RUSSIAN OIL FOR S. KOREA DOWN

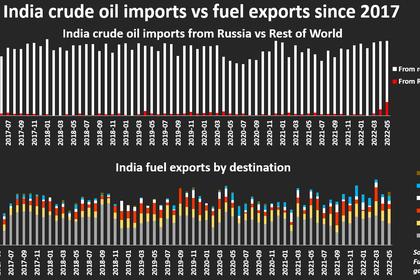

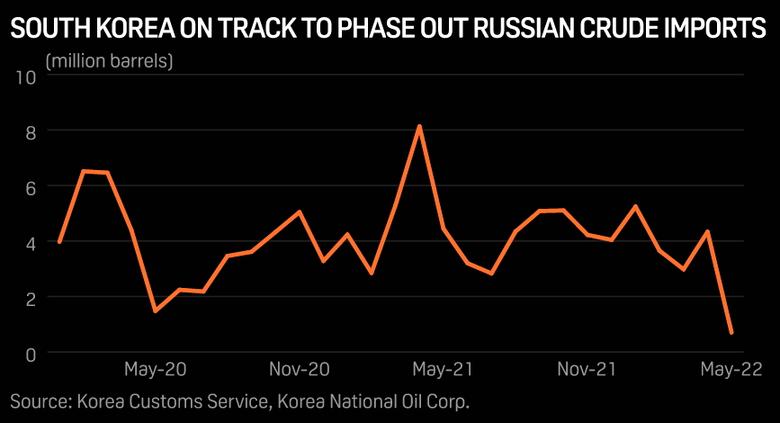

PLATTS- 21 Jun 2022 - South Korea slashed crude imports from Russia in May to just a single Aframax cargo, according to latest customs data, a clear cut signal that Asia's third biggest crude importer is on track to completely phase out Russian oil purchases before the end of the year, industry and refinery sources said June 21.

South Korea took just 695,859 barrels from Russia in May, down 84.3% from 4.44 million barrels imported from the non-OPEC producer a year earlier, data from Korea Customs Service released June 20 showed. The May shipments marked the lowest monthly Russian crude imports since 310,000 barrels were received in November 2006.

Although there are still some Russian crude supplies tied to quarterly and half-yearly term contracts, South Korea will eventually halt Russian oil purchases as many companies look to avoid trade, logistical, legal and financial complications that could affect corporate reputations, refinery feedstock managers at major South Korean refiners told S&P Global Commodity Insights.

Reflecting the drastic cutback in Russian crude purchases, South Korea's overall crude oil imports in May fell 1.8% year on year to 79.51 million barrels, or 2.56 million b/d.

Still, major South Korean refiners including SK Innovation indicated that they are not overly worried about the shortfall in light and medium sweet Far East Russian ESPO, Sokol and Sakhalin Blend crude intake as Russian oil typically accounted less than 5%-6% of the country's overall refinery feedstock import basket and there were plenty of alternative supply sources.

Over January-May, South Korea's crude imports were up 9.5% year on year at 425.03 million barrels, the customs data showed.

High refinery runs

Local refiners are enjoying record high cracking margins and the middle distillate producers are poised to register robust export earnings in the second and third quarters, though surging retail diesel and gasoline prices would dampen domestic auto fuel sales, a refinery official said.

Refiners are maintaining their run rates at nearly 100% to meet strong Asian refining margins, and they are looking to raise diesel output for exports to maximize profits amid global diesel supply shortages, he said.

Refiners in the Middle East are mainly focused on delivering oil products to Europe and with limited exports from China, many net importers of transportation fuels -- especially those in Southeast Asia and Oceania -- are relying heavily on South Korea for their fuel requirements, S&P Global reported previously, citing traders and middle distillate marketers across Asia.

South Korean refiners and condensate splitters processed 83.53 million barrels, or 2.78 million b/d. of crude in April, up 8.2% from 77.2 million barrels a year earlier, rising for the ninth straight month, latest data from state-run Korea National Oil Corp. or KNOC showed.

In an effort to feed and maintain high refinery run rates, major South Korean refiners would continue to take ample light sweet crude supplies from the US, while both state and corporate level efforts have been put in place to secure more Middle Eastern barrels following the decision by OPEC+ June 2 to raise production quotas by 648,000 b/d for July and another 648,000 b/d for August.

South Korea's Minister of Trade, Industry Energy Lee Chang-yang held talks in Seoul June 8 with his UAE counterpart, Sultan bin Ahmed al-Jaber who is also CEO of ADNOC. Lee asked for the UAE's support for stable crude oil supplies, S&P Global reported previously.

South Korea's US crude imports in May rose 0.1% year on year to 9.294 million barrels, marking the 14th consecutive month of year-on-year increase, the customs data showed.

The data also showed crude imports from top supplier Saudi Arabia, except shipments from the Saudi-Kuwaiti Neutral Zone, jumped 33.5% year on year to 30.74 million barrels in May.

KNOC will release more detailed oil trade data for May, including shipments from other major suppliers and import costs, in the week of June 26.

-----

Earlier: