OPEC + RUSSIA STRENGTHENING

PLATTS - 01 Jun 2022 - Russia and Gulf oil producers have reaffirmed their support for the OPEC+ alliance, Moscow said June 1, a day before the group is expected to ratify another modest output hike for July in the face of rising oil prices.

Russian foreign minister Sergei Lavrov was in Saudi Arabia for talks with counterparts from the region, while a delegate-level OPEC+ advisory technical committee was convening to review market conditions.

The alliance, which will hold its formal ministerial meeting virtually June 2, has come under much scrutiny in recent days with some delegates suggesting that Russia could be made exempt from its quota and that a larger production increase than the typical monthly 432,000 b/d could be considered for July.

The developments, which S&P Global Commodity Insights has previously reported, were not discussed by the technical committee, delegates said, with any decisions over the future of the OPEC+ alliance to be made by ministers in future meetings.

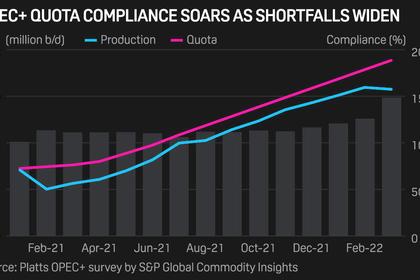

According to a report prepared for the committee and seen by S&P Global, OPEC+ analysts continue to see supply exceeding demand for much of 2022, with the full-year surplus at 1.4 million b/d – assuming the group fulfills its quota hikes as scheduled, which it has not done for months.

In fact, the coalition fell 2.6 million b/d short of its targets in April, the report showed, as many countries are unable to raise production further and Russia has come under ratcheting western sanctions that it says could cause its output to contract some 8%.

Meanwhile those with spare capacity – primarily Saudi Arabia and the UAE – have held off on breaching their quotas to maintain OPEC+ unity rather than spark a market share battle.

Still, the analysis points to the likelihood that ministers will stick to their plan of another 432,000 b/d increase in quotas for July that will in effect be much smaller due to those constraints.

Platts Analytics, part of S&P Global, estimates that the actual monthly OPEC+ output rise will be about 230,000 b/d in June and July, dropping to below 100,000 b/d from August.

"There is no plan to increase beyond the current agreement," one delegate said.

Lavrov meetings

Russia's future role in the OPEC+ alliance, which controls about half of global crude supply, has been the subject of much speculation.

One of the world's top three oil producers, Russia joined forces with OPEC and nine other allies to shore up the market from 2017 in a series of production cuts that are scheduled to be phased out by September, though the group's official "declaration of cooperation" runs through December.

Lavrov's trip to the Middle East sought in part to shore up Russia-OPEC ties.

Core Gulf members have stood by Moscow through the invasion of Ukraine and declined to capitulate to demands by key consuming countries, including the US, Japan and India, to ditch the OPEC+ deal and ramp up production more aggressively to counter rising prices.

Moscow has been especially insistent that its share of the oil market, now being pinched by sanctions and an EU ban on seaborne Russian imports, be respected, sources have said, though discounted Russian barrels are now competing against Middle Eastern crudes in India and China.

Lavrov met with several Gulf ministers bilaterally and during a strategic dialogue between Russia and the Gulf Cooperation Council, the Russian foreign ministry said in statements.

Lavrov and Saudi counterpart Prince Faisal bin Farhan "noted the stabilizing effect that close coordination between Russia and Saudi Arabia has on the global hydrocarbons market," the ministry said.

Lavrov also discussed the OPEC+ agreement with UAE foreign minister Sheikh Abdullah bin Zayed.

"Close coordination between Russia and the UAE on OPEC+ in the interests of stabilizing and predicting world energy prices, was noted," a ministry statement said.

Lavrov also met with ministers from Bahrain, Kuwait and Qatar.

US diplomacy

But Russia is not the only country courting key OPEC members.

US officials have reportedly visited Saudi Arabia in recent weeks, to pave the way for a potential first meeting between President Joe Biden and Crown Prince Mohammed bin Salman, as the two countries seek to smooth over fractious relations.

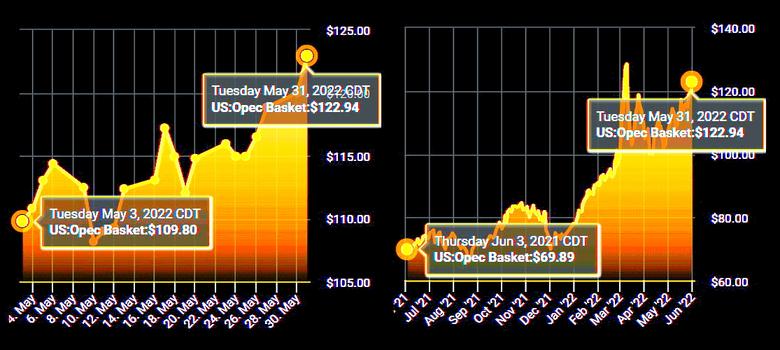

Some delegates have floated the idea that Russia may no longer be bound to a quota going forward, joining fellow sanctioned members Iran and Venezuela. That could potentially allow OPEC+ members with spare capacity to fill any gap left by the sanctions on Russia, some delegates have suggested – a move sure to be welcomed by the US, where gasoline and diesel prices have soared to record levels.

But Russia has made no request for an exemption, according to sources, and how an OPEC+ alliance would operate in practice with its second largest member freed from production restraints is unclear.

OPEC+ ministerial talks will begin at 2 pm Vienna time (1200 GMT) in a nine-country monitoring committee co-chaired by Saudi Arabia and Russia, before the full group convenes at 2:30 pm.

-----

Earlier: