RUSSIAN DIESEL FOR EUROPE

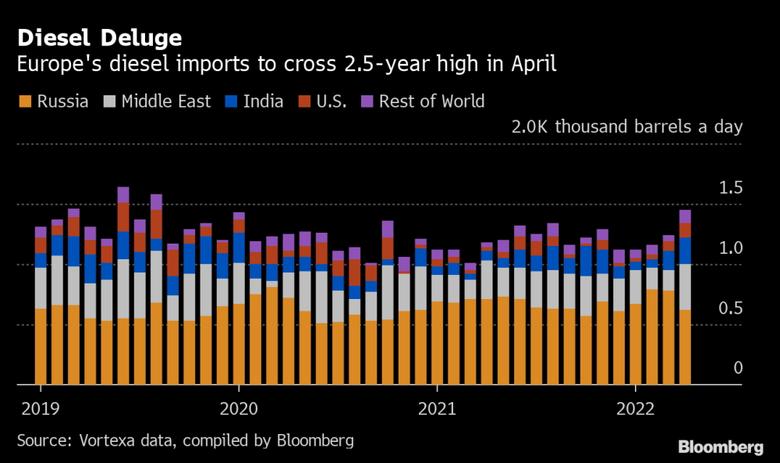

PLATTS - 12 Jul 2022 - European traders are scratching their heads over how to replace what could be at least 2 million mt/month of Russian barrels when an EU export ban kicks in at the end of the year and whether they should be locked in to term contracts or, given the uncertainty, keep things flexible on a term basis.

The threat of demand destruction, already being felt in diesel prices, which have come off record highs, is complicating the process, traders and analysts told S&P Global Commodity Insights on July 12.

"For next year, we will have to see how it goes...it may be much more complicated if there are no flows coming from Russia," a middle distillates trader said. "If we cut Russian supply from one day to the other, we deprive ourselves of 2 million mt of imports."

The European market is poised to see significant flows of diesel from Asia and the US but this has not materialized on a huge scale yet.

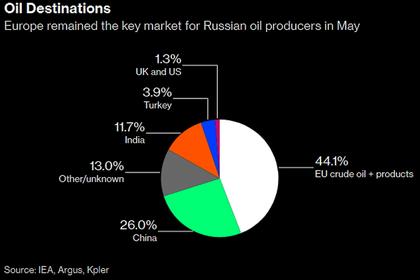

"The market will do its job by opening arbitrages, India can import more crude oil from Russia and export more diesel to Europe...If the premiums increase very strongly, then it should open the arbitrage from the US," the trader said.

Russian diesel cargoes are currently easy to place in Northwest Europe, according to traders. However, supply into Europe -- structurally short of diesel -- next year is uncertain.

"We don't know how to replace [these flows]; no solution has been found yet," a second trader said.

Post-war Russian exports

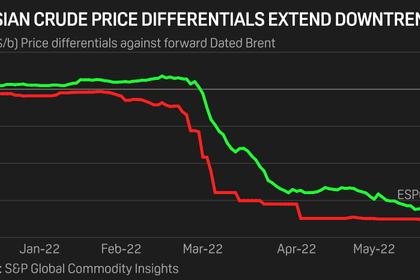

Visibility over Russian diesel export volumes from Baltic and Black Sea ports has diminished in recent months as spot purchases of Russian product are increasingly being shunned by the market.

However, France, Germany and Poland continued to receive term diesel cargoes from Russia, while spot diesel cargoes that would typically supply the UK are now ending up in the Amsterdam-Rotterdam-Antwerp hub instead, with a few Primorsk cargoes also finding their way to Barcelona.

While there has been a small drop in exports of ultra-low sulfur diesel from the Baltic ports of Primorsk and Vysotsk int he wake of Russia's invasion of Ukraine on Feb. 24, these flows between Russian and Europe have now stabilized. Black Sea flows followed a similar trend.

Exports of ULSD from Russia's Black Sea ports of Tuapse and Novorossiisk in July are set to rise by 17.36% month on month to 338,000 mt and 137.5% to 250,800 mt, respectively, while exports of ULSD from Primorsk in June totaled 1.13 million mt, up from 1.04 million mt in May, according to copies of the loading programs seen by S&P Global Commodity Insights.

Total exports of ULSD from Russia into Europe in June amounted to 2.33 million mt, up from 2.26 million mt in May, according to Kpler data. Those figures compare with 2.37 million mt in June 2021 and 2.28 million mt in May 2021.

Planning for 2023

When planning for next year, market participants are trying to answer three questions: how much proportion of the supply they need should be termed versus spot –typically between 50% and 80% is secured through annual term contracts -- where will the supply come if Baltic and Black Sea Russian flows are banned and on what pricing basis should these contracts be based?

The first trader said that whether market participants with shorts into European countries will prefer to buy more on the spot market rather than commit to expensive physical premiums was a big question. "When do you start to take into account an element of demand destruction [if prices are too high]?" he said.

According to a third trader, demand for road fuel diesel is already ticking down in some European countries due to high flat prices and global inflationary pressure.

"There is not very strong demand on the prompt, there is a slight reduction in demand," he said, adding that the first estimates of French domestic consumption of diesel in June showed a 5% year-on-year drop.

""There is no shortage of product at the moment, there are more imports from the Middle East and the Far East," he said, adding that while there are concerns about supply next year in light of sanctions against Russia, diesel cargoes continue to load from Russian ports and supply Northwest Europe, notably France.

"Stopping Russian diesel imports into France will be complicated, Germany will be even more complicated," he said. "There will be more demand towards Eastern Europe...We must replace Russian diesel shipments with imports, but it will be expensive."

"How should we negotiate for next year? We don't want to end up with term contracts that would be very expensive, but on the other hand, the spot is also very expensive," he said.

CIF NWE ULSD cargoes rose $30/mt on the day to $1,199/mt on July 11, to be assessed by Platts at a $91.25/mt premium over August ICE low-sulfur gasoil futures, while CIF NWE all origins ULSD cargoes were assessed at a $16.75/mt discount to August ICE LSGO future, according to S&P Global data. Since June 1, CIF NWE ULSD cargoes have excluded Russian-origin diesel.

-----

Earlier: