EUROPEAN ENERGY CATASTROPHE

BLOOMBERG - Sept 5, 2022 - European governments are racing to stave off a ballooning energy catastrophe this winter that’s threatening to dwarf the billions of euros of relief on offer for consumers and businesses.

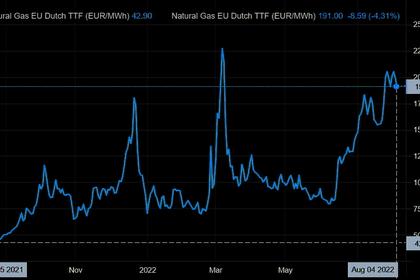

Gas prices surged more than 35% on Monday as traders reacted to Russia’s decision to keep its main gas pipeline shut indefinitely. The euro also slid to its lowest in two decades and equities fell. Policy makers are now grappling with how to curb demand dramatically, and also prevent wild market swings spilling into broader financial disruption.

While gas storage sites are being filled quicker than expected, but concerns remain over how Europe will replace lost flows from Russia when it gets cold and demand rises. European energy ministers are set to discuss radical proposals to curb power prices when they hold an emergency meeting on Friday -- including gas-price caps and a suspension of power derivatives trading.

Germany Nuclear Stress Tests Due Monday (11:22 a.m.)

Germany said it will present the results of a keenly awaited report studying the feasibility of extending operations at some of its nuclear plants beyond the end of the year. Germany has been inching toward keeping its three remaining reactors open as it faces its worst energy shortages in decades.

European Solidarity at Risk (10:15 a.m.)

German Foreign Minister Annalena Baerbock warned of a breakdown of European solidarity as supplies tighten during winter. The central question will be “whether we’ll be able to secure gas supply for all people in Europe or not,” Baerbock told a meeting of German ambassadors in Berlin Monday. “We will be put through a hard test by this question.” A breakdown of European gas solidarity would be a victory for Russian President Vladimir Putin, she warned.

Austria Says No Disruption for End Users (10:02 a.m.)

Austrian regulators reported that there’s no disruption in supplies to end users, and that current supply is sufficient as long as there are no further curtailments. OMV AG, the country’s biggest fossil-fuel provider, said it was receiving only 30% of contracted gas volumes after Nord Stream’s shutdown. The country’s storage depots are about 68% full and currently on track to reach 80% by the first week of October, according to the latest data published by Gas Infrastructure Europe.

German Relief Insufficient, ING Says (9:41 a.m.)

Germany’s 65 billion euros of aid to help citizens deal with high energy prices probably won’t stave off an economic downturn, according to ING Groep NV. The country on Sunday announced measures including higher subsidies for lower-income households, payments to students and pensioners, and a cap on power prices. The full program may not become operational this year, and with little support for companies or households that don’t receive social transfers, “the package will probably fall short in preventing the broader economy from falling into recession,” the bank said.

Utilities, Industrial Shares Sink (9:20 a.m.)

Sectors most exposed to the energy crisis are bearing the brunt of the market selloff. Steelmaker Thyssenkrupp AG, car-parts manufacturer Valeo, chemicals firm BASF SE, cement maker Cie de Saint-Gobain and gas utility Uniper SE are among the worst performers in Europe on Monday. There’s growing fear that companies may have to scale back production further because of surging energy costs.

Italians Tire of Sanctions, Poll Says (8:50 a.m.)

A growing number of Italians want to remove sanctions against Russia to counter spiraling gas prices and inflation, according to a recent poll. A Termometro Politico survey published Saturday said 51% of respondents want to lift sanctions, with 44% in favor of keeping them. As many as 43% of Italians think it was wrong to impose them in the first place, according to a Quorum/YouTrend poll for SkyTG24 published Monday.

Power Prices Jump (8:45 a.m.)

Wholesale power prices rose across Europe as the Nord Stream cut pushed up the cost of running gas-fired power plants. German power for next month rose as much as 16%, while the benchmark year-ahead price jumped 33% to 675 euros per megawatt-hour. That benchmark spiked above 1,000 euros early last week.

Hungary’s Flows are Fine (8:30 a.m.)

Gas deliveries to Hungary are uninterrupted, Foreign Ministry State Secretary Tamas Menczer told public television M1 on Monday. The country, which has opposed drastic sanctions on Moscow, is receiving Russian gas through the TurkStream link via the Black Sea, the only pipeline route through which supplies haven’t been disrupted this year. Russia is even providing Hungary with additional volumes of gas, on top of their contract, according to Hungarian officials.

German Storage Keeps Building (7:33 a.m.)

The EU has been building up its gas stockpiles to offset a Russian cutoff, and with storage sites nearly 82% full it has a buffer for at least part of the winter. Storage sites in the region’s powerhouse Germany are now 86% filled, according to Gas Infrastructure Europe. But Klaus Mueller, president of the Federal Network Agency energy regulator warned last month that even with gas storage at 95%, there would only be enough for 2 1/2 months of demand if Russia switched off flows.

European Gas Leaps (7:15 am)

Natural gas prices surged in response to the Nord Stream news. “Given the gas supply tightness, one cannot exclude mandatory gas curtailment for non-essential industries or even ‘rolling gasouts’ this winter depending on the weather,” analysts at JPMorgan said in a note. Goldman Sachs predicted that European prices could approach the highs set in August after Russia’s move.

Gas Flows Via Ukraine are Stable (6:30 a.m.)

Russian gas supplies via Ukraine remain stable, data show. Flows have been curbed since May when one of two crossing points was put out of service. With Nord Stream shut, there’s going to be renewed focus on the flows via Ukraine. Norwegian gas flows are also curbed because of seasonal works.

-----

Earlier: