U.S. GAS PRICES DOWN

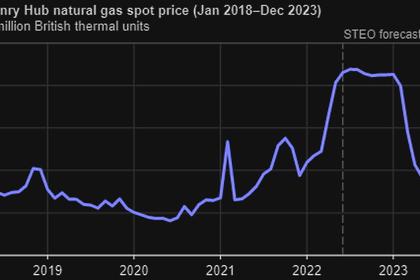

PLATTS - 23 Jun 2022 - US natural gas working stocks rose by a larger-than-expected 74 Bcf during the week ended June 17, reducing the deficit to a seasonal low of 13.2%, which helped spur a selloff for US natural gas futures.

Storage inventories rose to 2.169 Tcf for the week ended June 17, the US Energy Information Administration reported on June 23. The build was more than an S&P Global Commodity Insights' survey of analysts calling for a 70 Bcf net injection.

The weekly injection was substantially higher than the 49 Bcf build reported during the corresponding week in 2021 but less than the five-year average build of 82 Bcf, according to EIA data. As a result, stocks were 305 Bcf, or 12.3%, less than the year-ago level of 2.474 Tcf and 331 Bcf, or 13.2%, below the five-year average of 2.500 Tcf. While the deficit to the five-year average increased in absolute terms, it fell to its lowest point, percentage wise, so far this injection season.

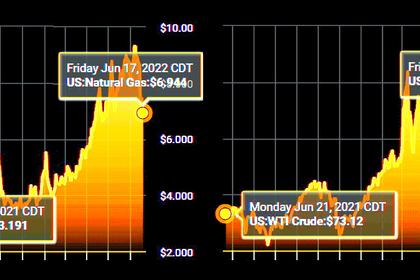

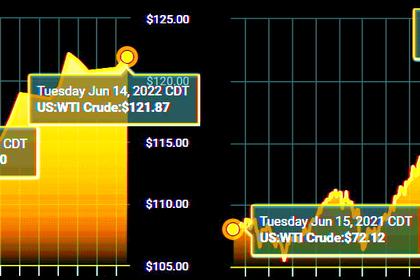

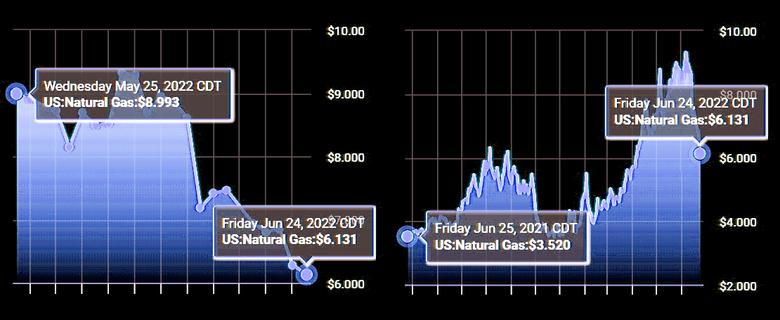

By mid-session on June 23, the NYMEX Henry Hub July contract had dropped more than 60 cents, trading around $6.20/MMBtu by 1 pm ET. The contract was trading 15 cents lower around $6.70/MMBtu in the minutes before the weekly storage report published at 10:30am ET, with the downward momentum accelerating after the report came out. If the bearish sentiment holds to daily settlement, it will be the prompt-month's lowest settlement since April 6. NYMEX July had been in a holding pattern over the most recent three trading sessions, settling in a tight range of around $6.80-$6.95/MMBtu.

Supply-demand uncertainty

Opposing forces of supply and demand had introduced some uncertainty around this week's storage number, with the S&P Global survey of analysts showing a wider-than-normal range of responses. The lowest response recorded was 48 Bcf and the highest response 96 Bcf. Market watchers noted stronger-than-normal power burn could absorb some of the looseness in the market created by an extended unplanned outage at Freeport LNG, but the extent to which elevated power burn would be enough to stave off further losses in gas futures had been unclear.

June has seen record-breaking heat sweep across the eastern half of the country, lifting gas-fired power demand well above seasonal norms. Data from Platts Analytics shows that power burn demand has averaged 37.7 Bcf/d so far this month, up 2.1 Bcf/d from the same time last year.

On the supply side, robust US gas production has been a bullish thumb on the scales for supply-demand balances, with month-to-date production coming in 2.4 Bcf/d higher than year-ago levels.

Outlook

A forecast by S&P Global's supply and demand model calls for a smaller draw of 56 Bcf for the week ending June 24, which would widen the deficit in absolute terms. The week in progress has seen a continuation of the very hot temperatures, especially in Texas, with the Electric Reliability Council of Texas reporting a series of record-breaking daily power loads. Gas-fired generators have provided 35%-45% of daily load in the ERCOT service area over the last week, data from the system operator shows.

-----

Earlier: