian crude are increasingly whetting the appetite of China's independent refineries, but Beijing may not rush into shipping in plentiful cargoes from the non-OPEC supplier at current prices for strategic petroleum reserves, analysts said.

China's SPR stock stood at 325.71 million barrels as of May to account for 67% of the state crude reserve storage capacity that Kpler monitors. That was 6.12 million barrels lower than the historical high of 341.83 million barrels in June 2020, Kpler's data showed.

"China won't be violating rules by building SPR stocks with cheap Russian crudes," said a Beijing-based official with a state-owned trading house.

However, overall global crude prices were still above expectations of the government, despite the discounts, analysts added.

"Crude prices are still at a high level which does not make economic sense to replenish stocks despite the deep discounts of Russian barrels," said a source at a Zhoushan SPR storage site in eastern Zhejiang province.

He added that since Beijing had not released a lot of oil from its SPRs in the past years, the tanks were still holding robust level of stocks and there was no urgent need to replenish.

Although spot ESPO, Sokol and Urals crudes were offered at steep discounts, the timing does not bode well to build reserves as the spot market price differentials and outright settlement prices were two different mechanisms, said a feedstock trading strategist at a state-run Chinese petroleum and chemicals company that regularly imports Russian crude.

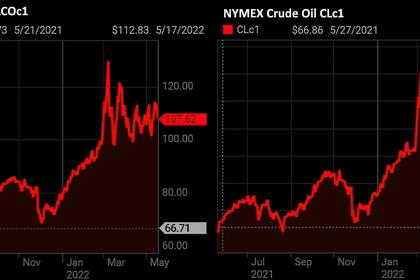

China's typical stance is to aggressively build crude stocks when outright prices are very low, like $60/b or below, not when mere spot price differentials are low, the trading strategist added.

"Spot cargo discounts are seen as deep as $10/b for many Russian grades but the outright benchmark prices are still above $100/b, which essentially means the final settlement prices would still be above $80/b-$90/b," the trading strategist said.

Margins and run rates recover

Sources and analysts said the discounted Russian Urals had helped to boost refining margins and operation rates for independent refineries.

Russian Urals were offered at a discount of $10-$11/b against the ICE Brent Futures on a delivered basis in Shandong market, lower from around $7-$8/b in previous weeks, according to refinery sources.

Prior to this, only sanctioned barrels, such as Iranian crudes and Venezuelan Merey crudes, were sold at such deep discounts.

ESPO was offered at a discount of $3-$5/b for June-July loading, against ICE Brent Futures, on a DES Shandong basis. "Deals of Urals were last heard done at a discount of $8/b," said a trade source.

These cargoes had become attractive as crudes such as Western African barrels were offered at premiums of above $4/b for July-loading.

"Very few deals for those regular grades like WAF or Tupi have been heard, as most independent refineries were shying away," said the source.

Urals were even more attractive than Iranian barrels which have been sold at heavy discounts in the past months. Iranian Light crude having similar quality like Urals were offered at a slightly higher basis of discounts at $7-$8/b, according to sources.

Several Dongying-based refineries were heard have secured some Urals cargoes in the past weeks, with the first arrivals expected in late May or early June at Shandong ports. Sources said sulfur content of some Urals were around 1.6%-1.8%, slightly higher than Iranian Light crudes.

Trade sources added that a blended feedstock -- made from the mixture of Iranian Light crude and Venezuelan Merey crude -- were also recently offered at around $11-$12/b discount against ICE Brent Futures.

"It has been very difficult to sell Merey crudes due to weak demand for producing asphalt. Hence, the new blended crude," said one source.

Feedstock costs could ease further

Traders said feedstock costs for independent refineries could fall further given the current high flat prices in international market.

In April, bitumen blend and Iranian crudes, accounted for almost half of those feedstock imports to the country's independent sector in Shandong, according to S&P Global Commodity Insights data.

Independent refineries have been lifting utilization rates at their facilities, with the refining margins improved, ever since late April.

According to JLC, the weekly run rate at 40 independent refineries in Shandong, recovered slightly to around 57.4% as of May 18, up by 1.8 percentage point from a week earlier, a third straight month-on-month increase since the end of April.

"Margins have been improving and refineries have been raising throughput along the way," said an analyst with JLC.

Independent refineries Tianhong Chemical and Shanneng Petrochemical had re-started after maintenance.

The weekly average run rates would likely rise to around 56-57% in May, compared with around 50% in April, according to the analyst.

Refinery sources said the operational environment had improved as they have been able to postpone the payment of the VAT tax, in accordance with the government's policy to support the economy given the weak economic environment.

-----

Earlier: