SAUDI, CHINA COOPERATION

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

SAUDI, CHINA COOPERATION

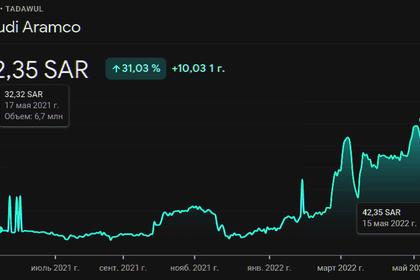

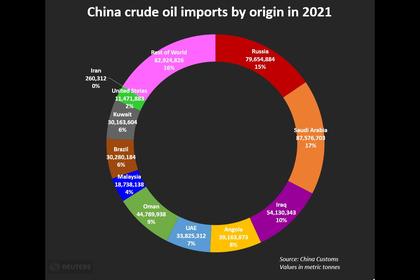

AN- August 03, 2022 - Saudi oil giant Aramco has signed an initial agreement with China Petroleum & Chemical Corp., known as Sinopec, to collaborate on projects in the Kingdom, according to a statement.

The areas of potential cooperation include upstream and downstream businesses, engineering and construction, oilfield services, carbon capture and hydrogen.

The companies will also discuss the opportunities for the establishment of a local manufacturing hub in King Salman Energy Park.

Mohammed Y. Al Qahtani, Aramco Senior Vice President of Downstream, said: “We are delighted to be able to extend our relationship with Sinopec and leverage our mutual strength and reach while creating a path to bring our long-standing cooperation in China to our facilities in Saudi Arabia.

“This latest collaboration will help to further advance our strategic relationship with Sinopec into key areas of mutual benefit within the Kingdom."

Yu Baocai, President of Sinopec, said: “The two companies will join hands in renewing the vitality and scoring new progress of the Belt and Road Initiative and Vision 2030.”

-----

Earlier:

2022, August, 4, 10:20:00

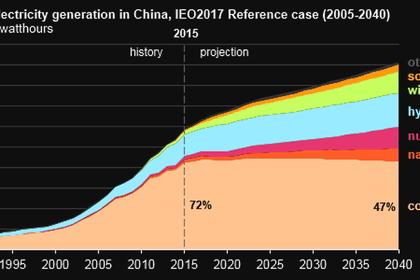

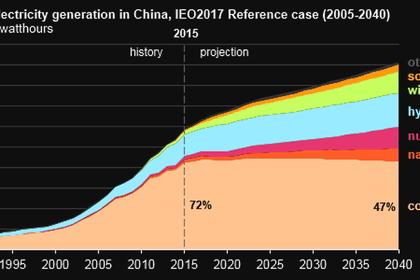

CHINA ENERGY PLAN

Indeed, by 2025, companies in the steel, building materials, petrochemicals, non-ferrous metals, consumer goods, equipment manufacturing and electronics sectors with an annual revenue of CNY20m (US$2.9m) or more will have to cut their energy use by 13.5% from 2020 levels.

2022, August, 3, 12:15:00

SAUDI'S INVESTMENT MARKETING $3.2 TLN

Saudi Arabia would be looking to secure investments in untapped business sectors, including green hydrogen, renewable energy, and information technology.

2022, July, 15, 11:50:00

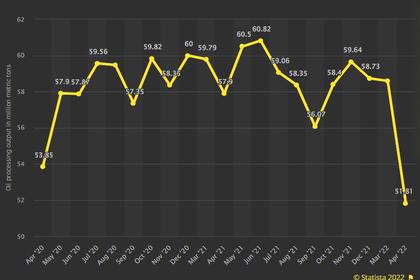

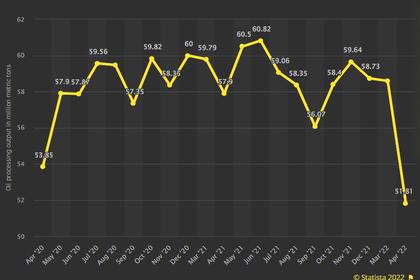

CHINA'S OIL THROUGHPUT UPDOWN

As a result, China's crude throughput in June rose a further 1.9% month on month to 54.94 million mt in May, when the volume had rebounded 4.1% from a 35-month low of 51.81 million mt in April,

2022, May, 16, 12:00:00

CHINA'S OIL DOWN TO 12.7 MBD

The crude throughput was the lowest since March 2020 when it was at 11.81 million b/d, following lockdowns after the initial COVID-19 wave.

2022, May, 11, 11:15:00

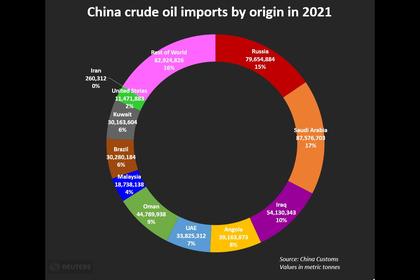

CHINA NEED RUSSIAN OIL

Thus, after the slump in March inflows, Russian crude imports by China's independent refiners recovered 35.7% year on year to 2 million mt in April

All Publications »

Tags:

SAUDI,

ARAMCO,

CHINA,

SINOPEC,

OIL,

CARBON,

HYDROGEN