GLOBAL OIL DEMAND 2022: +3.4 MBD ANEW

OPEC - 14 June 2022 - OPEC MONTHLY OIL MARKET REPORT

Oil Market Highlights

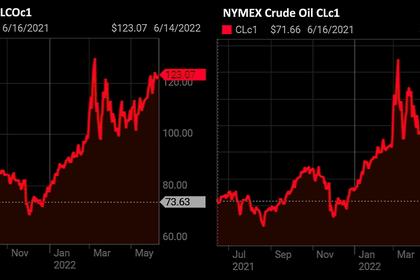

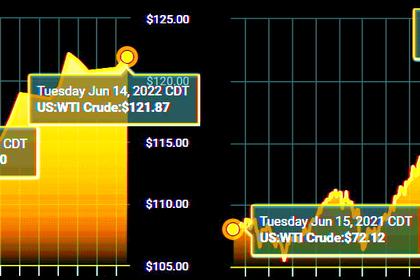

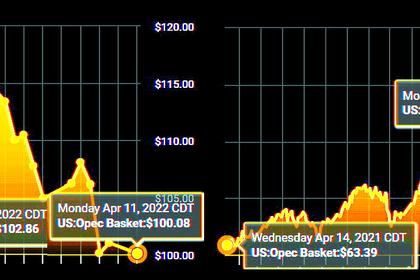

Crude Oil Price Movements

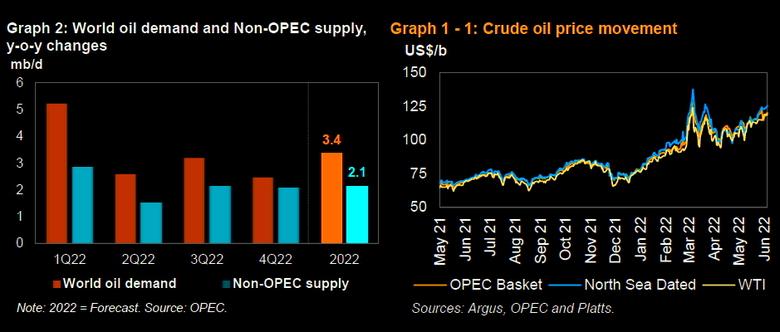

Crude oil spot prices recorded solid gains in May, buoyed by strong physical crude market fundamentals. Tight oil product markets and high refining margins have prompted refineries to increase throughputs, boosting crude demand, specifically for light sweet crude. Planned and unplanned oil supply disruptions in several regions contributed to tightening fundamentals. The OPEC Reference Basket increased $8.23, or 7.8%, to settle at $113.87/b. Oil futures prices rallied in May driven by tightening oil products markets, near-term global oil supply risks amid continued geopolitical tensions in Europe, as well as the prospect of a firm recovery in demand after Chinese authorities started to gradually ease COVID-19-related lockdown measures. The start of the summer driving season in the Northern Hemisphere provided further support. The ICE Brent front-month contract rose $6.04, or 5.7%, in May to average $111.96/b and NYMEX WTI increased by $7.62, or 7.5%, to average $109.26/b. As a result, the Brent/WTI futures spread narrowed by $1.58 to average $2.70/b. Backwardation in the Brent, WTI and Dubai futures markets strengthened significantly in May and the near-month contract spreads moved into deep backwardation as the outlook for oil market fundamentals tightened. Hedge funds and other money managers turned bullish on crude prices in May, raising their total futures and options net-long positions in ICE Brent and NYMEX WTI by 18.2%.

World Economy

World economic growth in 2022 remains broadly unchanged at 3.5%, following growth of 5.8% in 2021. US GDP growth for 2022 is revised down to 3.0% from 3.2%, after growth was reported at 5.7% for 2021. Euro-zone economic growth for 2022 is revised down to 3.0% from 3.1%, following growth of 5.4% in 2021. Japan’s economic growth for 2022 is revised down to 1.6% from 1.8%, after growth of 1.7% in 2021. China’s 2022 growth remains unchanged at 5.1%, after growth of 8.1% in 2021. India’s 2022 GDP growth remains at 7.1%, after 2021 growth of 8.3%. Brazil’s economic growth forecast for 2022 is revised up to 1.2% from 0.7% in the previous assessment, following growth of 4.6% in 2021. For Russia, the 2022 GDP growth forecast is unchanged, showing a contraction of 6.0%, following reported growth of 4.7% in 2021. Consumption remains robust, especially in the advanced economies, with an expected continued recovery particularly evident in the contact-intensive services sector, which includes travel and transportation activity, leisure and hospitality. However, significant downside risks prevail, stemming from ongoing geopolitical tensions, the continued pandemic, rising inflation, aggravated supply chain issues, high sovereign debt levels in many regions, and expected monetary tightening by central banks in the US, the UK, Japan and the Euro-zone.

World Oil Demand

World oil demand growth in 2021 remained unchanged at 5.7 mb/d. Oil demand in the OECD increased by 2.6 mb/d in 2021, while the non-OECD showed growth of 3.1 mb/d. For 2022, world oil demand growth is broadly unchanged to stand at 3.4 mb/d. Within the quarters, the 2Q22 is revised down, reflecting the lockdown in some part of China leading to lower-than-expected demand, while 2H22 is revised up on expectations of higher demand during the summer holiday and driving season. Oil demand growth in 2022 is forecast at 1.8 mb/d in the OECD and 1.6 mb/d in the non-OECD.

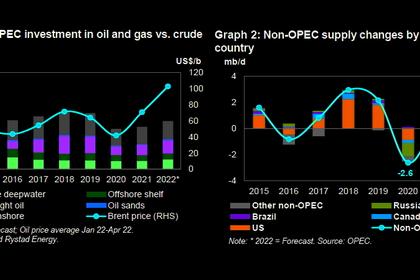

World Oil Supply

The estimate for non-OPEC liquids supply growth in 2021 remains broadly unchanged at 0.6 mb/d. Total US liquids production is estimated to have increased by 0.1 mb/d y-o-y in 2021. The forecast for non-OPEC supply growth in 2022 is revised down by 0.25 mb/d to 2.1 mb/d. Russia’s liquids production for 2022 is revised down by 0.25 mb/d. The US liquids supply growth forecast for 2022 remains marginally unchanged at 1.3 mb/d. The main drivers of liquids supply growth in 2022 are expected to be the US, Brazil, Canada, Kazakhstan, Guyana and China, while declines are expected mainly in Russia, Indonesia and Thailand. OPEC NGLs and non-conventional liquids production in 2021 is revised up by 20 tb/d from last month’s assessment, representing growth of 0.1 mb/d y-o-y to average 5.3 mb/d. Growth of 0.1 mb/d is also expected for 2022. In May, OPEC-13 crude oil production decreased by 176 tb/d m-o-m to average 28.51 mb/d, according to available secondary sources.

Product Markets and Refining Operations

Refinery margins on all main trading hubs continued to increase in May, albeit at a considerably lower rate than in the previous months. With the conclusion of the peak turnaround season, rising product output started to limit the contraction in global product balances. In the Western Hemisphere, gasoline was the sole positive performer and margin driver across the barrel. Gasoline inventories declined in the US, while gasoil stocks showed some recovery. In Asia, all product markets strengthened, with the exception of naphtha and fuel oil, as regional transport fuel consumption improved amid the roll back of COVID-19 lockdown measures in China. Going forward, refinery intakes are expected to rise further to accommodate a seasonal pickup in fuel consumption and to replenish stocks.

Tanker Market

Dirty tanker spot freight rates fell back from the sharp gains seen the previous month. Suezmax rates declined 37% m-o-m and Aframax fell 22% over the same period, as ample availability overwhelmed the upward pressure caused by trade dislocations. VLCC rates declined 20%, with losses both East and West of Suez. In contrast, clean rates continued to surge, up 37% on average amid tight product markets. Dirty spot freight rates are likely to remain capped by ample tanker supply, while clean rates could continue to benefit from trade shifts necessitating higher vessel demand in the summer driving season in the Northern Hemisphere. Crude and Refined Products Trade Preliminary data shows US crude imports averaged 6.4 mb/d in May, a gain of 6% m-o-m, while crude exports set a new record high of 3.7 mb/d in May. US product imports remained steady, averaging 2.2 mb/d, supported by an increase in gasoline flows ahead of the driving season. China’s crude imports averaged 10.5 mb/d in April and preliminary data shows May imports at 10.8 mb/d, as inflows continued to pick up from the weak performance in February despite lower refinery throughputs. China’s product exports edged lower in April, averaging 1.0 mb/d, as declines in gasoline, diesel and fuel oil exports offset increased jet fuel outflows. The anticipated lifting of lockdown measures should support China’s crude imports in June, although this could be offset by refiners drawing from existing inventories. India’s crude imports jumped 13% to a new record high of 5.1 mb/d in April, as refineries maximized run rates and snapped up discounted Russian crude. Japan’s crude imports saw the fourth-consecutive m-o-m gain in April, edging up to average 2.9 mb/d amid expectations of improving product demand. Japan’s product imports, including LPG, were broadly flat, while product exports fell 30% m-o-m, with declines across most major products amid lower flows to China. OECD Europe trade flows remain a key uncertainty due to sanctions and the challenges of sourcing crude and refined products from other suppliers.

Commercial Stock Movements

Preliminary April data sees total OECD commercial oil stocks up 1.8 mb m-o-m. At 2,628 mb, inventories were 287 mb less than in the same period a year ago, 332 mb lower than the latest five-year average, and 299 mb below the 2015–2019 average. Within components, crude stocks rose m-o-m by 9.3 mb, while product inventories fell m-o-m by 7.5 mb. At 1,293 mb, OECD crude stocks were 129 mb lower than the same time a year ago, 180 mb lower than the latest five-year average, and 179 mb below the 2015–2019 average. OECD product stocks stood at 1,335 mb, representing a deficit of 158 mb compared to the same time a year ago, 152 mb lower than the latest five-year average, and 120 mb below the 2015–2019 average. In terms of days of forward cover, OECD commercial stocks fell m-o-m by 0.6 days in April to stand at 57.4 days. This is 7.6 days below April 2021 levels, 8.0 days less than the latest five-year average and 4.8 days lower than the 2015–2019 average.

Balance of Supply and Demand

Demand for OPEC crude in 2021 is revised down by 0.2 mb/d from the previous month’s assessment to stand at 28.0 mb/d, which is around 5.0 mb/d higher than in 2020. Demand for OPEC crude in 2022 is revised up by 0.1 mb/d from the previous month’s assessment to stand at 29.2 mb/d, which is around 1.1 mb/d higher than in 2021.

-----

Earlier: