STRENGTHENING THE RUSSIAN FINANCIAL SYSTEM

PLATTS - 24 May 2022 - Russia will increasingly use barter and specific currency transactions for energy supplies, an S&P Global Commodity Insights analyst said May 24, as a default looms for billions of dollars in foreign currency reserves if the US allows a key waiver to expire May 25.

"Ultimately, Russia is likely to see its financial system backed by commodity collateral," Alan Struth, manager, macroeconomics & oil demand, global oil at Platts Analytics. "Its currency will be formally backed by commodity exports and transactions."

The US Treasury Department granted the waiver for Russian bond payments to US investors in late February. It authorizes payments related to debt or equity Russian banks VEB, Otkritie, Sovcombank, Sberbank and VTB, that were sanctioned in response to Russia's invasion of Ukraine.

A White House spokeswoman did not respond May 24 to a request for comment on the waiver deadline.

Analysts see sanctions as having a bigger impact on energy trade than a government default, with the availability of funding and insurance dependent on the credit rating of the buyer, rather than the seller.

"The credit ratings of key Russian exporters across oil, gas, metals, fertilizers, etc have already been very negatively impacted by the Ukraine war and sanctions," George Voloshin of Aperio Intelligence said. "Problems with buying Russian commodities have more to do with sanctions and the resulting financial and logistical issues rather than with the credit ratings of specific entities."

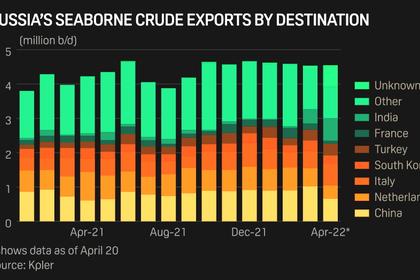

Russia is already grappling with sanctions that have led to seizure of Russian assets abroad, complications in payment for Russian energy supplies, and traditional buyers turning away from Russian exports.

This has had a major impact on prices for Russia's key crude grade Urals. Platts' assessment of Urals May 23 was $79.065, compared with Dated Brent at $115.525/b. On Feb. 23, the day before the invasion, Platts assessed Urals at $90.72/b and Dated Brent at $100.48/b.

The Russian economy ministry forecasts an average Urals price of $80.10/b in 2022.

Analysts expect the war to prove costly in the long-term for Russia's finances. Despite recent high oil and gas prices since the invasion began Feb. 24., the conflict is set to result in Russia losing market share for its hydrocarbon exports.

Financial sanctions, and production declines, which S&P Global predicts will reach 2.8 million b/d in August, could also diminish Russia's influence within OPEC+.

Non-dollar trade

Sanctions introduced this year are accelerating Russia's bid to increase energy trading in currencies other than the US dollar.

Maria Shagina, a visiting senior research fellow at the Finnish Institute of International Affairs, said that sanctions are raising questions about whether central banks' foreign reserves can be considered sanction-proof, and whether the US dollar is a safe asset.

"The overuse of sanctions will further motivate countries to build a parallel financial system and rally their trading partners around non-dollar currencies," Shagina said.

Russian President Vladimir Putin signed a decree March 31 requiring EU buyers of Russian natural gas to transfer funds in euros or dollars to a new Russian account at Gazprombank, from which payments would be made to Gazprom in rubles after conversion.

Countries that refused to comply with the new mechanism, including Poland, Bulgaria and Finland, have been cut off from Russian supplies. Fears remain that other countries will be cut off, as more payment deadlines come up in the coming days.

However, some of the EU's biggest buyers of Russian gas, including Germany's Uniper, Italy's Eni and France's Engie have said that they have made arrangements to be able to continue paying for Russian gas.

Nonetheless, concerns about the impact of the new payment terms on Russian gas deliveries to Europe have kept prices at sustained highs since late March.

The TTF month-ahead price jumped 8% to Eur105.50/MWh ($111/MWh) on April 27, the day that Russia suspended deliveries to Poland and Bulgaria, according to S&P Global Commodity Insights data.

Prices remain high, with the TTF month-ahead contract assessed by S&P Global on May 23 at Eur84.38/MWh, still 240% higher year on year.

-----

Earlier: