RUSSIAN OIL WITHOUT LIMITS

WSJ - August 4, 2022 - A Biden administration proposal to cap the price of Russian oil is facing skepticism from some oil analysts and financiers who question whether the U.S. and its allies can effectively dictate the global sales price for a major supplier of oil.

Officials from the White House, Treasury Department and Energy Department have hosted a series of calls and meetings in recent weeks with banks, maritime insurers and oil companies about the price-cap idea, according to people familiar with the meetings. Those talks come on top of a range of diplomatic efforts with China, Europe and others to build support for the novel plan.

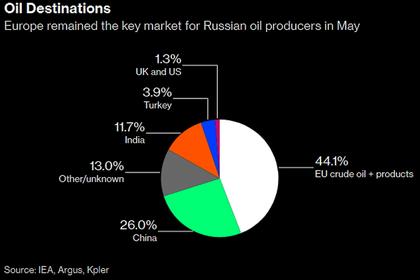

The price-cap push is at the center of Western efforts to impose tighter economic penalties on Russia for its invasion of Ukraine earlier this year. While the U.S. and European Union have already moved to ban imports of Russian oil into their ports, officials are now scrambling to curb Russia’s revenue from its oil sales globally and also avoid soaring energy prices during a time of high inflation. Russian officials say their economy hasn’t been slowed by the Western sanctions, while U.S. officials say the sanctions are already hampering Russia’s war effort.

The discussions with industry officials about the price cap have raised questions among some participants about the feasibility of the plan.

“I don’t know of anybody who works in markets who believes this is a workable idea and I think most of us who work in markets believe that it has dangers associated with it,” said Edward Morse, the global head of commodities research at Citigroup, who has participated in briefings with administration officials. “It invites opportunities to use potential loopholes.”

Russia may find alternative ways to sell its oil that would escape the U.S.-led sanction effort, creating possible market distortions and arbitrage opportunities, and some Russian officials have suggested they would refuse to sell oil under the price cap. Depending on the exact enforcement of the price cap, the effort could also create a new sanctions-compliance system that may be difficult for banks and insurers to enforce.

Treasury officials have that said Russia would continue to have an economic incentive to sell oil under the price cap, or else risk possibly damaging their production capacity, and that they are aiming to design the cap so that banks, insurers and others can easily comply with it.

“Our goal is not that every drop of Russian oil would be sold within the price cap coalition,” Deputy Treasury Secretary Wally Adeyemo, who recently traveled to Europe for talks on the plan, said in an interview. “Our goal is that we reduce Russian revenue while allowing energy to flow onto the market.”

Many of the questions about the price-cap plan stem from its central premise: Russia needs access to insurance and financing from institutions in the U.S., U.K., and the EU to export large volumes of oil. Under the proposal, shipments of Russian oil would be denied access to Western insurance and financing unless the sales price of the oil fell under the cap. Such a cap could fall between $40 and $60 a barrel. Benchmark oil traded near $90 a barrel on Wednesday.

The price cap would effectively pare back an EU ban on insuring and financing shipments of Russian oil that is scheduled to begin in December. But Treasury officials have said that without insurance and financing from the U.S., U.K. and EU, Russia would be largely unable to export its oil, which would risk a potentially large price increase that markets haven’t yet anticipated.

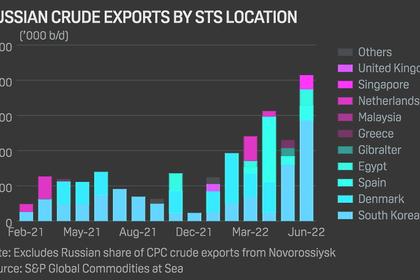

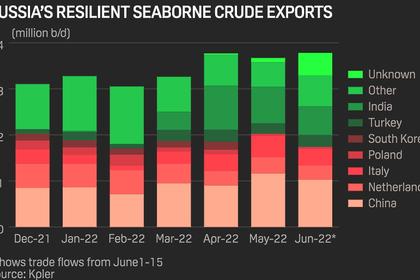

But some in markets dispute that analysis. They are pointing to signs that Russia and purchasers of its oil are already seeking alternatives to the insurance and reinsurance suppliers in the U.K. and EU.

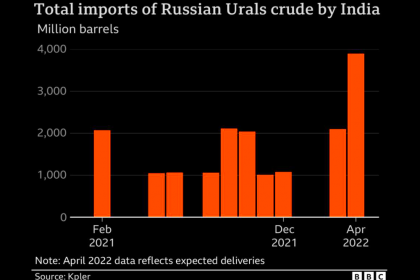

India and China are two large markets for Russian oil that aren’t aligned with U.S.-led sanctions. Officials in those countries have already started arranging alternative insurance for shipments of Russian oil Under a recent deal for purchases through 2028 between Indian Oil Corp. , a major Indian refiner, and Kremlin-aligned giant Rosneft Corp., Rosneft will handle the delivery and insurance of the oil, meaning the shipments could likely happen without access to Western financing and insurance.

Russian oil is currently trading roughly $30 below global benchmarks because of legal and political concerns about handling Russia’s biggest export commodity during the war. Even with that discount, market participants and sanctions analysts say it is unlikely Russia could export nearly as much oil without access to Western institutions—particularly reinsurers.

“The pool of risk takers will be much smaller, but it doesn’t mean that no drop of Russian oil will ever be on the global market,” Maria Shagina, a sanctions expert at the International Institute for Strategic Studies, said of the insurance ban.

Biden administration officials are unconcerned by the prospect of Russia selling oil to purchasers like India and China without Western financing and insurance, according to people familiar with their thinking. Rather than forcing purchasers to buy Russian oil at a certain price, the price-cap plan would give buyers a cheaper option, according to industry and administration officials.

Even if purchases happen outside the U.S.-crafted price-cap plan, prices could still fall just because of its existence. That would still meet the U.S. goal of reducing the sales price of Russian oil, according to people familiar with the Biden administration’s view.

“If the discount is big enough, we’re accomplishing our goal,” Mr. Adeyemo said.

For purchases of Russian oil that could eventually take place under a price cap, buyers would likely attest that they would comply with the cap in the letter of credit for the purchase. But it is an open question whether or how to verify that purchases made with the financing comply with the price cap, a possibly labor-intensive step, according to a person familiar with discussions between the Treasury and banks on the topic.

“We’re working to make sure that the system for attestation or for determining the price at which the crude is being sold is as simple as possible for the private sector,” Mr. Adeyemo said.

Crafting the details of the plan both with diplomatic partners and private sector institutions will face a deadline: Dec. 5, when the EU insurance and financing ban is set to go into effect. The cap would likely have to be largely crafted several weeks ahead of that to give markets time to prepare for it. Initially, some U.S. officials had said a price cap could go into place ahead of the December sanctions.

The December timeline has frustrated some, including Oleg Ustenko, an economic adviser to Ukrainian President Volodymyr Zelensky, who wants to start cutting into Russia’s oil revenues sooner.

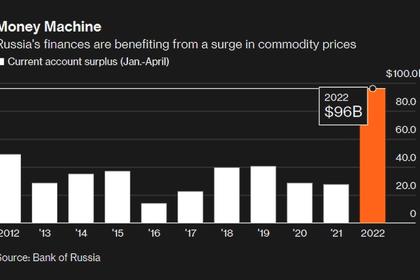

“To tell you the truth we think it’s inappropriate to wait for December because you can imagine how much money Russia is going to make from their oil,” he said.

-----

Earlier: