U.S. NEED FINANCIAL STABILITY

U.S. FRB - June 17, 2022 - Monetary Policy Report

Summary

In the first part of the year, inflation remained well above the Federal Open Market Committee’s (FOMC) longer-run objective of 2 percent, with some inflation measures rising to their highest levels in more than 40 years. These price pressures reflect supply and demand imbalances, higher energy and food prices, and broader price pressures, including those resulting from an extremely tight labor market. In the labor market, demand has remained strong, and supply has increased only modestly. As a result, the unemployment rate fell noticeably below the median of FOMC participants’ estimates of its longer-run normal level, and nominal wages continued to rise rapidly. Although overall economic activity edged down in the first quarter, household spending and business fixed investment remained strong. The most recent indicators suggest that private fixed investment may be moderating, but consumer spending remains strong.

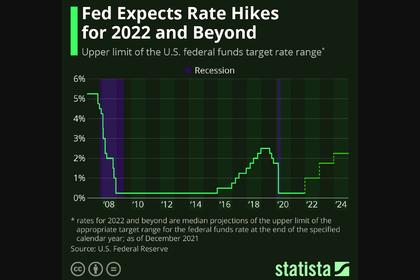

In response to sustained inflationary pressures and a strong labor market, the FOMC has been adjusting its policies and communications since last fall. At its March meeting, the FOMC raised the target range for the federal funds rate off the effective lower bound to ¼ to ½ percent. The Committee continued to raise the target range in May and June, bringing it to 1½ to 1¾ percent following the June meeting, and indicated that ongoing increases are likely to be appropriate. The Committee ceased net asset purchases in early March and began reducing its securities holdings in June.

The Committee is acutely aware that high inflation imposes significant hardship, especially on those least able to meet the higher costs of essentials. The Committee’s commitment to restoring price stability—which is necessary for sustaining a strong labor market—is unconditional.

Recent Economic and Financial Developments

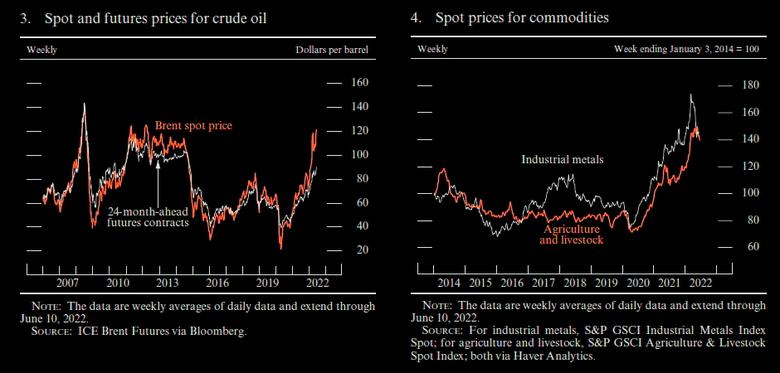

Inflation. Consumer price inflation, as measured by the 12-month change in the price index for personal consumption expenditures (PCE), rose from 5.8 percent in December 2021 to 6.3 percent in April, its highest level since the early 1980s and well above the FOMC’s objective of 2 percent. This increase was driven by an acceleration of retail food and energy prices, reflecting further increases in commodity prices due to Russia’s invasion of Ukraine. The 12-month measure of inflation that excludes the volatile food and energy categories (so-called core inflation) rose initially and then fell back to 4.9 percent in April, unchanged from last December. Three-month measures of core inflation have softened since December but remain far above levels consistent with price stability. Measures of near-term inflation expectations continued to rise markedly, while longer-term expectations moved up by less.

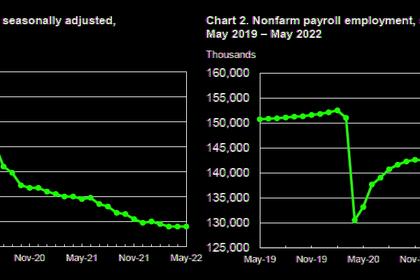

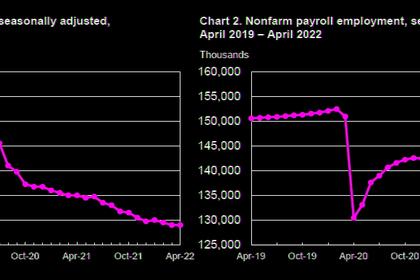

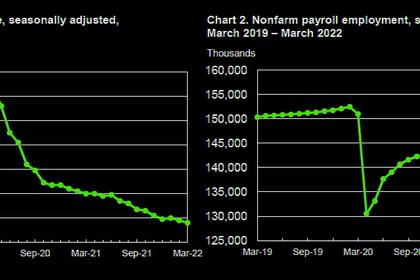

The labor market. Demand for labor continued to outstrip available supply across many parts of the economy, and nominal wages continued to increase at a robust pace. While labor demand remained very strong, labor supply increased only modestly. As a result, the labor market tightened further between December and May, with job gains averaging 488,000 per month and the unemployment rate falling from 3.9 percent to 3.6 percent—just above the bottom of its range over the past 50 years.

Economic activity. Real gross domestic product (GDP) is reported to have surged at a 6.9 percent annual rate in the fourth quarter of 2021 and then to have declined at a 1.5 percent annual rate in the first quarter. The large swings in growth rates reflected fluctuations in the volatile expenditure categories of net exports and inventory investment. Abstracting from these volatile components, growth in private domestic final demand (consumer spending plus residential and business fixed investment—a measure that tends to be more stable and better reflects the strength of overall economic activity) was strong in the first quarter, supported by some unwinding of supply bottlenecks and a further reopening of the economy. The most recent indicators suggest that private fixed investment may be moderating, but consumer spending remains strong. As a result, real GDP appears on track to rise moderately in the second quarter.

Financial conditions. Financial conditions have tightened significantly this year. The expected path of the federal funds rate over the next few years shifted up substantially, and yields on nominal Treasury securities across maturities have risen considerably since late February amid sustained inflationary pressures and associated expectations for further monetary policy tightening. Equity prices were volatile and declined sharply, on net, while corporate bond yields increased substantially and spreads increased notably, partly reflecting some concerns about the future corporate credit outlook. Mortgage rates also rose sharply. In turn, tighter financial conditions may have begun to weigh on some financing activity. On the business side, nonfinancial corporate bond issuance was solid in the first quarter but slowed somewhat in April and May, with speculative-grade bond issuance being particularly weak. That said, the growth of bank loans to businesses picked up, and business credit quality has remained strong thus far. For households, mortgage originations declined materially. Nevertheless, mortgage credit remained broadly available for a wide range of potential borrowers. For other consumer loans (such as auto loans and credit cards), credit standards eased somewhat further or changed little, and credit outstanding grew briskly.

Financial stability. Despite experiencing a series of adverse shocks—higher-than-expected inflation, the ongoing supply disruptions related to COVID-19, and Russia’s invasion of Ukraine—the financial system has been resilient, though portions of the commodities markets temporarily experienced elevated levels of stress. The drop in equity prices and rising bond spreads suggest that valuation pressures in corporate securities markets have eased some from their previously elevated levels, but real estate prices have risen further this year. While business and household debt has been growing solidly, the ratio of credit to GDP has decreased to near pre-pandemic levels and most indicators of credit quality remained robust, suggesting that vulnerabilities from nonfinancial leverage are moderate. Large bank capital ratios dipped in the first quarter, but overall leverage in the financial sector appears moderate and little changed this year. Recent strains experienced in markets for stablecoins—digital assets that aim to maintain a stable value relative to a national currency or other reference assets—and other digital assets have highlighted the structural fragilities in that rapidly growing sector. A few signs of funding pressures emerged amid the geopolitical tensions, particularly in commodities markets. However, broad funding markets proved resilient, and with direct exposures of U.S. financial institutions to Russia and Ukraine being small, financial spillovers have been limited to date.

International developments. Economic activity has continued to recover in many foreign economies, albeit with new significant headwinds from Russia’s invasion of Ukraine and COVID lockdowns in China. These headwinds have, on net, pushed commodity prices higher, worsened supply disruptions, and lowered household and business confidence, thus damping the rebound in foreign economic activity. As in the United States, consumer price inflation abroad is high and has continued to rise in many economies, boosted by higher energy, food, and other commodity prices as well by supply chain constraints. In response, many foreign central banks have raised policy rates, and some have started to reduce the size of their balance sheets.

Foreign financial conditions have tightened notably since the beginning of the year, in part reflecting the tightening in foreign monetary policy and concerns about persistently high inflation. Sovereign bond yields in many advanced foreign economies rose. Foreign risky asset prices declined, also driven by downside risks to the growth outlook amid the lockdowns in China and Russia’s invasion of Ukraine. The trade-weighted value of the dollar appreciated notably.

Monetary Policy

In response to significant ongoing inflation pressures and the tightening labor market, the Committee has been adjusting its policies and communications since last fall. The Committee wound down net purchases of securities and began reducing those securities holdings more rapidly than expected, and also initiated a swift increase in interest rates. Adjustments to both interest rates and the balance sheet are playing a role in firming the stance of monetary policy in support of the Committee’s maximum-employment and price-stability goals.

Interest rate policy. In March, after holding the federal funds rate near zero since the onset of the pandemic, the FOMC raised the target range for that rate to ¼ to ½ percent. The Committee raised the target range again in May and June, bringing it to the current range of 1½ to 1¾ percent, and conveyed its anticipation that ongoing increases in the target range will be appropriate.

Balance sheet policy. The Federal Reserve began reducing its monthly net asset purchases last November and accelerated the reductions in December, bringing net purchases to an end in early March. In January, the FOMC issued a set of principles regarding its planned approach for significantly reducing the size of the Federal Reserve’s balance sheet. Consistent with those principles, the Committee announced in May its specific plans for significantly reducing its securities holdings and that these reductions would begin on June 1.

The Committee acutely recognizes the significant hardship caused by elevated inflation, especially on those least able to meet the higher costs of essentials. The Committee is strongly committed to restoring price stability, which is necessary for sustaining a strong labor market.

Special Topics

Labor market disparities. The labor market recovery over the past year and a half has been robust and widespread as the labor market effects of the pandemic have eased, with particularly strong improvement among groups that had suffered the most. As a result, employment and earnings of nearly all major demographic groups are near or above their levels before the pandemic, and employment rates are again near multidecade highs. However, there remain notable differences in employment and earnings across groups that predate the pandemic.

Developments in global supply chains. Supply chain bottlenecks remain a major impediment for domestic and foreign firms. While U.S. manufacturers have been recording solid output growth for more than a year, order backlogs and delivery times remain high, and producer prices have risen rapidly. Further risks to global supply chains abound. In China, COVID-19 lockdowns drove the largest monthly declines in industrial production there since early 2020 while also disrupting internal and international freight transportation. In addition, the war in Ukraine continues to put upward pressure on energy and food prices and has raised the risk of disruption in the supply of inputs to some manufacturing industries.

Monetary policy rules. Simple monetary policy rules, which relate a policy interest rate to a small number of other economic variables, can provide useful guidance to policymakers. Many simple policy rules prescribed strongly negative values for the federal funds rate during the pandemic-driven recession. With inflation running well in excess of the Committee’s 2 percent longer-run objective, a strong U.S. economy, and tight labor market conditions, the simple monetary policy rules considered here call for raising the target range for the federal funds rate significantly.

Global inflation. Inflation abroad rose rapidly over the past year, reflecting soaring food and commodity prices, pandemic-related supply disruptions, and demand imbalances between goods and services. The price pressures have been amplified by the war in Ukraine and COVID-19 lockdowns in China. Although the recent inflation surge was concentrated in volatile components, such as food and energy, price increases have broadened to core goods and services.

Global monetary policy. With inflation rising sharply across the globe, many central banks have tightened monetary policy. Policy tightening started last year as some emerging market central banks, particularly those in Latin America, were concerned that sharp increases in inflation could become entrenched in inflation expectations. Since fall 2021, many central banks in the advanced foreign economies have also started tightening monetary policy or are expected to do so soon, and several central banks that had expanded their balance sheets over the past two years are now allowing them to shrink.

Developments in the Federal Reserve’s balance sheet. Following the conclusion of net asset purchases, the balance sheet remained stable at around $9 trillion. Alongside the removal of policy accommodation—through actual and expected increases in the policy rate—plans for shrinking the size of the balance sheet were announced in May and were initiated in June. Despite the size of the balance sheet remaining steady, reserve balances fell, in large part because of increasingly elevated take-up at the overnight reverse repurchase agreement (ON RRP) facility, which reached a record high of $2.2 trillion. In an environment of ample liquidity, limited Treasury bill supply, and low repurchase agreement rates, the ON RRP facility continued to serve its intended purpose of helping to provide a floor under short-term interest rates and to support effective implementation of monetary policy.

-----

Earlier: