GLOBAL LNG UNCERTAINTY

REUTERS - Aug 9 - Major energy traders are taking hundreds of millions of dollars in losses as they scramble to plug a liquefied natural gas (LNG) supply gap after several outages hampered efforts to fill European storage ahead of the winter heating season.

Unplanned disruptions at LNG plants in the United States, Nigeria and Australia have wrong-footed traders, including BP and Shell, forcing them to pay inflated costs for alternative supplies.

In a market already struggling to meet global demand for natural gas after Russia sharply reduced pipeline supplies into Europe, the lost LNG cargoes which can be transported by ship, have pushed global prices sharply higher in recent months.

BP (BP.L) took a more than $500 million hit to replace LNG cargoes lost after a sudden shutdown of the Freeport LNG plant in Texas in June, industry sources told Reuters.

Freeport, the second-biggest U.S. LNG export plant, supplies BP with 4 million tonnes per year from a total portfolio of 18 million tonnes, BP Chief Financial Officer Murray Auchincloss told Reuters.

"Freeport does create an impact in the quarter and we've provided for that for the year," Auchincloss said. The company had deducted the expected costs from its second-quarter profit, but Auchincloss did not specify costs.

A BP spokesperson declined to comment on the loss figure.

France's TotalEnergies (TTEF.PA) also said it would replace eight cargoes of LNG it was scheduled to receive from Freeport by buying in the spot market in the third quarter of the year. It was unclear how much the replacement cargoes would cost TotalEnergies.

Freeport produces 15 million tonnes of LNG per year.

Traders typically sign long-term offtake agreements with LNG producers and agree on separate deals to supply consumers with cargoes from their global portfolios. It's rare to use plant outages to justify not supplying consumers through what is known as force majeure.

Shell , the world's largest LNG trader with a 20% market share, cut its LNG production volumes in the second quarter by 4%, mainly due to supply losses from the Sakhalin-2 plant in Russia, where it exited operations after Moscow's invasion of Ukraine in February.

The company continues to receive LNG cargoes under existing long-term deals with Sakhalin-2, a company spokesperson said.

But the future of the contracts is shrouded in uncertainty after Russia gave foreign investors in the project one month to claim their stakes in a new entity that will replace the existing one. Shell Chief Executive Ben van Beurden said it was "highly unlikely" Shell would join the new entity.

The supply loss impacted Shell's second-quarter profit by around $200 million in the quarter, according to estimates by industry sources. Shell declined to comment on the figure.

On top of that, Shell and its partners lost LNG production at the giant Prelude floating LNG off the western coast of Australia after shutting it down amid a pay dispute.

Nigeria's huge LNG export terminal on Bonny Island has also seen output declines in recent months as a result of a shortfall in natural gas supplies due to rampant theft and sabotage to oil and gas pipelines.

The money lost is dwarfed by enormous profits both BP and Shell recorded this year on the back of soaring refining margins and high oil and gas prices.

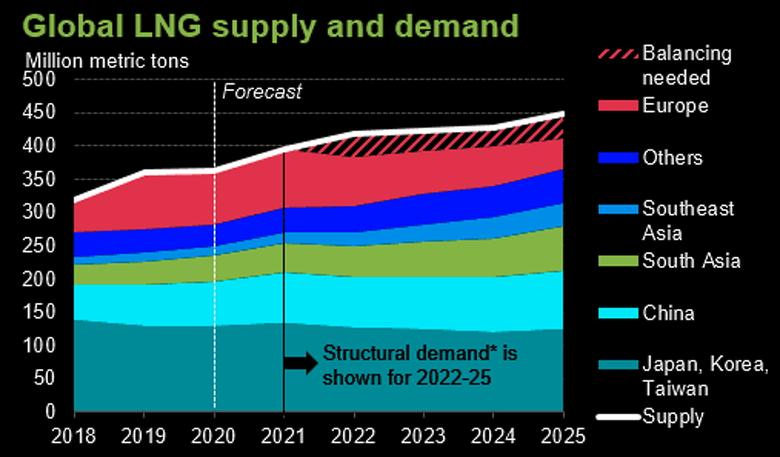

But lower availability of LNG has pushed benchmark prices to record highs as Europe sought to ramp up imports rapidly to replace lost Russian pipeline natural gas.

At current prices, an average cargo of LNG would cost around $100 million in the spot market.

European LNG imports from January to July surpassed a record 100 billion cubic metres (bcm), or 75 million tonnes (Mt), almost reaching the level observed through the entire 2021, according to Nnenna Amobi, senior LNG analyst at Refinitiv.

Around 35% of total European imports were received from the United States in July, versus 43% in June, mainly due to the loss of Freeport cargoes.

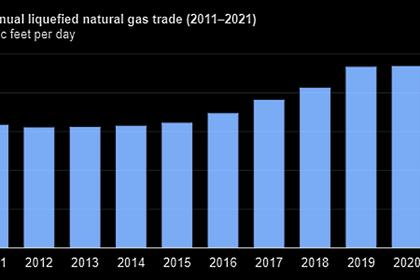

The global LNG market reached 380 million tonnes in 2021, according to Shell.

-----

Earlier: