U.S. OIL INDUSTRY LIQUIDATION

By ED REID Vice President, Marketing (Retired) / Executive Director (Retired) / President (Retired) Columbia Gas Distribution Companies / American Gas Cooling Center / Fire to Ice, Inc.

ENERGYCENTRAL - Aug 16, 2022 - President Biden spoke about his approach to destroying the US oil industry during a primary campaign debate in 2020. The approach focused on depriving the industry of supply through a combination of banning new exploration and drilling on federal lands and the application of new laws and regulations making industry operations more difficult and more expensive.

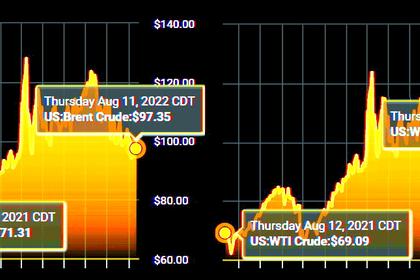

The Biden Administration has aggressively pursued this approach over the past 18 months, as documented here. The actions taken by the Administration have had a predictable effect on both gasoline and Diesel prices and availability. It is ludicrous to assume that a commitment by the federal government to destroy an industry would not create turmoil within the industry and among its customers.

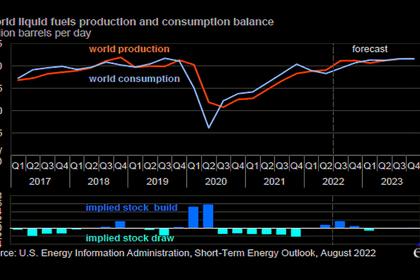

The Administration has reacted to the resulting price increases and supply shortages by blaming the US oil industry and accusing it of price gouging; and, seeking production increases from OPEC. The Administration has even approached Venezuela and Iran about supplying additional oil. Only after these approaches to foreign suppliers has the Administration begun encouraging the US industry to increase production, while still maintaining the intent to put the industry out of business.

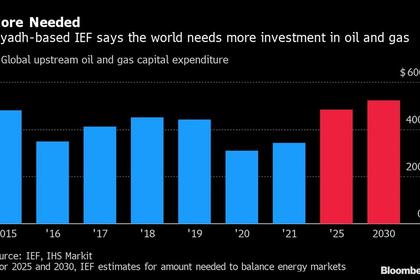

The US oil industry has modestly increased production from existing fields, but has been reluctant to invest in new E&P activity in the face of the Administration’s actions and threats of future actions. The Wall Street Journal recently described the industry’s approach as an “orderly liquidation” of current assets, including using increased revenues resulting from higher demand and prices to fund share buybacks and distributions to stockholders. This approach by the industry appears to be a reasonable exercise of fiduciary responsibility to its shareholders.

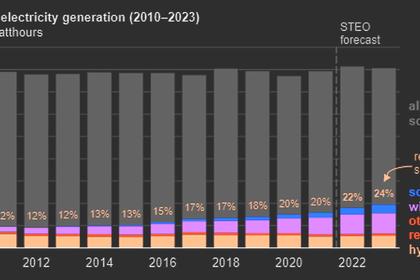

It seems likely that this “orderly liquidation” approach will spread to other energy industry participants under similar Administration threats to their futures. The owners and operators of coal mines and coal-fired powerplants are faced with termination of their operation by 2030 and are unlikely to make any significant investments in their facilities in the interim. They would also likely terminate operations if faced with the necessity of major facility repairs or deteriorating market conditions. It is also unlikely that state utility commissions would approve incremental investments in coal facilities owned by utilities under their jurisdiction.

It also seems unlikely that either utility or non-utility generators would invest in new natural gas combined-cycle gas turbine (CCGT) generators, since their operations would be required to cease by 2035 to comply with the Administration’s goals. New CCGT generator facilities would have to be fully depreciated over 10 – 12 years, or 25-30% of their useful lives. Such rapid depreciation would further increase the cost of the electricity they generated.

There is no indication that such orderly liquidations would be offset by orderly installation of replacement facilities, particulary since the long-duration electricity storage technology necessary to render renewable generation facilities dispatchable is not currently commercially available, nor is there any schedule for its commercial availability of any indication of its likely cost and performance.

-----

This thought leadership article was originally shared with Energy Central's Energy Collective Group. The communities are a place where professionals in the power industry can share, learn and connect in a collaborative environment. Join the Energy Collective Group today and learn from others who work in the industry.

-----

Earlier: