GLOBAL RISK & STAGFLATION

WBG- JUNE 2022 - Global Economic Prospects

Executive Summary

The world economy continues to suffer from a series of destabilizing shocks. After more than two years of pandemic, the Russian Federation’s invasion of Ukraine and its global effects on commodity markets, supply chains, inflation, and financial conditions have steepened the slowdown in global growth. In particular, the war in Ukraine is leading to soaring prices and volatility in energy markets, with improvements in activity in energy exporters more than offset by headwinds in most other economies. The invasion of Ukraine has also led to a significant increase in agricultural commodity prices, which is exacerbating food insecurity and extreme poverty in many emerging market and developing economies (EMDEs). Numerous risks could further derail what is now a precarious recovery. Among them is, in particular, the possibility of stubbornly high global inflation accompanied by tepid growth, reminiscent of the stagflation of the 1970s. This could eventually result in a sharp tightening of monetary policy in advanced economies to rein in inflation, lead to surging borrowing costs, and possibly culminate in financial stress in some EMDEs. A forceful and wideranging policy response is required by EMDE authorities and the global community to boost growth, bolster macroeconomic frameworks, reduce financial vulnerabilities, provide support to vulnerable population groups, and attenuate the long-term impacts of the global shocks of recent years.

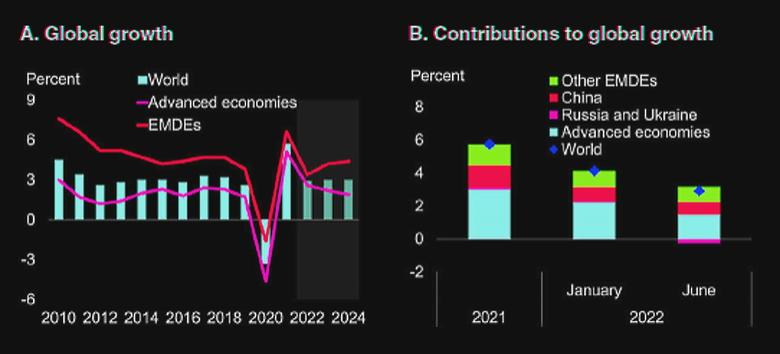

Global outlook: Following more than two years of pandemic, spillovers from the Russian Federation’s invasion of Ukraine are set to sharply hasten the deceleration of global economic activity, which is now expected to slow to 2.9 percent in 2022. The war in Ukraine is leading to high commodity prices, adding to supply disruptions, increasing food insecurity and poverty, exacerbating inflation, contributing to tighter financial conditions, magnifying financial vulnerability, and heightening policy uncertainty.

Growth in emerging market and developing economies (EMDEs) this year has been downgraded to 3.4 percent, as negative spillovers from the invasion of Ukraine more than offset any near-term boost to some commodity exporters from higher energy prices. Despite the negative shock to global activity in 2022, there is essentially no rebound projected next year: global growth is forecast to edge up only slightly to a still-subdued 3 percent in 2023, as many headwinds—in particular, high commodity prices and continued monetary tightening—are expected to persist. Moreover, the outlook is subject to various downside risks, including intensifying geopolitical tensions, growing stagflationary headwinds, rising financial instability, continuing supply strains, and worsening food insecurity.

These risks underscore the importance of a forceful policy response. The global community needs to ramp up efforts to mitigate humanitarian crises caused by the war in Ukraine and conflict elsewhere and alleviate food insecurity, as well as expand vaccine access to ensure a durable end of the pandemic. Meanwhile, EMDE policy makers need to refrain from implementing export restrictions or price controls, which could end up magnifying the increase in commodity prices.

With rising inflation, tightening financial conditions, and elevated debt levels sharply limiting policy space, spending can be reprioritized toward targeted relief for vulnerable households. Over the long run, policies will be required to reverse the damage inflicted by the dual shocks of the pandemic and the war on growth prospects, including preventing fragmentation in trade networks, improving education, and raising labor force participation.

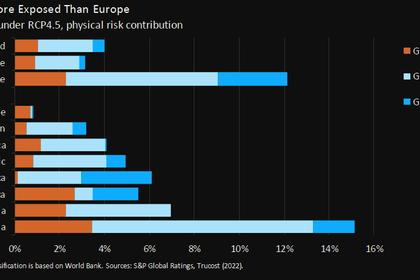

Regional prospects: Russia’s invasion of Ukraine is affecting EMDE regions to different degrees via impacts on global trade and output, commodity prices, inflation, and interest rates. The adverse spillovers from the war will be most severe for Europe and Central Asia, where output is forecast to sharply contract this year. Output growth is projected to slow this year in all other regions except the Middle East and North Africa, where the benefits of higher energy prices for energy exporters are expected to outweigh those prices’ negative impacts for other economies in the region. Risks for all EMDE regions are tilted to the downside and include intensifying geo-political tensions, rising inflation and food shortages, financial stress and rising borrowing costs, renewed outbreaks of COVID-19, and disruptions from disasters.

This edition of Global Economic Prospects also includes short analytical pieces on the risk of global stagflation and the impact of Russia’s invasion of Ukraine on the global economy through global energy markets.

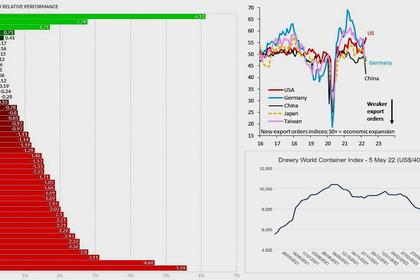

Global stagflation. Global inflation has risen sharply from its lows in mid-2020, on rebounding global demand, supply bottlenecks, and soaring food and energy prices, especially since Russia’s invasion of Ukraine. Markets expect inflation to peak in mid-2022 and then decline, but to remain elevated even after these shocks subside and monetary policies are tightened further. Global growth has been moving in the opposite direction: it has declined sharply since the beginning of the year and, for the remainder of this decade, is expected to remain below the average of the 2010s. In light of these developments, the risk of stagflation—a combination of high inflation and sluggish growth—has risen. The recovery from the stagflation of the 1970s required steep increases in interest rates by major advanced-economy central banks to quell inflation, which triggered a global recession and a string of financial crises in EMDEs. If current stagflationary pressures intensify, EMDEs would likely face severe challenges again because of their less well-anchored inflation expectations, elevated financial vulnerabilities, and weakening growth fundamentals.

This makes it urgent for EMDEs to shore up their fiscal and external buffers, strengthen their monetary policy frameworks, and implement reforms to reinvigorate growth.

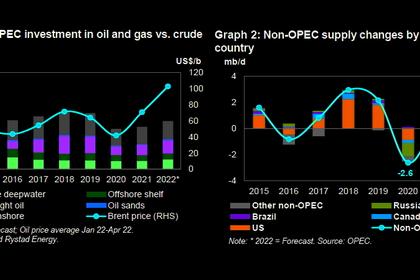

Russia’s invasion of Ukraine: Implications for energy markets and activity. Russia’s invasion of Ukraine has disrupted global energy markets and damaged the global economy. Compared with what took place in the 1970s, the shock has led to a surge in prices across a broader set of energy-related commodities. In energy-importing economies, higher prices will reduce real disposable incomes, raise production costs, tighten financial conditions, and constrain policy space.

Some energy exporters may benefit from improved terms of trade and higher commodities production. However, on net, model-based estimates suggest that the war-driven surge in energy prices could reduce global output by 0.8 percent after two years. The experience of previous oil price shocks has shown that these shocks can provide an important catalyst for policies to encourage demand reduction, substitution to other fuels, and development of new sources of energy supply.

-----

Earlier: