OIL PRICES CAN RISE

By NICK FERENGI Founder and Editor CAGR Value

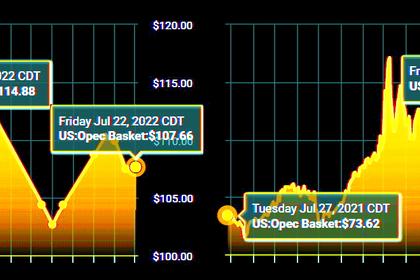

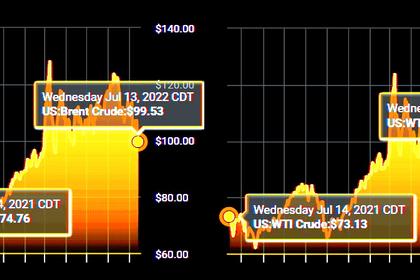

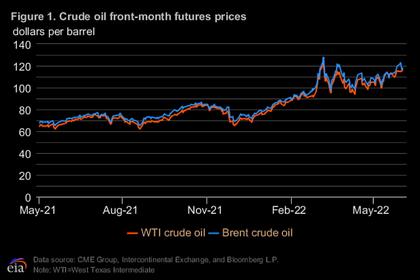

ENERGYCENTRAL- Jul 28, 2022 - Oil Prices rallied between December 2021 and March 2022 to hit new 14-year highs. The light crude oil raced to reach $130 per barrel before plunging to a low of $93 in April. And after surging again to hit a high of $123 on June 10, the WTI crude oil price pulled back again to trade below $94 last week.

Why oil prices have pulled back recently

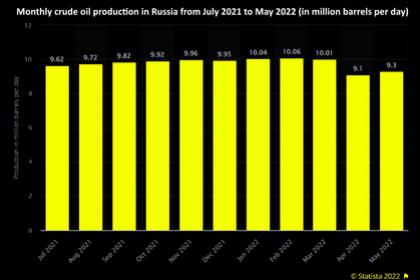

While the pandemic seems to be having a lesser effect on commodity prices, industry experts suggest that the recurrence of Omicron sub-variants of Covid-19 continues to hold back key decisions by OPEC to increase output to pre-pandemic levels.

Production cuts helped oil prices to rally significantly during the peak of the pandemic and they are still having a slight impact. However, the most significant factor in the price of oil right now is inflation coupled with recession fears.

Moreover, investors seem to be cashing out profits made during the bull run, which also adds pressure on the light crude oil price. According to trading data compiled by currencies and commodity trading brokerage platform Capital.com for Q2, the WTI crude oil was among the most shorted commodities on the platform.

Overall, investors demonstrated a higher level of bearish sentiment toward markets with equity prices also falling.

Another factor affecting oil prices is the ongoing rate hikes in the US, the UK, Europe, Canada and Australia. With inflation growth failing to slow down, the current rate hikes are seen as a threat to the stability of the global economy.

Therefore, investors have become more cautious about betting on assets that have rallied to new multi-year highs like oil and gas. According to the Capital.com report, the light crude oil witnessed as many exits in positions during the second quarter of 2022 as it witnessed entries during Q1.

That is to say, all those investors that helped rally the price of oil between January and March cashed out in Q2, especially during the final three weeks of June.

So have we reached a bottom yet?

From the chart, the WTI crude oil appears to have recently bounced off the crucial support zone at about $93.00 per barrel. It has since edged higher to trade at $97.26, indicating progress in the recovery.

Looking back to March, the light crude oil price has not traded below $93 for a considerable time, which suggests that it could be a strong base.

Therefore, despite the Federal Reserve’s decision to hike interest rates by another 75 basis points on Wednesday, it looks likely that oil prices will continue to recover from the recent collapse.

Conclusion

In summary, whilst investors remain worried by the aggressive approach taken by central banks around the world to raise interest rates, there is also optimism that correction for the December 2021-March 2022 oil price rally may be over.

In addition, the recent pullback also appears to have found strong support around the $93.00 per barrel level, which could trigger another bull run.

-----

This thought leadership article was originally shared with Energy Central's Energy Collective Group. The communities are a place where professionals in the power industry can share, learn and connect in a collaborative environment. Join the Energy Collective Group today and learn from others who work in the industry.

-----

Earlier: