EUROPE PAYS HARD

By GERARD REID Leader Alexa Capital

ENERGYCENTRAL - Aug 29, 2022 - With European wholesale natural gas, coal, and electricity as well as CO2 prices near to all-time highs, Europeans are facing a winter of discontent, one which may in fact last for many years.

Customers, be they industrial, commercial, or retail must contend with price increases at multiples of what they have paid in recent years. These are seismic shocks so great they could destabilize the whole ecosystem: the social, economic and political fabric of Europe. To better understand the magnitude of this situation and be in a position to make better, more informed decisions, some reckonings must be addressed:

The first reckoning: Europe is engaged in an ‘economic war’ with Russia.

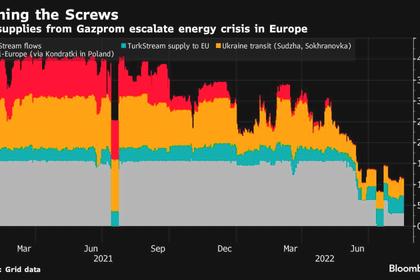

This is the trigger but not the root cause of the ongoing energy crisis. Europe and North America are sanctioning the Russian economy, including its energy exports, while Russia is retaliating by cutting key resources, in particular natural gas flows to Europe. This is massively disruptive, necessitates a move away from Russian energy (which traditionally supplies around 30% of European energy needs), and comes at a significant financial cost - some EUR185bn extra for energy imports in the first half of this year. In turn this is largely responsible for spiraling inflation, the collapse of both the Euro and British Pound against the US dollar, a growing unease amongst citizens, and most likely a deep recession across Europe.

The second reckoning: The cost of gas is a critical energy issue facing Europe.

Although I applaud Europe for pushing to fill up the storage tanks, what authorities have unwittingly done is cause panic in the market, which has contributed to pushing natural gas prices to all-time highs. European gas prices are now over 9x higher than a year ago and are now 10x what they are in the US.

The good news is that we will get through the coming winter as high prices will force customers to significantly cut demand which is good for the climate. But there are huge costs. Europe buys 5,000TWH of gas per year which, based on an average price of EUR70 per MWh last year, cost around EUR350bn. With the 2023 gas price at EUR330 per MWh, the extra cost will be EUR1.3trn which means that c.10% of individual incomes in 2023 could go on paying for gas.

The extremity of the upward movement in gas prices is what worries me most. Consumers simply cannot react quickly enough, meaning many customers will go into energy poverty and the harsh reality is that most businesses will be faced with significant financial difficulties. For instance, last year the German chemical producer BASF used 30.9m MWh of gas. To buy that quantity at the current wholesale price for next year, it would cost the business an extra EUR9bn. At those prices, BASF will no longer be competitive internationally and will be forced to raise prices to customers, further adding to the already negative inflationary spiral. And it will be the same across all of Europe.

The third reckoning: The all-time high of European electricity prices are caused by problems in the French Nuclear Industry, exacerbated by high gas and coal prices, as well as drought across Europe including low water levels across major rivers. Currently, 31 of France’s 56 nuclear plants are offline due to technical or maintenance issues.

As a result, France has gone from being the largest exporter of power in Europe over the last decade to become a major importer from all its neighbours, including Belgium, UK, Germany, Switzerland and Spain. In an already tight market this means that expensive marginal plants such as diesel gensets and reciprocating gas engines are setting the wholesale power prices for everyone across Europe. Forward prices in Germany for electricity in 2023 are now a whopping EUR950 per MWh. At those levels the value of the power markets next year could be over 11% of German GDP.

The fourth reckoning: Energy Inflation. Rising wholesale costs of coal, diesel, gas and electricity must eventually be passed onto the end customer. This can be a good thing because we need demand destruction, particularly on the gas side, but we are facing a global shortage of gas as a large amount of Russian gas is not finding its way onto global markets. This situation will increasingly ratchet up the pain levels for businesses and people across Europe, with civil strife likely.

The fifth reckoning: Naïve Optimism on Timing which is now biting hard. Most European regulators and governments guide that this energy crisis will only last one winter. This view however is both misleading, as it is not possible to completely decouple from Russian energy imports, especially gas, within 12 months, without significant pain. Europe’s demand for gas is presently circa 5,000TWh per year of which 1,300TWh comes from Russia. Replacing that Russian gas is a multi-year challenge, with European wholesale gas markets now pricing in multi-year challenges, with forward prices of EUR114/MWh for 2025 - 9x higher than current US gas prices.

The sixth reckoning: Financial Contagion refers to the spread of financial market disturbances from one company to another and maybe even one country to another. This is what we saw with the collapse of Lehman Brothers in 2008 and the resulting global financial crisis. The Too Big to Fail banks were bailed out and we are seeing something similar in European utilities with France having nationalized EDF and Germany bailing out Uniper.

What makes the situation in European energy trickier is the wide range of financial derivatives and opaque bilateral agreements that are used to hedge power purchases and sales. These exposures run into the trillions of euros and the complexity of such agreements makes it very difficult for authorities to understand the unintended consequences of any interventions. Currently all parties are scrambling for credit with up to 50% of European energy companies under significant financial stress. But unlike the banks where there is a lender of last resort in the form of a central bank there is none for an energy company.

The final reckoning: Breakdown of Chimerica and the world order we have known since WW2, with the US outsourcing production to China, then buying Chinese low-cost imports with US printed dollars. China got rich manufacturing everything, while the US and others benefited from low inflation and being able to sell expensive goods and services to the Chinese middle classes. Chimerica is now breaking down as China begins to challenge the US’s global hegemony.

China is also building an alliance with Russia, with the potential that China will receive low-cost energy and in return Russia will receive Chinese goods and most importantly Chinese technologies. The other implication of this is that the lower-cost energy imports Europe used to buy from Russia will now potentially go to China.

This all puts Europe in an increasingly difficult situation. China is Europe’s biggest trade partner and we rely on China for critical energy technologies such as solar and batteries, whereas Europe’s major strategic and ‘outsourced defense’ partner is the US.

-----

This thought leadership article was originally shared with Energy Central's Energy Collective Group. The communities are a place where professionals in the power industry can share, learn and connect in a collaborative environment. Join the Energy Collective Group today and learn from others who work in the industry.

-----

Earlier: