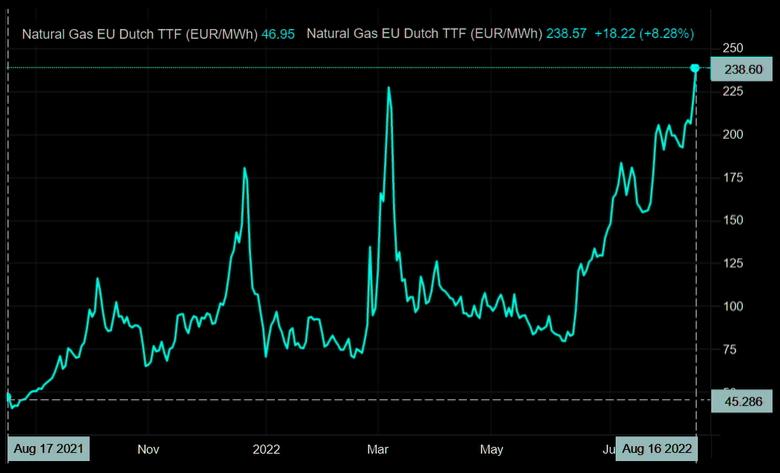

EUROPEAN GAS PRICES RISE

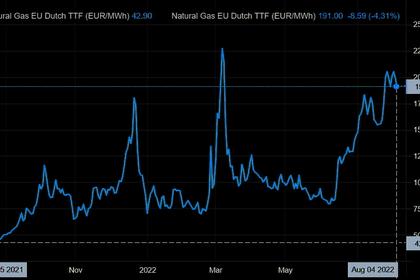

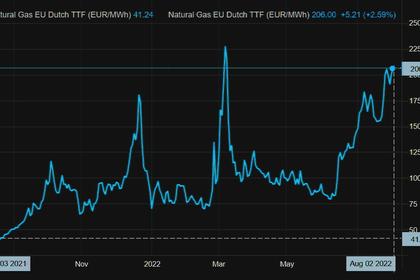

BLOOMBERG - Aug 16, 2022 - Natural gas extended gains as a scorching summer in Europe triggers higher-than-normal demand, exacerbating an energy crisis that’s threatening to push major economies into recession.

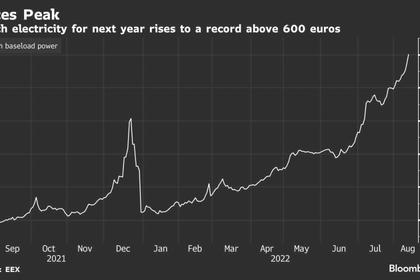

Benchmark futures increased as much as 6.5%, after settling 6.8% higher on Monday. Hot and dry weather is causing river water levels to drop rapidly, hampering the transport of energy commodities. It’s likely to force utilities to use more gas as replacement at a time when supply from Russia continues to be curbed.

“The seemingly inexorable move higher in European natural gas continued,” analysts at Deutsche Bank Research said in a note. “Prices have been bolstered by the latest European heat wave, which has seen rivers dry up and caused issues with fuel transportation, further compounding the continent’s existing woes on the energy side.”

The water level at a key point in the Rhine -- western Europe’s most important river for the transport of fuel and other industrial goods -- hit a new low this week, making it uneconomical for many barges to transit. Energy prices in Europe have been soaring after Russia cut gas supplies, including via the key Nord Stream pipeline, slamming the region’s economy.

Dutch front-month futures, the European benchmark, rose 2.5% to 225.50 euros a megawatt-hour as of 9:25 a.m. in Amsterdam. Prices are about 12 times higher than the seasonal average of the past five years.

Turbine Trouble

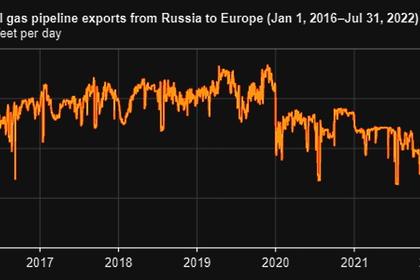

Meanwhile, the standoff continues between Germany and Russia over a Nord Stream pipeline turbine, that’s been stuck in transit after repair works were carried out in Canada. Moscow cut gas shipments through the link to 20% of capacity last month, citing technical problems. Germany’s Economy Minister Robert Habeck said Monday that Russia was using the equipment as an “excuse” to cut supplies to Europe.

“The turbine is available,” Habeck told reporters in Berlin. “The turbine and the delivery of the turbine was, is and will always be, a pretext of Gazprom or Putin, if Gazprom can still speak for itself at all.”

Liquefied natural gas -- which has helped Europe fill up storage sites as Russian supply fell -- may also become more difficult to get as competition for cargoes ramps up. High temperatures are increasing demand in Asia, while companies in the region are also boosting purchases to stockpile for the winter.

“There is a sense of urgency in South Korea, and to a lesser extent, Japan, to rebuild stockpiles ahead of winter as high temperatures have intensified withdrawals,” said Olympe Mattei, a BloombergNEF analyst in a report.

-----

Earlier: