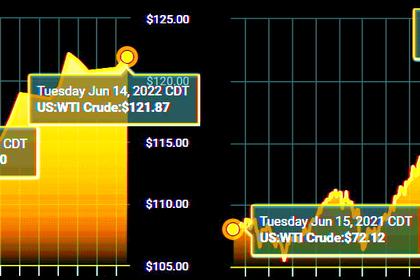

OIL PRICE: BRENT ABOVE $120, WTI ABOVE $118

REUTERS - June 15 - Oil prices fell on Wednesday on concerns about fuel demand and global economic growth before an expected big hike in interest rates by the U.S. Federal Reserve.

Brent crude futures for August were down $1.27, or 1%, at $119.90 a barrel as of 1001 GMT, in volatile trading.

U.S. West Texas Intermediate crude for July fell $1.44, or 1.2%, to $117.49 a barrel.

"Oil markets are seeing uncertainty over what central banks do next and how that impacts oil demand," said UBS analyst Giovanni Staunovo.

Surging inflation has led investors and oil traders to brace for a big move by the Fed this week - a 75-basis-point increase, which would be the largest U.S. interest rate hike in 28 years.

Stronger monetary policy tightening could "pave the way for recession-induced demand destruction," PVM analyst Stephen Brennock said.

The European Central Bank said on Wednesday it would hold a rare, unscheduled meeting on Wednesday to discuss turmoil in the bond markets.

Adding to demand woes, China's latest COVID outbreak has raised fears of a new phase of lockdowns.

Higher oil prices and dimming economic forecasts would weigh on demand prospects, the International Energy Agency said.

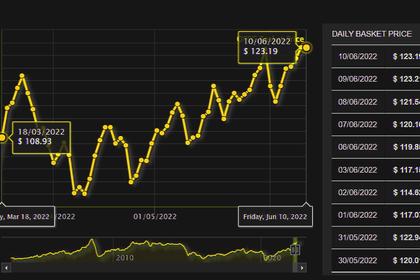

But persistent concerns about tight supply meant oil prices were still holding near $120 a barrel.

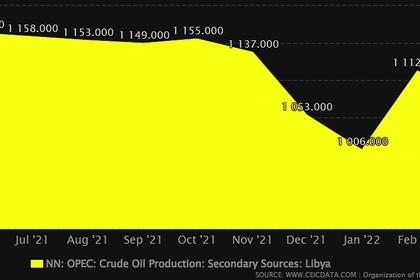

The Organization of the Petroleum Exporting Countries and its allies, known as OPEC+, are struggling to reach their monthly crude production quotas, recently hit by a political crisis that has reduced Libya's output.

"Because OPEC production is still falling noticeably short of the announced level, this would result in a supply deficit of around 1.5 million barrels per day on the oil market in the second half of the year," said Carsten Fritsch, commodity analyst at Commerzbank in Frankfurt.

Oil prices gained some support from tight gasoline supply. U.S. President Joe Biden told oil companies to explain why they were not putting more gasoline on the market.

U.S. crude and distillate inventories rose last week, while gasoline stockpiles fell, according to market sources citing American Petroleum Institute figures on Tuesday.

U.S. Department of Energy stock data is due on Wednesday.

-----

Earlier: