RUSSIAN OIL FOR CHINA UP AGAIN

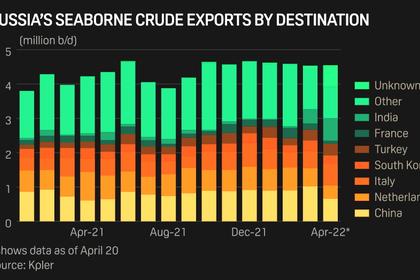

PLATTS - 31 May 2022 - China's independent refineries in Shandong are set to resume taking Russian Urals, with the first cargo arriving in early June and at least eight more cargoes later in the month, according to S&P Global Commodity Insights' shipping fixtures and market sources.

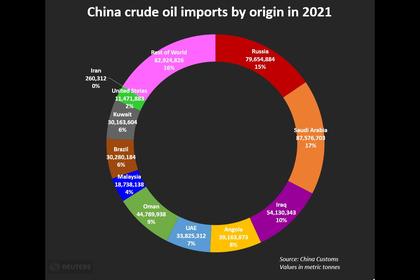

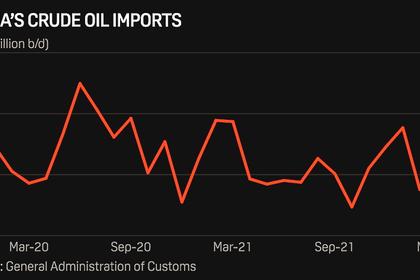

The refineries halted the flow of Urals in November due to more competitively priced alternative supplies, and subsequently held off on buying until late April, despite the price of Urals falling to deep discounts against benchmarks following Russia's invasion of Ukraine in late February.

In late April, Urals cargoes for late May or early June delivery were trading at a discount of around $5-6/b to benchmark ICE Brent crude futures on a DES Shandong basis, market sources said.

Market sources said that the independent refineries have now followed their state-owned peers and have started to return to the market for Russian crude. Of the nine cargoes, amounting to 880,000 mt, that are set to arrive into Shandong imminently, six are heading to Qingdao port, two into Yantai, and the rest to Rizhao.

The June-arrival volume is close to the total Urals imports by China's independent refining sector in full-year 2021 of 925,000 mt, S&P Global data showed. The Urals import volume by the independent refineries in 2020 was 5.14 million mt.

The first cargo is being carried by the 110,000 dwt Ns Corona, which will arrive into Qingdao port on June 4, according to data intelligence company Kpler.

"Demand for Urals is strong, dampening independent refiners' demand for regular crude grades, such as those from West Africa or Brazil," said one analyst in Shandong.

Western African barrels were offered at premiums of $6-7/b against ICE Brent for July-loading, sources said.

This week, Urals is being offered at a discount of around $9-10/b to ICE Brent futures for July arrival on a DES Shandong basis, against a discount of around $8-9/b May 23-27, market sources said.

Even compared with Iranian barrels, Urals remains attractive, sources said. Iranian Light crude's specifications are similar to Urals, with the grade currently being offered at a discount of $7.50-8/b to ICE Brent, according to sources.

-----

Earlier: