GLOBAL OIL DEMAND 2022 - 23: 100.3 - 103.0 MBD

OPEC - 12 July 2022 - OPEC Monthly Oil Market Report

Oil Market Highlights

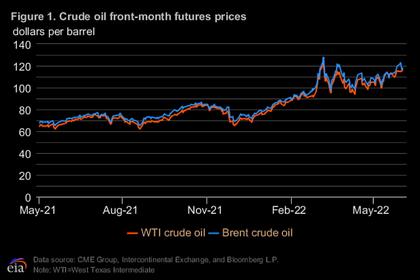

Crude Oil Price Movements

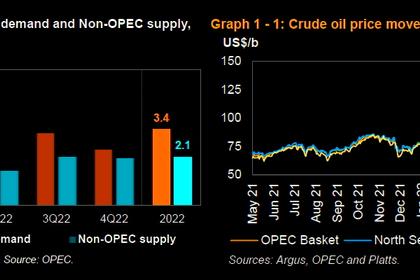

Crude oil spot prices rose in June, extending the previous month’s increase. Higher futures prices and strong physical crude market fundamentals drove the increase, amid higher crude demand from refiners and several supply disruptions. The OPEC Reference Basket rose $3.85, or 3.4%, to settle at $117.72/b. The ICE Brent front month increased by $5.54, or 4.9%, in June to average $117.50/b and NYMEX WTI rose by $5.08, or 4.6%, to average $114.34/b. The Brent/WTI futures spread widened by 46¢ to an average of $3.16/b. The market structure of all three major crude benchmarks – ICE Brent, NYMEX WTI and DME Oman – strengthened further in June and prompt time spreads moved into deeper backwardation. Hedge funds and other money managers cut net long positions by nearly 11% in the two major futures contracts.

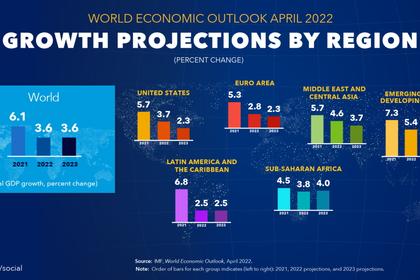

World Economy

World economic growth in 2022 remains broadly unchanged at 3.5%, while the initial forecast for 2023 expects global growth of 3.2%. US GDP growth for 2022 remains unchanged at 3.0%, followed by 2.1% growth in 2023. Euro-zone economic growth for 2022 is unchanged at 3.0%, while growth in 2023 is forecast at 2%. Japan is expected to growth by 1.7% in 2023, following growth of 1.6% in 2022, unchanged from the previous report. China’s 2022 growth remains at 5.1% and GDP growth in 2023 is seen slightly lower at 5%. India’s GDP growth remains at 7.1% in 2022 and is expected to grow by 6% in 2023. Brazil’s economic growth forecast for 2022 remained unchanged at 1.2%, increasing to 1.5% in 2023. For Russia, the 2022 GDP growth forecast is unchanged, showing a contraction of 6.0%, while growth is anticipated to recover to 1.2% in 2023.

Consumption remains robust, especially in the advanced economies, with an expected continued recovery particularly in the contact-intensive services sector, which includes travel and transportation activity, leisure and hospitality. However, significant downside risks exist, stemming from ongoing geopolitical tensions, the continued pandemic, rising inflation, aggravated supply chain issues, high sovereign debt levels in many regions, and expected monetary tightening by central banks in the US, the UK, Japan and the Euro-zone.

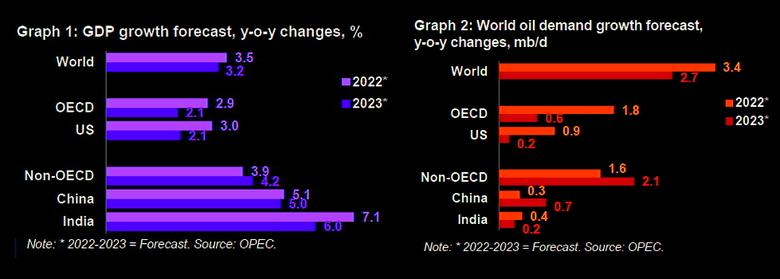

World Oil Demand

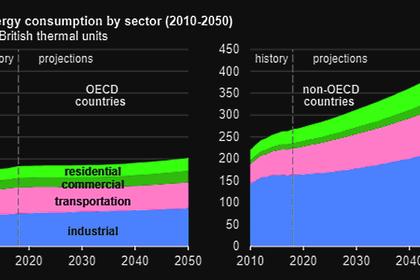

World oil demand growth in 2022 remains unchanged from the previous month’s assessment at 3.4 mb/d. Oil demand in the OECD is estimated to increase by 1.8 mb/d, while non-OECD is seen growing by 1.6 mb/d. Total oil demand is projected to average 100.3 mb/d. The first quarter of this year was revised higher, amid better-than-anticipated oil demand in the main OECD consuming countries. However, with the resurgence of COVID-19 in China and ongoing geopolitical uncertainties, oil demand in 2Q22 is revised lower. For 2023, world oil demand growth is expected to reach 2.7 mb/d to average 103.0 mb/d, with the OECD growing by 0.6 mb/d and non-OECD growth forecast at 2.1 mb/d. Oil demand in 2023 is expected to be supported by a still solid economic performance in major consuming countries, as well as improved geopolitical developments and containment of COVID-19 in China.

World Oil Supply

Non-OPEC liquids supply growth in 2022 remains broadly unchanged from the previous month’s assessment, despite upward revisions to China and Canada, and is now expected to grow by 2.1 mb/d to average 65.7 mb/d. The main drivers of liquids supply growth for the year are expected to be the US, Canada, Brazil, China, Kazakhstan and Guyana, while production is expected to decline mainly in Russia, Indonesia and Thailand. In 2023, non-OPEC liquids production is projected to grow by 1.7 mb/d to average 67.4 mb/d. Liquids supply in the OECD is forecast to increase by 1.4 mb/d in 2023, while non-OECD is seen growing by 0.2 mb/d.

The main drivers for 2023 are expected to be the US, with growth of 1.1 mb/d, followed by Norway, Brazil, Canada and Guyana. However, uncertainty regarding the operational aspects of US production and from ongoing geopolitical developments remains high. OPEC NGLs and non-conventional liquids are forecast to grow by 0.1 mb/d in 2022 to average 5.39 mb/d and by 50 tb/d to average 5.44 mb/d in 2023. OPEC-13 crude oil production in June increased by 234 tb/d m-o-m to average 28.72 mb/d, according to available secondary sources.

Product Markets and Refining Operations

Refinery margins at all main trading hubs continued to increase in June, supported by stronger product fundamentals despite rising product output levels, as refiners continued to increase processing rates following peak maintenance season. Rising transport fuel requirements in line with seasonal trends led to robust gains at the top and middle sections of the barrel. Meanwhile, naphtha and fuel oil came under pressure due to subdued demand and unfavourable economics. Going forward, refinery intakes are expected to rise further to accommodate a seasonal pick up in fuel consumption and allow a much-needed stock build.

Tanker Market

Dirty tanker spot freight rates in June recovered some of the losses seen the previous month. The tanker market continued to improve following the poor performance in 2021, although gains varied across sectors. Suezmax and Aframax markets have benefited from the rerouting of longstanding trade patterns resulting in longer voyages, while VLCCs have seen less momentum from these shifts, with lower flows on longer haul routes such as from the Americas to Asia. Suezmax rates rose 20% m-o-m and Aframax rates increased 11%, while VLCC rates were up 8% on average. Clean rates continued to see strong m-o-m growth, up 21% on average amid tight product markets and increased demand for longer haul routes.

Crude and Refined Products Trade

US crude imports remained broadly unchanged in June at 6.4 mb/d, while US crude exports slipped from the high levels seen the month before to average 3.4 mb/d. China’s crude imports averaged 10.8 mb/d in May, continuing to increase from the weak performance in February, with flows heading to inventories as refineries continued to cut runs. India’s crude imports fell back from an exceptional high the month before to average 4.6 mb/d in May, despite a surge in Russian inflows. Tanker tracking data shows India’s crude imports and product exports moving higher in June. Japan’s crude imports fell back from the previous month’s highs, averaging 2.6 mb/d in May. Recent estimates show OECD Europe’s imports strengthening in May and June, with increased y-o-y inflows from West Africa and the Middle East, partially offset by declines in North Africa.

Commercial Stock Movements

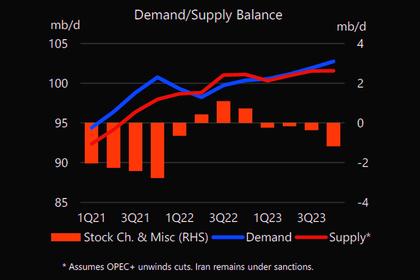

Preliminary May data sees total OECD commercial oil stocks up 10.5 mb m-o-m. At 2,680 mb, inventories were 253 mb less than the same time a year ago, 312 mb lower than the latest five-year average, and 276 mb below the 2015–2019 average. Within components, crude stocks fell by 10.1 mb m-o-m, while product stocks rose 20.6 mb over the same period. At 1,307 mb, OECD crude stocks were 103 mb below the same time a year ago, 176 mb lower than the latest five-year average, and 177 mb below the 2015–2019 average.

OECD product stocks stood at 1,373 mb, representing a deficit of 150 mb with the same time a year ago, 136 mb lower than the latest five-year average, and 97 mb below the 2015–2019 average. In terms of days of forward cover, OECD commercial stocks fell 0.7 days m-o-m in May to stand at 57.3 days. This is 7.0 days below May 2021 levels, 7.6 days less than the latest five-year average and 4.6 days lower than the 2015–2019 average.

Balance of Supply and Demand

Demand for OPEC crude in 2022 remains unchanged from the previous month’s assessment to stand at 29.2 mb/d, which is around 1.1 mb/d higher than in 2021. Based on the initial forecasts for world oil demand and non-OPEC supply in 2023, demand for OPEC crude is expected to reach 30.1 mb/d, 0.9 mb/d higher than the 2022 level.

-----

Earlier: