OIL MARKET RECONFIGURATION

PLATTS - 18 Jun 2022 - Rosneft CEO Igor Sechin said June 18 that the oil market is reconfiguring, with sanctioning countries set to pay a premium, at a time when Western sanctions imposed on Russia over its invasion of Ukraine are significantly reducing oil flows to Europe.

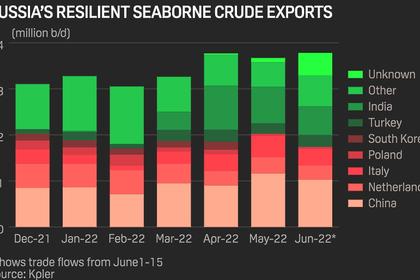

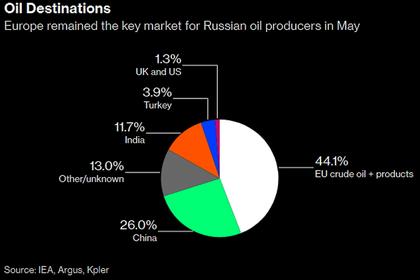

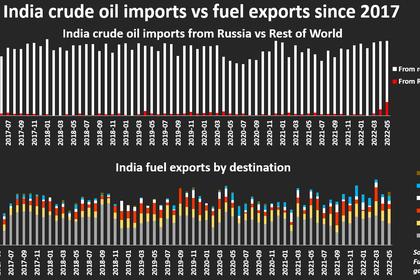

Non-sanctioning countries including India and China have significantly increased imports of Russian oil since the invasion began Feb. 24, taking advantage of major price discounts.

"We are already seeing movement towards a new configuration of the oil market, with the formation of two price patterns. A fair market price for friendly countries, and a premium added to the price for unfriendly countries, which will be used to pay off our costs associated with our former partners violating rules and obligations," Sechin said, according to the Prime news agency.

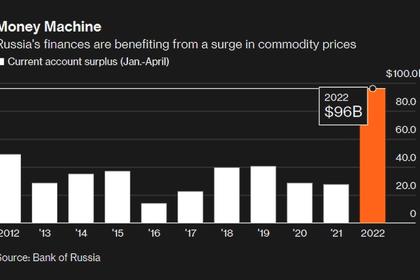

Export disruptions have led to Russia's key crude grade Urals trading at massive discounts in recent months.

S&P Global Platts last assessed Urals at $80.695/b June 17, compared to $120.575/b for Dated Brent. Prior to the invasion Urals was trading at a discount of around $10/b to Brent.

Several Russian officials have said that the major discounts are a temporary phenomenon and will narrow in the near future.

Sechin's comments come after Russian President Vladimir Putin said June 17 that current high oil and gas prices are the result of US and European countries' actions.

Russia has also said that greater use of long-term energy supply contracts would ease supply fears, as they give Russian companies guarantees that there will be a market for their output, facilitating investment in major, capital-intensive projects.

Sechin added that economic growth forecasts for developing countries indicate that growth in demand will outpace supply by 20%, and that to avoid a shortfall more investment is needed.

"However ... against a backdrop of majors reducing investment, this level will most likely not be reached, and the oil shortage could persist for a long time," he said.

Sechin added that Rosneft's major Vostok Oil project in eastern Russia is one of the few projects that could stabilize hydrocarbons markets. The state-controlled company expects output at the project to gradually increase to 115 million mt, equivalent to around 2.3 million b/d, in 2033.

He said that Rosneft expects resource estimates at the project to increase by 100 million mt, equivalent to around 733 million barrels, after finding oil at two exploration wells at the project. Rosneft said previously that the project includes 6.2 billion mt (45 billion barrels) of oil.

Alternative currencies

Sanctions against Russia are also accelerating a trend for Russia to trade commodities in currencies other than the US dollar.

Sechin said that there will inevitably be changes to the global financial system and new global reserve currencies will emerge to replace the dollar and the euro, Prime reported.

He said that Europe's abandoning of Russian energy and declining economic competitiveness have led to capital flight and the fall of the euro against the dollar.

"By banning trade relations with Russia, Europe has limited the circulation of its currency, reducing its attractiveness for international payments," Sechin said.

From April 1, Russian countersanctions included a stipulation that European consumers should now use a ruble payment mechanism to purchase Russian gas. Several countries have been cut off for refusal to comply with the new rules.

The measure was introduced in response to seizure of Russian assets abroad. Putin said that this will further lead to a move away from currency reserves to resources, as fears of asset seizures grow in governments across the world.

Novak said June 17 that Russia does not plan to introduce a ruble payment mechanism for Russian oil exports to sanctioning countries.

-----

Earlier: