INDIA NEED OIL INVESTMENT

PLATTS- 06 Jul 2022 - India's latest policy reform providing upstream producers freedom to sell their crude output in the domestic market without restrictions may attract more overseas and private companies to invest in the sector and potentially help the government to reap higher returns, analysts told S&P Global Commodity Insights.

The announcement -- which comes at a time when crude prices are hovering above $100/b and the country's oil import bill is ballooning -- will not only help to widen the customer base for upstream producers, it will also help to boost revenue for the government in the form of various taxes, they added.

"This decision will attract many national and international companies to do exploration and production in India. This will help increase revenue for the government," said Anil Agarwal, chairman of Vedanta Ltd, whose subsidiary Cairn Oil & Gas is India's largest private oil and gas exploration and production company.

Agarwal added that the company was committed to $4 billion of investment in the upstream sector and to eventually contributing 50% of India's domestic hydrocarbons output.

Crude marketing restrictions

The oil ministry said June 29 that India would allow operators to sell locally-produced crude in the domestic market without restrictions from Oct. 1, but restrictions on exporting locally-produced crude would remain.

Under the current policy, the operator of a field cannot directly sell the locally-produced crude into the market and needs government permission for any sale of crude and condensate within the country. But under the new policy, the government would cease its function of allocating domestic crude and condensate output.

"This initiative will ensure marketing freedom for all exploration and production players to monetize their crude oil at the highest price quoted through an e-auction in the domestic market," said Pankaj Kalra, CEO and Director of Essar Exploration and Production.

"For smaller players, with limitations in crude handling and processing facilities and consequently the inability of the government nominee to lift crude from the designated in-field delivery point, this led to about 20% loss of revenues to third parties as processing and handling charges. This can which can now be addressed under open tendering," he added.

India's policies on production, infrastructure and marketing have progressively been eased since 2014. These policies have resulted in the allocation of E&P acreages almost doubling compared with the area awarded before 2014, according to the petroleum ministry.

Rajat Kapoor, managing director for oil, gas and chemicals at Synergy Consulting, said that with the Cabinet approving a proposal which will allow upstream oil companies to sell crude oil to any company in the domestic market, private E&P companies are expected to benefit as they are now not beholden to state refiners to sell their crude.

"Private sector refiners like Reliance and Nayara, which source international crude, have to budget in considerable shipping fees for their imports. They could thus be willing to pay a premium to domestic crude, if available, that can offset higher freight rates, thus making sale of oil to these refiners more remunerative for local upstream producers," Kapoor added.

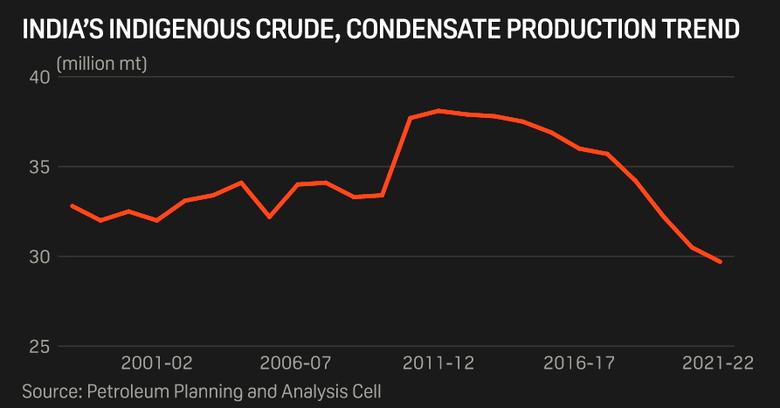

In need of investments

According to Prachur Sah, Deputy CEO of Cairn Oil & Gas, currently, 90% of the country's domestic production comes from old and aging oil fields.

Cairn has recently joined hands with international technology provider Baker Hughes to enhance recovery from the Bhagyam field and to increase its recoverable reserves.

State-run ONGC, which accounts for the bulk of India's crude oil production, said it had recently finalized its future exploration strategy, under which it will intensify its exploration campaign and allocate capital expenditure of about $3.91 billion over the next three fiscal years, a 50% rise over the previous three fiscal years.

ONGC said it plans to leverage international collaborations with reputed global majors for this, for which talks are in an advanced stage.

"ONGC has plans to drill six wells in the next three years -- two under ONGC's committed work program and four through government funding," it said.

"The government's decision to deregulate sales of domestically-produced crude oil will spur both investment and production. Sales in the open market will help in better price discovery, which will help in better demand supply management and also incentivize players to invest more," said Vibhuti Garg, lead India energy economist at the Institute for Energy Economics and Financial Analysis.

"However, any investment should not be based only on short-term market signals, but take a long-term view as lot of banks and financial institutions have committed no new investment. An IEA study also shows that if countries have to achieve the Paris agreement, no new investment in fossil fuels should happen," she added.

-----

Earlier: