OIL PRICE: BRENT ABOVE $120, WTI NEAR $118

REUTERS - June 17 - Oil rose on Friday, supported by supply tightness and new sanctions on Iran, but prices were on track for a weekly decline amid interest rate hikes from major central banks that fuelled worries about a sharp economic slowdown.

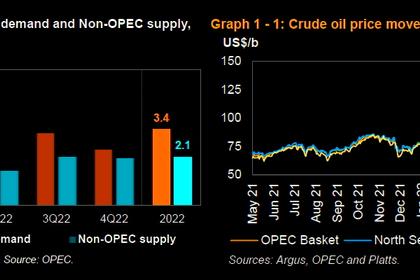

Brent crude was up $1.13, or 0.9%, to $120.94 a barrel at 1016 GMT, and U.S. West Texas Intermediate (WTI) crude had gained $1.03, or 0.9%, to $118.62.

Both contracts had fallen by more than $1 earlier in the session.

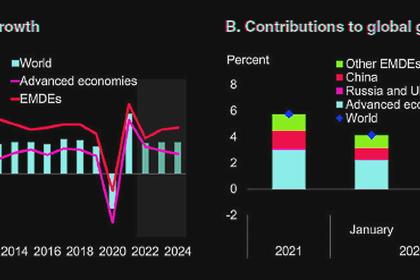

Brent was on track for its first weekly dip in five weeks, and U.S. crude for its first decline in eight weeks, in line with a fall in equity markets amid fears of a possible recession as central banks joined a chorus of outsized rate hikes.

"The influence of the macro environment has started to take over from oil specific fundamentals in recent days," said Investec's head of commodities Callum Macpherson.

"Consistent with the broader market pre-occupation with rates and inflation, the oil market narrative may now turn to focus more on affordability, rather than on supply."

However, U.S. sanctions on Chinese and Emirati companies and on a network of Iranian firms that help export Iran's petrochemicals lent some support to oil prices.

The U.S. government said while it is pursing diplomacy to revive a nuclear deal with Iran, it will continue to use sanctions to limit exports of oil, oil products, and petrochemicals from Iran.

Analysts estimate that a deal and the consequent lifting of sanctions on Iran's energy sector could add up to 1 million barrels of oil per day to global markets.

"The market has been watching negotiations between the West and Iran in anticipation of a revival of the nuclear deal in recent months. This brought back into focus the ongoing supply side issues in the market," ANZ Research analysts said in a note.

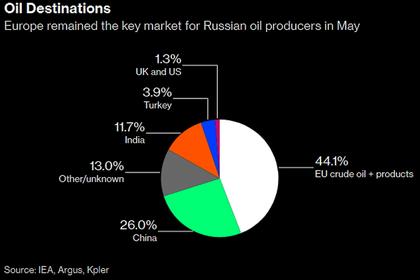

The global oil market continues to show signs of "turbulence", Russian Deputy Prime Minister Alexander Novak said on Friday, blaming the uncertainties over oil production recovery in Libya, Iran and Venezuela and a lack of energy infrastructure.

-----

Earlier: