EUROPE NEED OIL GAS INVESTMENT

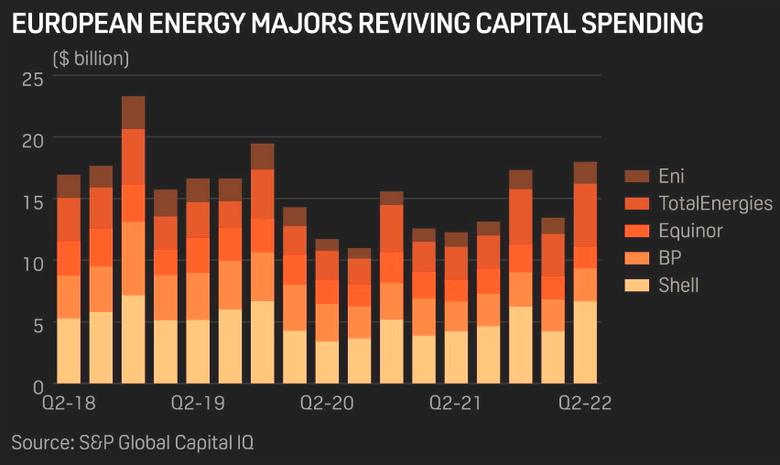

PLATTS - 03 Aug 2022 - Europe's embattled energy majors are warming up to increased investment in oil and gas amid intense regional energy security concerns, dwindling production metrics, triple digit oil prices and soaring profits.

Reporting another set of bumper quarterly earnings on the back of record prices and refining margins, energy majors are being called on to both accelerate their shift to clean energy while reinvigorate spending on oil and gas to help plug a hole left by sanctioned flows from Russia.

More than doubling year-ago levels, Shell, BP, TotalEnergies, Equinor, and Eni announced over $37 billion in Q2 profits as the key Dated Brent oil benchmark neared $140/b in March before settling well above the $100/b mark. At the same time, their upstream production is mostly in terminal decline as the majors prioritize spending on the energy transition.

For now, most of the sky-high profits are being deployed to shareholders via higher dividends and expanded share buybacks. But that has done little to help their defense that the huge earnings are not of their own doing.

While the majors remain committed to capital discipline, they face tough demands over how to spend their soaring profits as concerns over spiraling energy costs force hand-wringing over their role as key fossil fuel producers.

"There is a responsibility with making money and that responsibility is that we continue to invest in energy security...and in the energy transition because ultimately that will make society less dependent on the volatility of oil and gas," Shell's CEO Ben van Beurden said after reporting the company's second record quarterly earnings in a row.

Striking a balance

Pressure is clearly growing to direct more spending to upstream projects, in particular to mitigate Europe's looming gas supply crunch, as the world struggles with an energy crisis.

TotalEnergies said it would boost spending on short-cycle projects this year to help ease Europe's growing energy supply crunch. It expects its full-year capital spending to hit $16 billion in 2022 as it hopes to increase its sources of European natural gas and produce more LNG in the coming months. Part of the additional spending will go to increase gas deliveries to the European market from the North Sea, but also raise oil production capacity in Angola's prolific Block 17, CEO Patrick Pouyanne said.

Eni flagged its upstream tie-up with BP in Angola, its entry into Qatar's huge North Field LNG project and said it's in talks to fast-track a second floating LNG vessel off Mozambique.

BP stuck with its guidance to spend between $9 billion and $10 billion a year on its hydrocarbons business this decade but said it sees increasing investment into hydrocarbons "at the margin".

"We're very focused on where we can, making decisions that allocate capital to where energy security can be helped and to where we can make good returns," CEO Bernard Looney said, adding that BP will probably add a rig in the Gulf of Mexico this year.

BP has pledged to invest up to GBP18 billion ($22 billion) in the UK before the end of the decade including in the North Sea where Looney said some of the spending will target projects such as its Vorlich development as "energy security for today in hydrocarbons."

In the US, BP's Looney said he is "attempting to strike a balance" by leasing another drilling rig in the Gulf of Mexico and spending on clean energy projects.

Noting proposed US legislation on new offshore leasing he said; "It gives a nod to the importance of oil and gas...which I think is quite sensible and pragmatic between delivering energy security today, which is a hydrocarbon-based system for the US and at the same time a lot of climate provisions."

Fresh ears

Despite declining production volumes and clean energy pledges, European energy majors still generate by far the majority of their revenue from fossil fuels. BP and Shell generate around 90% of their operating cash flow from producing and selling fossil fuels.

Accelerated by the pandemic, the global push for clean energy has forced energy majors to rapidly pivot towards spending on the power sector and renewables. Oil and gas are now framed as a legacy business in a managed decline needed to fund the transition to cleaner energy.

But the global energy supply crisis has sharpened minds on energy security.

Undersupply "is a global problem and also a problem that has come about by policy decisions [by governments]. The industry has significantly underinvested collectively," Shell's Van Buerden said.

For Shell, Namibia, Suriname, Brazil, Oman, and Kazakhstan all remain frontier upstream areas with "lots of potential", he said.

He said policymakers who had pushed for cuts in oil and gas production to help hit net-zero targets were still doing too little to moderate demand for energy.

"I've never had as many good discussions with governments since [the Ukraine war started]. "A lot of them...a deeper realization of the depths of the challenge that we are in with when it comes to energy security also a better appreciation that, if this is what it takes to deal with conventional energy, how difficult can the energy transition really be. I think governments are realizing that we would need to work harder on demand, which is, of course, what we have been saying for a long time."

Inflation, windfall taxes

So far at least the post-pandemic inflation surge and supply chain issues have yet to dent energy majors' spending plans it seems. Shell and TotalEnergies while inflationary pressure is visible on drilling rig rates and steel cost, they are mitigating the impact by delaying tendering on some projects as steel prices are seen as having peaked. BP said it's seeing 30% inflation in solar panels but that higher power prices mean its returns from renewables remain stable.

At the operating level, Equinor said the combined higher prices of electricity and CO2 starting to impact its costs.

As oil and gas earnings rocket, a number of countries have also imposed windfall taxes on energy companies in the hope of defraying the impact of sourcing consumer energy prices. The UK has announced a 25% windfall tax on oil and gas producers.

But producers with North Sea assets were mostly circumspect about the extra cost of windfall taxes given their surging revenues from higher prices and strong refining margins.

TotalEnergies' Pouyanne said the tax would cost his firm $500 million, an expense that will be "absorbed" by the cash flow boost generated from higher gas prices.

In addition to similar windfall taxes in Italy, the two levies will create Eur800 million in extra costs for Eni, its CEO Claudio Dezcalzi said.

-----

Earlier: