RUSSIAN OIL EXPORTS MAXIMUM

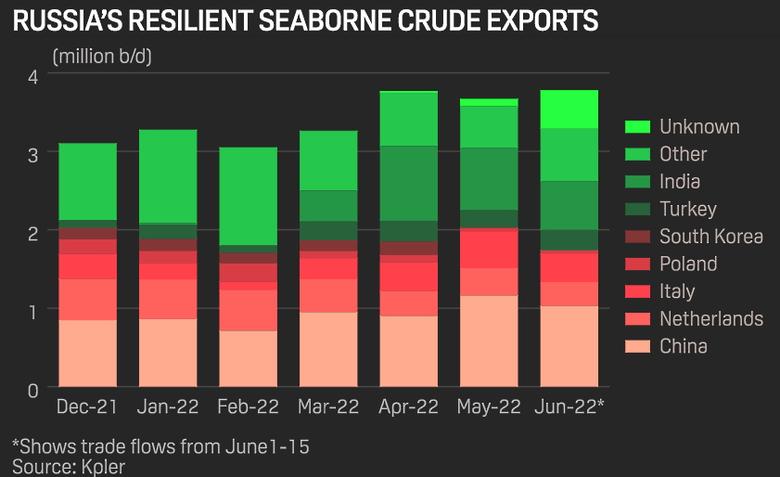

PLATTS - 16 Jun 2022 - Russian seaborne crude exports remained at post-pandemic highs in the first half of June as India and China continued to snap up discounted supplies despite tightening Western sanctions on Moscow.

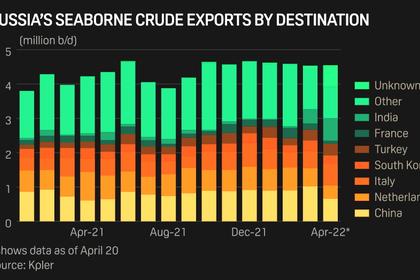

Compared to pre-war levels in January and February, Russia's shipped crude exports from June 1-15 rose by 576,000 b/d to average about 3.88 million b/d, according to preliminary data from shipping analytics provider Kpler. The latest export flows, which are up from 3.81 million b/d in May, put Russia's seaborne crude exports at the highest since May 2019.

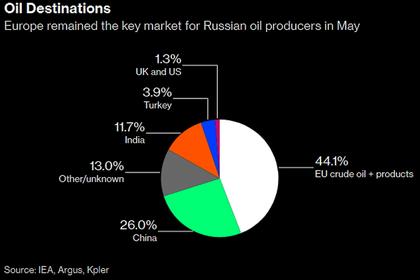

China and India continue to make up the biggest growth market for Russian oil as EU member states retreat from oil trade with Moscow ahead of the trade bloc's Q1-2023 deadline to end imports of Russian crude and products. The two Asian oil importers have now grown their share of Russian shipped crude to almost 30% and 20% respectively, a combined growth of more than 1 million b/d on pre-war levels. Russian crude export to Turkey have also doubled to 260,000 b/d and Bulgaria imports have also more than trebled to over 200,000 b/d compared to January and February, the data shows.

At the same time, EU imports of shipped Russian crude remained at around 1.3 million b/d in the first half of June, little changed from May but down from 1.75 million b/d in January and February. To make up the shortfall, the EU has seen its imports of US crude jump by around 400,000 b/d, or 50%, since the start of the year and bought more Norwegian and Egyptian crude, the figures show, as it cuts its dependence on Moscow's oil.

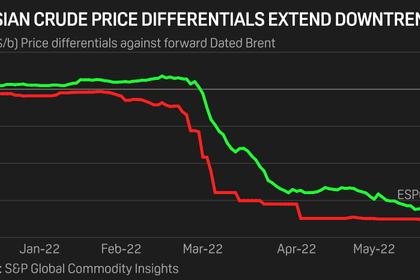

Russia's key export grade Urals has been trading at significant discounts to other crudes since the country invaded Ukraine on Feb 24. Platts assessed Urals at 92.145/b and Dated Brent at $132.06/b May 30, data from S&P Global Commodity Insights showed. Urals was assessed at $90.72/b and Dated Brent at $100.48/b the day before Russia invaded Ukraine.

But with higher crude oil and product prices globally, Russia's oil export revenues are estimated to have increased by $1.7 billion in May to about $20 billion, according to the International Energy Agency, unchanged from February.

Export resilience

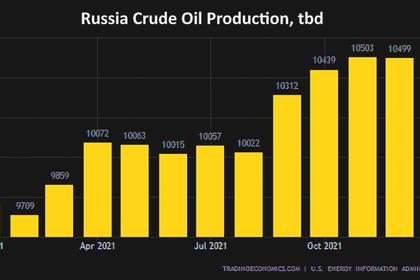

Russia's oil export resilience to Western boycotts and sanctions so far has surprised most market watchers. After plunging 930,000 b/d in April, Russian total oil production in May actually rose by 130,000 b/d to 10.55 million b/d, the IEA said in its June 15 monthly oil market report.

"[Russia's] crude oil exports to world markets were reallocated from traditional buyers adhering to new sanctions or shunning barrels voluntarily in solidarity with Ukraine," the IEA noted. "Even with a large swathe of Russian oil output hit by sanctions and embargoes, the country will easily retain its rank as the world's third-largest oil producer behind the US and Saudi Arabia."

Although the EU's ban excludes exports of Russian crude via the Druzhba pipeline to central Europe, the EU was importing about 2.3 million b/d of Russian crude and 1.2 million b/d of its oil products before the war, according to S&P Global Commodity Insights.

Russian crude and oil product flows to the EU, its former key export market, are still expected to see a sharper drop in the coming months after the bloc agreed to ban 90% of its imports of Russian crude and products, phased out over the next six to eight months.

Gray oil imports?

While Russian crude exports continue to grow, however, the shipping data shows that demand for its product exports has slowed considerably.

In the first two weeks of June, Russian exports of oil products, which are dominated by diesel, heavy fuel oil, vacuum gasoil, naphtha, and jet fuel, are averaging higher than May at 2.58 million b/d, according to Kpler, but remain down from a spike of 3.14 million b/d in February.

Russian product flows to the EU are now about 300,000 b/d lower than in February at around 1.3 million b/d, the figures show.

The data also supports growing concerns over potential 'gray' oil imports of Russian crude processed and re-exported as fuel by refiners in India and Turkey. Oil product imports to the EU from India and Turkey more than doubled to 165,000 b/d in May, according to Kpler. The EU's product imports from the Netherlands, a key refining and trading hub, also remain about 100,000 b/d higher than in January and February, the Kpler data showed, suggesting a jump in the blending of Russian diesel and other products with alternatives in the region.

Overall, Russian exports of shipped crude and products in the first half of June were up by about 170,000 b/d on pre-war levels, the data shows, at 6.4 million b/d, which is the net result of a 576,000 b/d increase in crude exports and 400,000 b/d fall in product exports.

-----

Earlier: