ASIA'S LNG DEMAND WILL RISE

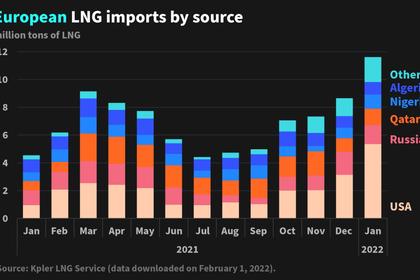

PLATTS - 07 Jun 2022 - Asia is witnessing the emergence of incremental demand for LNG spot cargoes as it enters the summer season, with firm demand amid continued supply risks stemming from the Russia-Ukraine war likely to keep LNG prices underpinned in the coming months, tempering the impact of China's recent lackluster consumption.

Regional LNG import demand has fallen close to 10% compared to last year's levels so far this year, but higher heating loads are expected to support an uptick in consumption in the coming months, which could spur some spot procurement across Northeast Asia, said Jeffrey Moore, Manager LNG Analytics Asia at S&P Global.

While some price-sensitive buyers are staying on the sidelines waiting for prices to drop, buyers in Asia are already chasing cargoes because of the summer demand season, an industry source in Singapore said.

Taiwan, South Korea, Japan and Thailand were still less price-sensitive compared with the likes of Bangladesh and Pakistan, he noted.

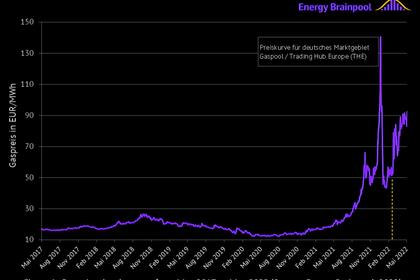

Given that a lot of European companies were opting out of paying for Russian gas in rubles, they would have to scout for additional spot cargoes while Asia demand was strong, he said, adding that prices were likely to stay supported above $20/MMBtu in the near term.

The Platts JKM for July was assessed at $23.668/MMBtu June 6, S&P Global Commodity Insights data showed.

Northeast Asia demand lends support

Taiwan imported 1.72 million mt of LNG in April, up 2.2% month on month and up 14.8% year on year, latest Taiwan Bureau of Energy data showed June 6. This comes due to the restocking of natural gas inventories in April in preparation for peak summer demand, sources said.

In Japan, LNG imports jumped 12.1% on the year to 5.57 million mt in April, marking the first year-on-year increase since August 2021, boosted by imports from Australia, Malaysia, Papua New Guinea and Indonesia, data from the country's finance ministry showed.

Japan bought over 10 spot cargoes for April delivery despite elevated prices, S&P Global data showed.

The country's nuclear output is expected to fall by more than 30% this summer from the same period a year earlier, which will help support gas demand despite stronger generation expected from coal-fired and even oil-fired units, Moore said.

"JERA has been buying a lot, but Japan is still not done buying... everything is pointing to a hot summer," a Singapore-based trader said.

"We should see some recovery on the demand side, but it will be interesting to see the inventory situation at the end of summer because it will change the way they restock or buy in the shoulder month season," he added.

South Korea's nuclear output is expected to pick up this summer compared to year-ago levels, which will mitigate a significant uptick in its LNG consumption compared to last year, although the country will still certainly need to import more as temperatures continue to push higher, Moore said.

South Korean importers, including state-run Korea Gas Corp. and private power utility and city gas provider SK E&S, have already paid $2.396 billion for shipments in April, up from $1.83 billion a year earlier, S&P Global reported earlier.

Taking stock of India, China

Buyers from Pakistan, Bangladesh and India have also sought June-July supply, sources said.

In India, GAIL has been mandated to import more LNG for city gas distribution networks as the country's energy requirements soar.

A policy guideline from the Ministry of Petroleum and Natural Gas Division on May 6 said GAIL will supply pooled natural gas 2.5% over and above the 100% requirement of the compressed natural gas for transport and the piped natural gas domestic segments of each geographical area mentioned in the quarterly allocation period.

For now, GAIL will buy one LNG cargo from the spot market every 30-40 days to meet city gas demand, GAIL Chairman and Managing Director Manoj Jain said May 27.

Meanwhile, China has been acting as a drag for the rest of Asia when it comes to LNG demand, sources said.

"I am not sure when the impact of the recent lockdowns in China will end and will translate into a recovery of industrial demand," a trading source based in Singapore said.

China remains the largest wildcard in the region as high spot prices, a weakening macroeconomic environment and competition from alternative fuels and supplies has so far limited its LNG procurement, Moore said.

However, as lockdown measures are lifted across major metropolitan areas, imports are expected to pick up, especially in the third quarter and into Q4, although as a whole LNG imports are expected to decline in 2022 from 2021 levels, he added.

"We are looking for near-term opportunities to buy spot cargoes, looking for $18/MMBtu," a buyer in China said.

However, if prices were to fall to $18/MMBtu, domestic consumers might wait for prices to fall further, he said, adding that end-users would retreat to lower prices only after having secured their "safety position" first.

-----

Earlier: