OPEC EARNINGS $842 BLN

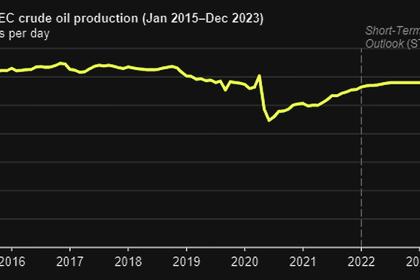

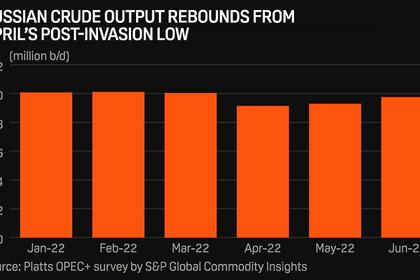

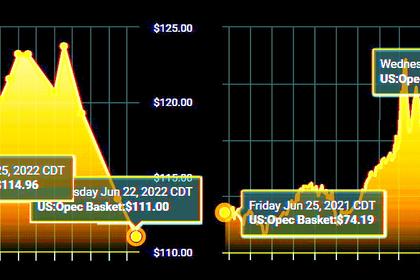

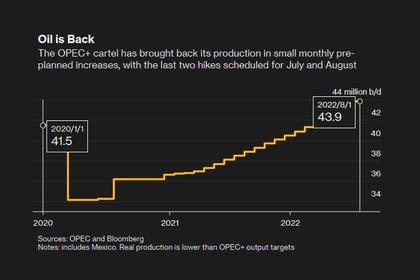

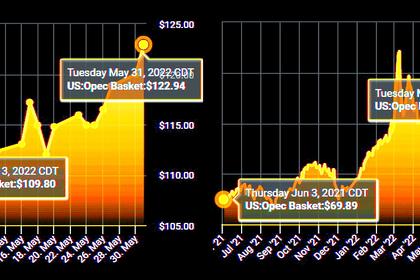

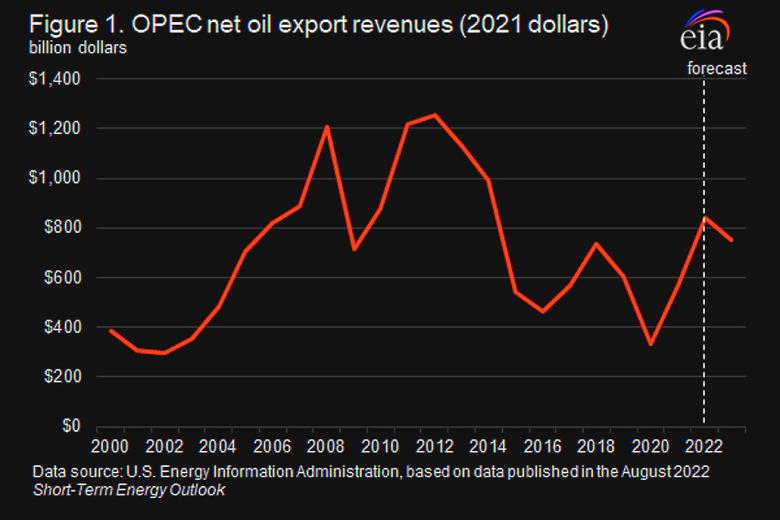

U.S. EIA - August 24, 2022 - Members of OPEC will earn about $842 billion in oil export revenue in 2022, the most inflation-adjusted net oil export revenue for the group since 2014, when they collectively earned nearly $992 billion. The 2022 OPEC revenues will be a nearly 50% increase from $570 billion in 2021 (Figure 1). The revenue increase can be attributed to 2.3 million barrels per day (b/d) more liquids production this year and on higher crude oil prices. Crude oil prices had been generally increasing since late 2020, when global consumption began to outpace production, resulting in inventory draws. However, prices further increased sharply following Russia’s full-scale invasion of Ukraine in February 2022 and have averaged more than $100 per barrel since then.

In 2021, OPEC’s export revenues increased by nearly 70% from 2020, when the group saw the least export earnings since 2002, an estimated $335 billion in 2021 dollars. The rise in export revenues from 2020 to 2021 was primarily the result of increased OPEC production and higher crude oil prices during the year. OPEC set higher production targets in 2021, and OPEC liquids production reached 31.7 million b/d, a 1.0 million b/d increase from 2020. Global crude oil prices increased in 2021, mainly as a result of global oil consumption outpacing oil production, which led to persistent withdrawals from global liquid fuels inventories throughout 2021 and into 2022.

Virtually all of OPEC’s liquids production increase in 2021 came from countries that were not subject to production targets; production from Iran, Libya, and Venezuela all increased in 2021. Using standard oil price benchmarks, these production increases resulted in estimated net export revenues in 2021 rising by $22 billion in Iran, $22 billion in Libya, and $4 billion in Venezuela. These estimates are based on the August 2022 STEO estimates of OPEC’s liquids production, liquids consumption, and crude oil prices, and consequently do not take into account discounts that Iran and Venezuela offered to their crude oil buyers because of sanctions that have made it difficult to sell their crude oil on the international market.

Iran’s crude oil production rose by 430,000 b/d in 2021, and its crude oil exports increased mainly to China during the year. Iran’s crude oil production increased to 2.5 million b/d in April 2021, from the low of 1.9 million b/d in mid-2020, and stayed at this level through December 2021. Libya’s crude oil production averaged nearly 1.2 million b/d in 2021, an increase of 800,000 b/d from 2020 (Figure 3). Libya’s crude oil production has continually fluctuated because of armed conflict and political instability since Libya’s first civil war, which began in 2011. Libya’s production has declined significantly since the beginning of 2022 and was less than 0.5 million b/d in July 2022. Venezuela’s production also increased during 2021. After five years of declines, Venezuela’s crude oil production rose from 0.5 million b/d in 2020 to almost 0.6 million b/d in 2021, primarily as a result of increased access to condensate and other diluents they use to blend with Venezuela's heavy crude oil and an increase in oil service companies’ activities in the country.

Looking ahead to 2023, OPEC members’ liquids production to rise to 34.5 million b/d, a 570,000 b/d increase from 34.0 million b/d in 2022. Although we forecast an increase in OPEC output in 2023, production will be about 2.4 million b/d less than OPEC’s annual all-time production high of 37.0 million b/d in 2016. OPEC net export revenues in 2023 will average $752 billion, nearly double the revenues in 2016 on an inflation-adjusted basis. The increase in crude oil prices will more than offset the effects of lower production.

OPEC net revenues will fall in 2023 as a result of lower global crude oil prices. Global oil inventories, which began to build in the second quarter of 2022, will be mostly balanced in 2023 and contribute to lower prices. However, our forecast is subject to heightened uncertainty related to how sanctions will affect Russia’s production as well as the economic outlook and the pace of oil consumption growth. In addition, some OPEC producers continue to face uncertainty related to their production because unplanned production outages could significantly affect future production and net export revenues. This uncertainty is particularly high in Iran, Libya, Venezuela, and Nigeria.

-----

Earlier: