GLOBAL OIL DEMAND 2022 - 23: 100.0 - 102.7 MBD

OPEC - 11 August 2022 - OPEC Monthly Oil Market Report

Oil Market Highlights

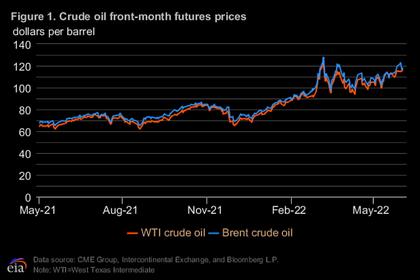

Crude Oil Price Movements

The OPEC Reference Basket fell $9.17, or 7.8%, m-o-m in July to average $108.55/b. Oil futures prices remained highly volatile in July, amid a sharp drop in liquidity. The ICE Brent front month declined $12.38, or 10.5%, in July to average $105.12/b and NYMEX WTI declined by $14.96, or 13.1%, to average $99.38/b. The Brent/WTI futures spread widened further by $2.58 to average $5.74/b. The market structure of all three major crude benchmarks – ICE Brent, NYMEX WTI and DME Oman – remained in strong backwardation, particularly Brent.

This was despite a sharp decline in front-month prices, as fundamental outlooks remained strong. However, the backwardation structure flattened in the first week of August. Hedge funds and other money managers extended heavy selloffs in July, cutting combined futures and options net long positions in ICE Brent and NYMEX WTI to their lowest level since April 2020.

World Economy

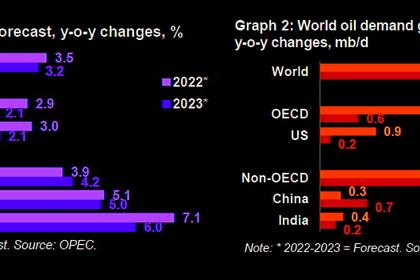

World economic growth is revised down to stand at 3.1% for 2022 and 2023. This is a result of weaker 2Q22 growth in the major economies and an observed soft trend in some key economies. For the US, GDP growth for 2022 is revised down to 1.8%, and to 1.7% for 2023. Euro-zone economic growth for 2022 is expected at 3.2%, while growth in 2023 is revised down to 1.7%. Japan’s economic growth for 2022 is revised down to stand at 1.4%, to be followed by growth of 1.6% in 2023. China’s 2022 growth forecast is revised down to 4.5%, while the 2023 forecast remains unchanged at 5.0%. The forecast for India remains unchanged at 7.1% in 2022 and 6.0% in 2023. Brazil’s economic growth forecasts remain at 1.2% in 2022 and 1.5% in 2023. The 2022 forecast for Russia is unchanged, showing a contraction of 6.0% followed by growth of 1.2% in 2023. Downside risks remain, stemming from the ongoing geopolitical tensions, the continued pandemic, ongoing supply chain issues, rising inflation, high sovereign debt levels in many regions, and expected monetary tightening by central banks in the US, the UK, Japan and the Euro-zone.

World Oil Demand

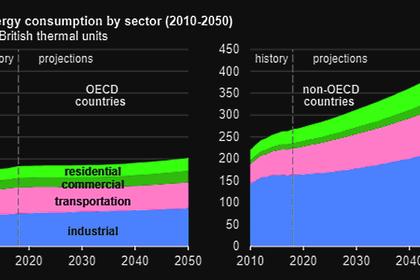

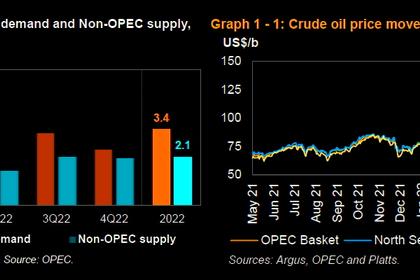

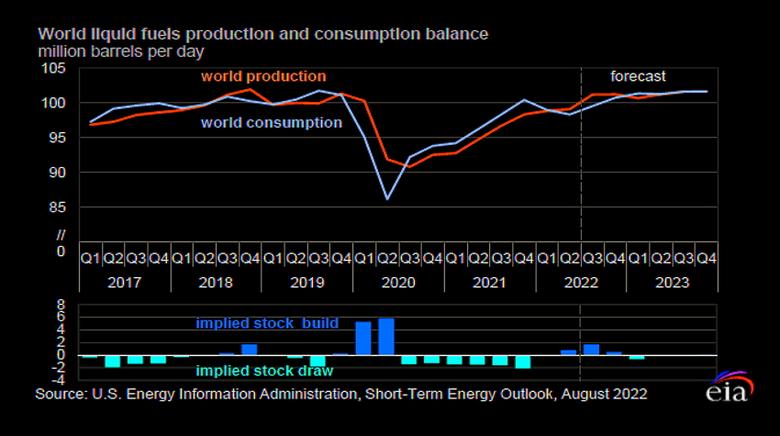

World oil demand growth in 2022 is revised downwards from the previous month’s assessment but still shows healthy growth of 3.1 mb/d, including the recently observed trend of burning more crude in power generation.

Oil demand in the OECD is estimated to grow by 1.6 mb/d, while the non-OECD is expected to grow by 1.5 mb/d. Total oil demand is expected to average around 100 mb/d in 2022. The first half of this year is revised higher, amid better-than-anticipated oil demand in the main OECD consuming countries. However, oil demand in 2H22 is revised lower, amid expectations of a resurgence of COVID-19 restrictions and ongoing geopolitical uncertainties. For 2023, the forecast for world oil demand growth remains unchanged at 2.7 mb/d, with total oil demand averaging 102.7 mb/d. The OECD is expected to grow by 0.6 mb/d and the non-OECD by 2.1 mb/d.

Oil demand in 2023 is expected to be supported by a still-solid economic performance in major consuming countries, as well as improving geopolitical developments and improvement of COVID-19 in all regions. World Oil Supply Non-OPEC liquids supply growth in 2022 is forecast at 2.1 mb/d to average of 65.8 mb/d, broadly unchanged from the previous assessment. An upward revision to Russia is offset by downward revisions to the US, Norway and Kazakhstan. The main drivers of liquids supply growth for 2022 are expected to be the US, Canada, Brazil, China and Guyana, while production is expected to decline mainly in Indonesia and Thailand. In 2023, growth in non-OPEC liquids production remains unchanged at 1.7 mb/d to average 67.5 mb/d. The main drivers for growth in 2023 are expected to be the US, Norway, Brazil, Canada and Guyana. However, uncertainty regarding the operational and financial aspects of US production, as well as the geopolitical situation in Eastern Europe remains high. OPEC NGLs and non-conventional liquids are forecast to grow by 0.1 mb/d in 2022 to average 5.4 mb/d and by 50 tb/d to average 5.4 mb/d in 2023. OPEC-13 crude oil production in July increased by 216 tb/d m-o-m to average 28.90 mb/d, according to available secondary sources.

Product Markets and Refining Operations

Refinery margins in all main trading hubs reversed trends in July, falling back from the multi-year record highs registered in June. A counter-seasonal downturn in US product demand and rising refinery processing rates in Europe and in Asia led to product stock builds, providing partial relief to the product tightness witnessed over the past months. At the same time, concerns over a weakening global economy and a softer product market outlook likely further contributed to the downturn in refining economics globally. This weakness was manifested across the barrel in all regions as product prices retreated from the record-breaking highs witnessed in June. Going forward, transport fuel requirements should remain supportive in line with seasonal trends. Refinery intakes are expected to remain well-sustained to fulfil seasonal fuel consumption and allow continued restocking of product inventories.

Tanker Market

Dirty tanker spot freight rates in July have fully recovered from the decline seen earlier in May, as trade dislocations boosted activities in longer haul routes. VLCC rates on the Middle East-to-East route rose by 26%, while flows West were up 30%. The wide Brent/WTI spread also made US crude more competitive in Asia, supporting VLCC demand. Aframax rates on the Mediterranean to North West Europe route increased 38% m-o-m on average, while Suezmax rates from the US Gulf to Europe rose by 23%, amid strengthening demand for longer haul flows to Europe. Clean rates came down after gaining steadily over the past months, with declines particularly strong in the Med, as trade dislocations generated volatility.

Crude and Refined Products Trade

Preliminary data shows US crude imports reached a three-year high of 6.7 mb/d in July, amid higher flows from OPEC member countries and Brazil. US crude exports jumped to a record high of 3.7 mb/d based on preliminary weekly data, as the wide Brent/WTI spread stimulated a return of Asian buying. China’s crude imports fell to an almost four-year low of 8.7 mb/d in June and are expected to remain at low levels, as lockdown measures earlier in the year and a spike in buying triggered by geopolitical developments in February have left inventories at ample levels. India’s crude imports edged higher, averaging 4.7 mb/d in June, with Russia flows up 0.9 mb/d y-o-y according to secondary sources. India’s crude imports are likely to remain close to current levels in July, with Russian inflows remaining above 1.0 mb/d but with slight lower flows from elsewhere. Japan’s crude imports dropped to an 11-month low in June, averaging 2.3 mb/d, although still managed an increase y-o-y. Japan’s crude imports are expected to recover with the return of refineries from maintenance in July. Preliminary figures show OECD Europe crude imports remaining at high levels in recent months, while crude exports fell to 7-year lows in April.

Commercial Stock Movements

Preliminary June data indicates total OECD commercial oil stocks rose 20.9 mb m-o-m. At 2,712 mb, inventories were 163 mb below the same period a year ago, 261 mb lower than the latest five-year average, and 236 mb below the 2015–2019 average. Within components, crude and product stocks increased by 6.4 mb and 14.5 mb, respectively, m-o-m. At 1,330 mb, OECD crude stocks were 54 mb lower y-o-y, 125 mb lower than the latest five-year average, and 135 mb below the 2015–2019 average. OECD product stocks stood at 1,381 mb, representing a deficit of 109 mb compared with the same month last year, 136 mb lower than the latest five-year average and 100 mb below the 2015–2019 average. In terms of days of forward cover, OECD commercial stocks rose m-o-m in June by 0.1 to stand at 58.9 days. This is 3.7 days below June 2021 levels, 5.3 days less than the latest five-year average, and 2.9 days lower than the 2015–2019 average.

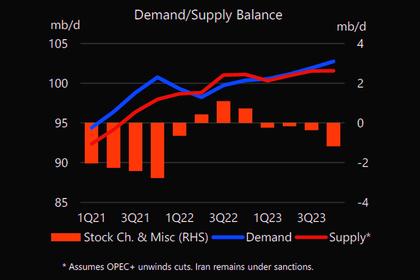

Balance of Supply and Demand

Demand for OPEC crude in 2022 is revised down by 0.3 mb/d from the previous month’s assessment to stand at 28.8 mb/d, which is around 0.9 mb/d higher than in 2021. Similarly, demand for OPEC crude in 2023 is revised down by 0.3 mb/d from the previous month’s assessment to stand at 29.8 mb/d, around 0.9 mb/d higher than the 2022 level.

-----

Earlier: