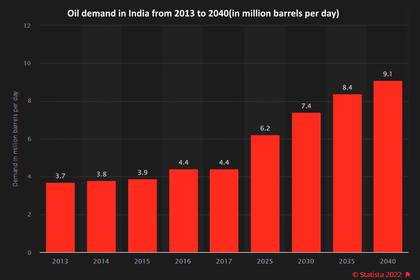

INDIA NEED MORE OIL

PLATTS - 27 Jun 2022 - India is exploring options to sign term crude deals with smaller suppliers as well as Russia, a sign that triple-digit oil prices and a ballooning import bill are prompting New Delhi to look beyond traditional exporting regions, such as the Middle East, for term crude sourcing.

As the country feels the pain of soaring oil prices that is threatening to destroy demand to some extent, its refiners are now eyeing Guyana, Azerbaijan and Gabon to see if some term deals are possible, a move which would help to cut dependence on the volatile spot market.

"Today, nobody is bothering who is buying what from where. We are quite happy to source from as far as we can," a leading Indian oil ministry source said.

The official added that high crude prices were not in the interests of consuming as well as producing nations. "It will lead to recession and also to fall in demand," the official said, adding that cuts in existing crude supply would cause inflation rates to shoot up and impact overall demand in the economy.

Even analysts held similar views.

"We believe that 2020 marked the start of a new structural cycle in the industry, which could mean higher average prices for the current decade. But at the same time, investors should also not discount the probability of an energy induced recession which could lead to a cyclical downturn over the next 12 months," Bernstein Research said in a note.

Russia, OPEC

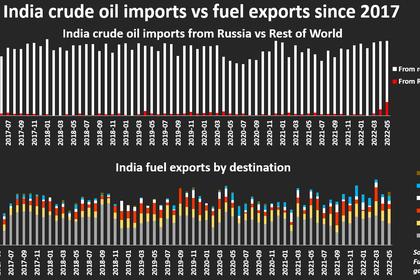

Indian government officials and sources at state refiners said Russian crude oil was not under any sanctions and therefore payment continued to be done under normal mechanisms.

"We have been exploring the option to contract Russian oil for a term deal," an official at a leading state-run refiner said, but added that no term deal has been finalized.

Indian government officials are of the view that the big question would be who would fill the void in case at least 7 million-9 million b/d of Russian crude vanishes from global markets due to any direct sanctions on the oil trade with Russia.

"When prices go up, you have no option but to buy from anywhere," one Indian government source added. "If Russian oil was not available in the market today, then the global crude price would have been $340 a barrel."

According to Platts Analytics, the decision by OPEC+ to raise quotas by 648,000 b/d for July and another 648,000 b/d for August -- about 50% higher than the recent monthly increases -- will offer Asia breathing space, as demand is expected to rise by 2 million b/d in the third quarter compared with the second quarter.

But Indian government officials doubted if OPEC's recent output decision would make any impact on prices. The global oil market has discounted OPEC's decision to raise output as it felt the producers' block can at best raise output by 100,000 to 150,000 b/d due to various factors, they added.

India is planning to use half of its strategic oil reserves for commercial purposes and avoid filling up the reserve to the full when global crude prices are high, government officials said.

Demand slowdown

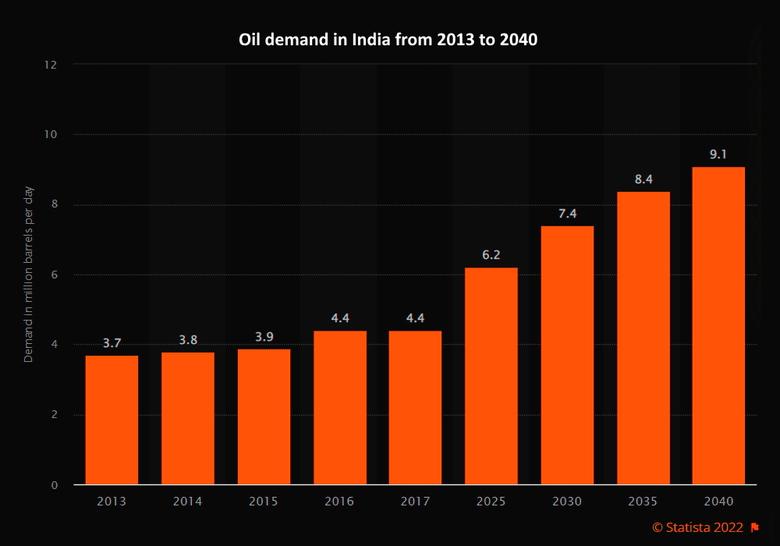

Surging oil prices applied brakes on India's crude oil appetite in May, with volumes slipping 9.1% from April to 19.57 million mt, or 4.6 million b/d, according to data from the country's Petroleum Planning and Analysis Cell.

The latest May statistics capped April's upward trend when the country's crude oil inflows rebounded 14.3% year on year on the back of higher oil products demand, both in export and domestic markets.

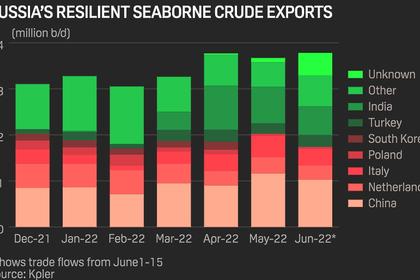

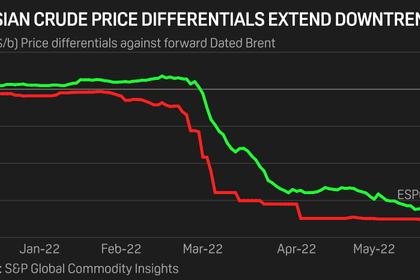

But with plentiful Russian crude available at discounted prices, market participants are of the view that India's appetite for cargoes from the non-OPEC supplier will remain robust in the foreseeable future, which in turn would help India's overall demand for crude to stage at least a modest recovery.

In the cumulative January-May period, India's crude imports rose 8.5% year on year to 96.97 million mt.

India's demand for oil products rose 23.8% year on year to 18.27 million mt, in May, according to the PPAC data. Analysts said oil products demand growth reflected a recovery from last year's relatively low base when India was hit by a second COVID-19 wave.

In May, demand for diesel, gasoline and naphtha rose 31.7%, 51.5% and 123.1% year on year, respectively, but consumption of oil products rose only marginally by 0.4% month on month as demand for mass transportation fuel like diesel was low due to high crude prices.

"Our primary responsibility is that at the retail level there must be supply," one senior government source said.

-----

Earlier: