EUROPEAN COLD WINTER

By GERARD REID Leader Alexa Capital

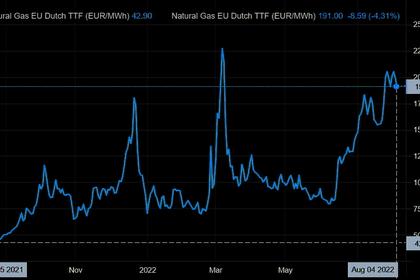

ENERGYCENTRAL - Sep 2, 2022 - Given the backdrop of the on-going energy crisis (and economic war with Russia), there is significant and growing liquidity stress across European energy markets, as participants try to manage financial exposures, which are over €1,000bn. To limit the risk of another ‘Lehman Brothers-type’ crisis, it will be both prudent and critical to provide loan facilities to energy companies.

For illustration purposes, consider this hypothetical example: If a year ago, you wanted to secure the price you receive for your 1TWh of electricity production in Q1 2023, you would have to have sold a future contract on the power market at €75 per MWh, worth €75m. The initial margin or collateral which is posted with the exchange, would have been c.15% or €10m. As the power price changes from day to day, cash payments move between the buyer and seller of that contract, depending on the changing value of the contract. So for instance, if the power price rises to €100 per MWh, the contract value would increase in value to €100m and the difference to the original contract value, the “variation margin”, some €25m would be transferred to the buyer of the contract, via the energy exchange.

Utilities and buyers have complex risk management systems and under ‘normal circumstances, can usually access the liquidity to make these margin calls. But with the future price for Q1 now at €700 per MWh, the value of that 1TWh contract is now €700m. That means that the utility would have to transfer €625m to the buyer of the contract.

The upside is that when the utility sells the physical power in the market to fulfil the contract in Q1 2023, the position will be reversed, and a similar amount of cash will come in. However, in the current stressed environment, it is becoming increasingly difficult for these energy providers to meet collateral calls on these contracts.

As a result, all energy companies and traders are scrambling for credit lines with up to 50% of European energy companies under significant financial stress. But unlike the banks, where there is a lender of last resort in the form of a central bank, there is no such equivalent for an energy company.

As a result, there is huge systemic risk developing which is why the German government had to jump in to provide emergency liquidity to Uniper and LEAG, as have the Finish government with Fortum and the Austrian government with Wiener Stadtwerke. The risk of contagion risk spreading is now so great that all governments have to speak with their energy companies to ensure that they have the necessary short-term funding.

Going forward, it would make sense that a European institute such as the European Central Bank be given the power and responsibility to regulate and provide emergency liquidity to energy companies and traders, as the ECB would with financial institutions.

In addition, changes are needed to EU EMIR-regulation (The European Market Infrastructure Regulation) which set the legal framework for margining and collateral requirements and, mistakenly, treats power generators as if they were financial institutions. There is a big difference between power generators and financial institutions, as the former mostly own generation assets, meaning their commitments are backed up by physical as opposed to just financial assets.

Finally, a large part of energy contracting and hedging takes place outside the power exchanges which makes it very difficult for authorities, let alone exchanges, to understand and quantify risks. In the future, these contracts need to be fully disclosed and made tradeable. That should help to make future decision making easier. But it is not going to help keep us warm this winter or indeed even in winter 2024. The key imperative now is to ensure that liquidity is available for the 1,000s of energy companies across Europe to avoid a Lehman Brothers style collapse which could serious repercussions for the wider financial system and economy.

-----

This thought leadership article was originally shared with Energy Central's Energy Collective Group. The communities are a place where professionals in the power industry can share, learn and connect in a collaborative environment. Join the Energy Collective Group today and learn from others who work in the industry.

-----

Earlier: