IRANIAN OIL RISES

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

IRANIAN OIL RISES

PLATTS - 03 Jul 2022 - Iran, whose energy trade is pressed by US sanctions, is ready to pump more oil as the world needs the crude to balance supply and demand and calm prices before travel seasons in the US and Europe, the oil minister Javad Owji said, according to economic daily Donyay-e Eqtesad on July 2.

Iran could increase production to levels before the sanctions, he said, without giving an estimate of current output. "There are some worries about oil supply shortage in the coming months," he said, despite some concerns about economic slowdown and possible curbs to demand because of geopolitical tensions.

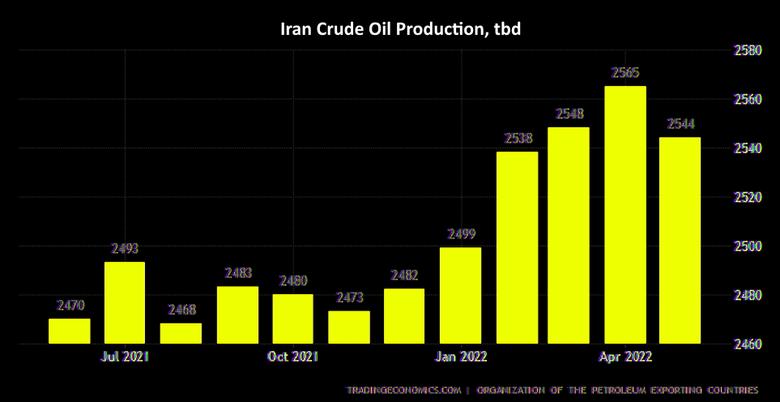

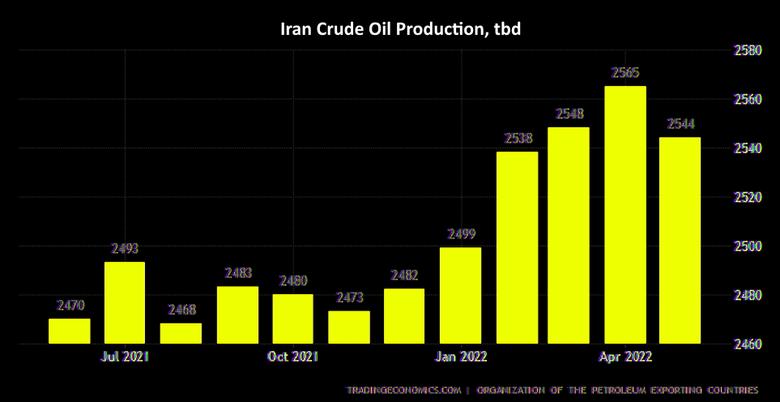

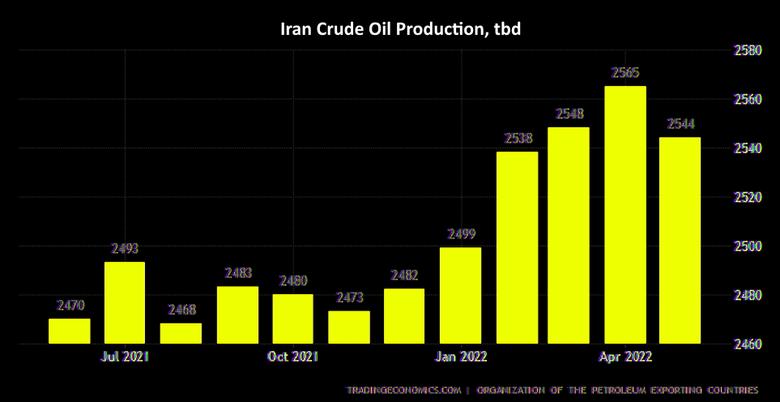

Iran's oil production was 3.8 million b/d before the Trump administration imposed sanctions in 2018. The OPEC member recently said its oil production capacity has topped that figure. In May, according to the Platts survey by S&P Global Commodity Insights, output was 2.58 million b/d, holding at the highest level since March 2019.

"The oil market is in such situation that return of Iran's oil to the market can partially respond to customers and help the global markets reach balance and tranquility," Owji said.

"Particularly, we will be watching global demand increase for oil and oil products as the summer and travel seasons in the Unites States and Europe are approaching," he said.

-----

Earlier:

2022, June, 28, 11:45:00

IRANIAN NUCLEAR RENEWAL

Under the JCPOA between Iran the P5+1 group of countries (the USA, UK, France, Russia, and China plus Germany) Iran agreed to limit its nuclear development in return for the lifting of sanctions.

2022, May, 12, 13:50:00

IRAN'S NUCLEAR ELECTRICITY 10 GW

In April, AEOI head Mohammad Eslami unveiled a Comprehensive Strategic Document of Iran’s Nuclear Industry which envisages the generation of 10,000MW of nuclear electricity.

2022, April, 20, 11:25:00

IRAN NEED INVESTMENT $80 BLN

Iran sits on the world's second-biggest gas reserves after Russia. It exports gas to Iraq and Turkey, with a minor swap with northern neighbors Azerbaijan and Turkmenistan.

All Publications »

Tags:

IRAN,

OIL,

PRODUCTION,

SANCTIONS