ESG & ENERGY INVESTMENT

By PETER BERNARD Chief Executive Officer Datagration

ENERGYCENTRAL - Aug 26, 2022 - Creating and investing in an environmental, social, and governance (ESG) strategy is no longer an option, it is a necessity. Any business looking to expand operations and grow revenue must invest in a robust and complete ESG strategy. Customers, lenders, and insurers are constantly asking more and more questions about ESG and, perhaps most importantly, investors have signaled that potential investments will not be made if a company does not meet ESG expectations.

The Growing Influence of ESG

The ESG landscape has entirely transformed over the past two decades. Investors, customers, and stakeholders have only recently begun to take an active interest in their assets' social and environmental impacts. Sixteen years ago, only 63 investment companies were included in the 2006 United Nations Principles for Responsible Investment (PRI) report for incorporating ESG issues representing $6.5 trillion in assets under management (AUM). Jump to 2019, and 2,450 signatories representing $80 trillion in AUM reported ESG-driven investments.

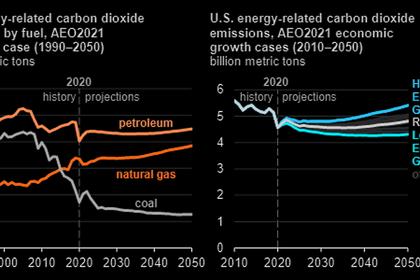

According to PwC, 80% of investors now report that ESG considerations are a significant influence in their investment decisions, with 50% indicating they would withdraw from investments that did not take appropriate action. Several major investor funds are voting against Chairman/CEO’s who do not have GHG reduction targets in the company's long-term company strategies. Corporate Social Responsibility is now a critical piece of business operations, and corporations must be prepared for wholesale changes to meet ESG goals.

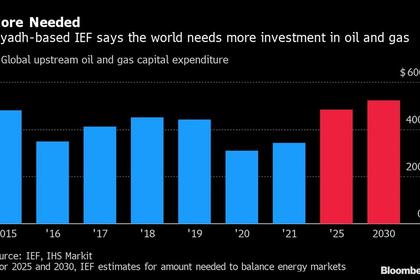

The growing emphasis on ESG is a key component in the upstream oil and gas industry. ESG may even be more relevant in this industry than any other as the nation increases its focus on addressing the challenges of climate change and transitioning to more renewable energy.

It’s understandable that oil and gas companies fear that ESG will be a profit killer if they promote renewable energies and acknowledge the industry’s effects on the climate. It is also understandable that increased emphasis on renewable energy sources leads companies to fear oil and gas use would decline. But in fact, the opposite has occurred, and global energy demand has risen from year to year, extending the need for greater production and supply. The truth is ESG programs are helping oil and gas companies retain or grow profits and increase overall demand.

ESG Reporting

Just because ESG has become a trending topic across industries does not mean that investors and assets have ESG reporting down to a science. Far from it, as the PwC 2021 Global investor survey showed that investors expressed substantial worries about the quality of information accessible to them when considering ESG goals, particularly information on their assets' carbon footprint. Being able to circumvent ESG reporting issues to holistically represent a company’s ESG strategy will be critical to securing funding from potential investors. The answer to the ESG reporting conundrum lies in better and more actionable data--integrating a Unified Data Model (UDM-PetroVisor)) into a business’s operations enables a company to create a holistic view of its ESG information and inevitably provide better data to investors.

Investors want to be able to see and learn about a business's sustainability and ethics policies. They want to be sure that their financial contributions will not be used in ways that are detrimental to their interests. For that to happen, upstream oil and gas companies must have the proper ESG data available and actionable. Without an effective UDM solution, oil and gas companies will find it incredibly challenging to accurately calculate things like carbon, fugitive and methane emissions. A UDM enables upstream oil and gas companies to extract data from anywhere at any time and can then cleanse, refine, map, display and characterize all the data in one place, making it easy for investors to make sense of all the information. Investors want to know everything they can before making any moves with their money, and without a UDM, companies cannot extract and understand the data that fully and accurately represents their operations.

Transparency – The Crucial Component Of Any ESG Strategy

Now more than ever, investors value transparency in business activities, the reporting they conduct and the rewards they anticipate. For business leaders, the dilemma is how to simultaneously achieve the business change required in this evolving environment and the rewards investors want in performing their fiduciary duty. Most importantly, investors' primary concern with ESG reporting is the relevance to the business model and how the reporting meets the goals of material and comparable metrics in the industry they serve. At all stages, a business must continue to inquire as to whether the ESG disclosure and data being tracked is of sufficient quality. Furthermore, another key evaluation point is asking whether the reporting assists investors in gaining a better understanding of the company's ESG journey toward fulfilling its objectives.

Before investors make a move and invest their money, they must learn more. Improved reporting enables investors to more fully grasp how a sustainable business model contributes to long-term viability. It provides tools to evaluate how an ESG approach contributes to value creation and ascertains whether a company's initiatives present the opportunity for growth or the risk of harming the people or environment they operate in.

Bottom Line

Investors will back firms that adopt the appropriate ESG activities, and they want to be included in the journey, no matter how challenging. That requires being candid about your prospects for long-term value creation and the methods through which you intend to manage ESG risks, even those that are unanticipated. When you communicate to investors and other stakeholders how you intend to reset your strategy, rethink your reporting, reinvent your operations and push toward new results, you establish trust while generating long-term value.

-----

This thought leadership article was originally shared with Energy Central's Energy Collective Group. The communities are a place where professionals in the power industry can share, learn and connect in a collaborative environment. Join the Energy Collective Group today and learn from others who work in the industry.

-----

Earlier: