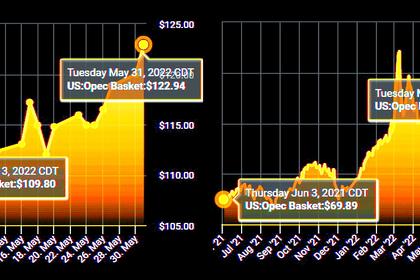

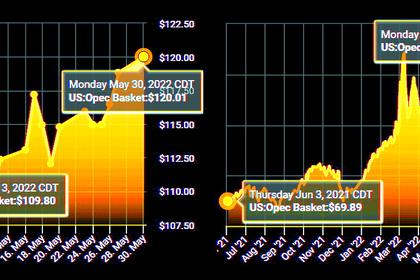

OIL PRICE: BRENT NEAR $118, WTI NEAR 116

REUTERS - June 3 - Oil slipped on Friday after OPEC+ decided to increase production targets by slightly more than planned, although tight global supply and rising demand as China eases COVID restrictions limited the decline.

The Organization of the Petroleum Exporting Countries and allies, or OPEC+, on Thursday increased their output boost to 648,000 barrels per day (bpd) in July and August rather than 432,000 bpd as previously agreed.

Brent crude fell 85 cents, or 0.7%, to $116.76 a barrel by 0925 GMT, after rising $2 intra-day on Thursday. U.S. West Texas Intermediate (WTI) crude slipped 88 cents, or 0.8%, to $115.99.

"I believe it's just a technical move lower after yesterday's giant post-OPEC+ rally," said Jeffrey Halley of brokerage OANDA. "Holidays in China, Hong Kong, Taiwan and the UK are impacting trading volumes."

Although Brent was on track to fall for the week, U.S. crude was heading for a sixth weekly gain on tight U.S. supply, which has prompted talk of fuel export curbs or a windfall tax on oil and gas producers.

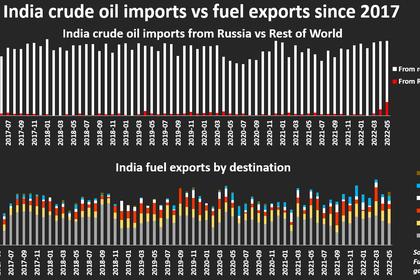

Still, expectations that supply will stay tight limited losses. OPEC+ divided the hike across its members and still included Russia, whose output is falling due to sanctions and some buyers avoiding its oil over the invasion of Ukraine, suggesting the boost will undershoot.

"OPEC+ is still likely to supply considerably less oil to the market than agreed and thus not bring the relief that had been hoped," said Commerzbank analyst Carsten Fritsch in a report.

A weekly inventory report on Thursday showed U.S. crude stockpiles fell by a more-than-expected 5.1 million barrels and gasoline inventories also dropped, underlining the tight supply.

Support also came from rising demand. With daily COVID-19 cases falling, China's financial hub Shanghai and capital, Beijing, have relaxed COVID-19 restrictions this week. The Chinese government has vowed support to stimulate the economy.

In focus later on Friday will be U.S. employment data for May. Investors are looking to the report for confirmation of a slowdown in the job market, which could convince the Federal Reserve to go slow on interest rate hikes.

-----

Earlier: