U.S., IRAN SANCTIONS ANEW

PLATTS - 06 Jul 2022 - The US government leveled July 6 new sanctions targeting international companies facilitating Iran's oil and petrochemicals exports to east Asia, in the latest sign of pressure to return to the nuclear deal.

The sanctions freeze assets of companies based in Iran, Vietnam, Singapore, the UAE and Hong Kong.

The State Department designated 15 individuals and entities tied to "illicit sales and shipment" of Iranian oil, petroleum products and petrochemicals that have generated millions of dollars' worth of revenue. The list included Vietnam-based Truong Phat Loc Shipping Trading, Singapore-based Everwin Ship Management, and Iran-based Zagros Tarabaran-E Arya, Persian Gulf Star Oil Co. and East Ocean Rashin Shipping.

The Treasury Department sanctioned eight entities and two individuals based in Iran, Hong Kong and the UAE.

Treasury's list included Iran-based Jam Petrochemical for sales to China and the Philippines; Hong Kong-based Lustro Industry Ltd., and UAE-based Edgar Commercial Solutions FZE, Ali Almutawa Petroleum, Petrochemical Trading, and Petrokick.

Treasury said UAE-based Iranian nationals Morteza Rajabieslami and Mahdieh Sanchuli have partnered to export tens of millions of dollars in Iranian crude and petrochemicals on behalf of Switzerland-based Naftiran Intertrade Co. through companies and ships under their control.

The sanctions freeze any assets the individuals or companies have in the US financial system and ban US persons from dealing with them.

Iran talks fizzle

The latest round of indirect talks to revive the 2015 Joint Comprehensive Plan of Action ended without progress June 29, with the US State Department blaming Iran for raising unrelated issues and appearing "not ready to make a fundamental decision on whether it wants to revive the deal or bury it."

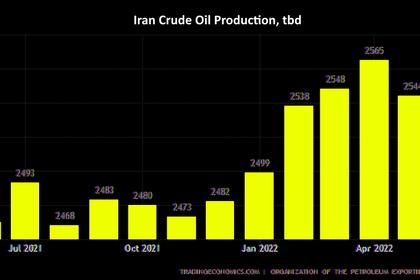

If the US and Iran can agree to restart the JCPOA, oil sanctions relief as part of the deal could return as much as 1 million b/d to the tight global market that has few options for near-term incremental supply.

The talks restarted June 28 after a three-month lag and moved to Doha, Qatar, where some watchers were optimistic that the host country could help bring the two sides together.

Iranian oil exports rose to 850,000 b/d in June from a 2022 low of 650,000 b/d in May, according to Platts Analytics, a part of S&P Global Commodity Insights.

Platts Analytics saw diminishing odds of a near-term deal the longer the stalemate persisted, while risks from regional tensions have increased.

The Eurasia Group remains skeptical that a breakthrough will be reached this year, especially as the US midterm elections in November shrinks the "political space" to strike a deal.

Secretary of State Antony Blinken said Iran has failed to demonstrate a commitment to achieving a mutual return to full implementation of the JCPOA.

"Absent a change in course from Iran, we will continue to use our sanctions authorities to target exports of petroleum, petroleum products, and petrochemical products from Iran," he said in a July 6 statement.

-----

Earlier: