To regain leverage against Russia and take control of the crisis, European governments including non-EU members such as UK, Switzerland and Norway must step in quickly with coordinated and emergency measures to protect the public interest. More practically:

1. Help Customers Save Energy

Normally high prices lead to demand reductions, but many customers still have no idea how much energy they are using until the bill comes at the end of the year. The answer is smart meters for gas and electricity, but these take time to install. In addition, many customers, including most businesses, have ignored energy for the last decade as prices had been always getting cheaper. It is thus critical to run marketing campaigns, like in the oil crisis in the 1970s, requesting people set lower heat temperatures, lower speed limits, turn off streetlights when not needed, unplug devices when not used, etc. We need to help change customer behaviour and run pan European marketing campaigns to explain the energy challenge. I call this a “Save Energy to Save Europe,” campaign.

In addition, financial incentives should be introduced to encourage energy efficiency noting that small incremental changes in demand could quickly bring prices down for everyone. One way to do this would be to offer residential customers who reduce energy consumption by 30% VAT rebates or to make the energy bill tax deductible. This would be easy to police as all that would be needed is for customers to send in the last two annual energy invoices.

2. Do Everything Possible to Increase the Supply of Gas

We need to increase LNG imports as a top priority and need to build the necessary infrastructure to import and store, and to better transport gas across the continent. The focus needs to be on speed and so for instance floating LNG terminals need to be a core focus. At the same time though we must be careful not to lock Europe into investments in assets that may become stranded in our transition to alternatives to natural gas.

That said, Europe also needs to urgently increase gas production, especially for the next few years. This means reopening the Groningen gas field in the Netherlands (pay residents to move), some of the North Sea gas fields and introducing financial incentives to enable other marginal sites across Europe to be opened. In addition, we need to appeal to other NATO members such as Canada, the UnitedStates and Norway to increase gas production for delivery to Europe. Finally, regulations should be put in place to incentivise alternatives such as biogas production across the continent, not to mention longer term solutions such as heat-pumps and solar based district heating solutions.

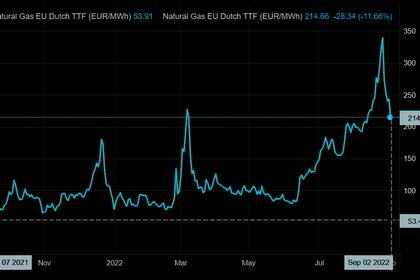

3. Introduce Emergency Measures to Bring Down Gas Prices

This starts with talking to Norway, a member of NATO and a partner in the economic war with Russia to ensure prices stay low. This could be quite simple to implement, with the state owned Equinor offering all its customers new contracts that are tied to the oil price or which are an average of the 2021 price. In addition, with natural gas being bought in the US at $9 an MMBTU and being delivered to Rotterdam at $70 there is a need to scrutinise and forcefully regulate the activities, costs and profit margins of oil and gas players and traders to ensure that they are acting in European public interest.

Another possibility is for European countries to band together into a ‘buyers’ cartel’ whereby a maximum price is put in place for purchases by all members as well as corporate buyers. This would have the advantage of taking much of the speculative activity out of the market. What this maximum price could be is open to debate but could well be the Asian LNG price noting that the Japanese, Koreans and Chinese are the major competitors to Europe for those deliveries.

4. Provide Emergency Loan Facilities to Energy Companies

There is huge liquidity stress across European energy markets as participants try to manage financial exposures, which run into 100s of billions of euros. To limit risks of a Lehman Brothers crisis, it is critical to provide loan facilities to energy companies, many of whom are finding it very difficult to access the necessary liquidity to fulfil future contracts and meet margin calls. The contagion risk is spreading and is now so great that all governments must speak with their energy companies to help them with emergency loan facilities if needed.

5. Ensure Alternatives to Gas Generation are Available

This year we are seeing significant increases in gas usage for power generation across Europe. This is poor usage of gas, which is more effectively, efficiently, and economically used for industrial and residential heat purposes. To do this Europe needs to ensure that everything from diesel gensets to batteries to coal power plants are used to ensure system resilience. The biggest issue however is nuclear.

In France, currently half the nuclear power plants are offline due to technical or maintenance issues. Bringing these plants back online safely is critical to ensure Europe can keep the lights on this winter and save gas. One thing that could help is that Europe offers France technical support. In addition, there needs to be pressure put on the German government to allow the 3 existing nuclear power plants to run through this crisis as well as putting back online the 3 that were closed last year. If this does not happen the risk of a blackout increases substantially as does the economic cost to all Europeans.

6. Borrow to Finance the Efforts

The UK government bailout of its energy customers is said to cost over £100bn. That is over 4% of UK GDP but still does not deal with the cause of the problem which is the lack of gas in the system and the need to reduce dependency on fossil fuels.

We need to revamp and rejuvenate our energy systems which is a great opportunity for Europe. This needs an action plan for what we should and should not invest in, as well as a plan on financing it. We should also consider introducing War Bonds which should be designed to finance what could be a multi-year economic war with Russia as well as reduce our addiction to fossil fuels, and control inflation by taking money out of circulation.

In summary, decisive, and co-ordinated action is needed by all European countries to bring energy inflation under control and to help in the economic war with Russia. This starts with EU members but extends to non-EU members such as Norway, Switzerland, and the UK as well as wider supporters such as the US, Canada, Australia and Japan. This is the best way to win back leverage from Mr Putin. If we fail to do this, we are risking public support waning, Mr Putin gaining more leverage over us and all our efforts to date in terms of sanctions and help for Ukraine will have been in vain.