EUROPEAN ENERGY INFLATION

BLOOMBERG - Sept 6, 2022 - Switzerland and Finland joined Germany in offering credit facilities to energy companies as the worsening supply crunch and surging prices threaten to create financial havoc in Europe.

As European policy makers rush to find fixes to the spiraling energy crisis, liquidity is becoming one of the most pressing issues. When EU energy ministers meet in Brussels on Friday, deploying “emergency liquidity instruments” is one of the key items on the agenda pushed by the Czech presidency.

German Companies are Seeking Help (9:15 a.m.)

The German government is receiving a growing number of calls from companies with liquidity problems, according to an official, and they are working on a plan to help.

Truss Plans £40 Billion Aid for UK Businesses (9:05 a.m.)

Incoming UK Prime Minister Liz Truss is finalizing plans for a £40 billion ($46 billion) support package to lower energy bills for businesses. She is considering two options, either setting a guaranteed unit price that businesses will pay, or a percentage or unit price reduction that all energy suppliers must offer firms, according to documents seen by Bloomberg.

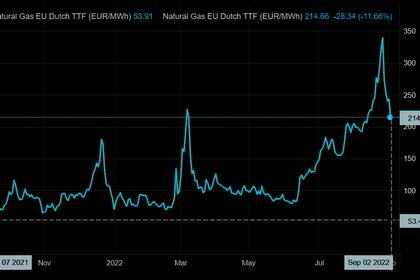

Europe Gas, Power Prices Drop (9 a.m.)

Benchmark energy futures fell after jumping on Monday, with Dutch front-month gas losing as much as 13% and German year-ahead power falling 11%. Traders are weighing governments’ efforts to fix the crisis following the immediate panic over Russia’s move to halt the key Nord Stream gas pipeline. Also, gas demand is as yet still relatively low ahead of the heating season.

“Maybe Russia has played the potential hand too soon as we are still not in the colder winter months,” said Nick Campbell, a director at Inspired Plc.

Centrica Seeks Liquidity Buffer (8.53 a.m.)

Centrica Plc is in talks with banks on the potential extension of credit lines, according to a person familiar with the matter. The move is a pre-emptive one as volatile energy prices increase collateral requirements, the person said.

German Nuclear Decision ‘Useful’ (8:45 a.m.)

Germany’s decision to keep two nuclear power plants available this winter can make only a limited contribution to the country’s energy security but any means of saving gas is useful “in the current extremely uncertain situation,” according to an environmental economist at the IfW research institute in Kiel.

“The current crisis has not changed the medium to long-term usefulness of nuclear power,” Sonja Peterson from the Kiel, Germany-based institute said in an emailed statement. It “remains an expensive, risky and conflict-prone technology that does not fit into a power system based on renewable energies.”

Fortum Gets Help (8:20 a.m.)

Finnish utility Fortum Oyj got 2.35 billion euros ($2.3 billion) of bridge funding from the Finnish state to ensure adequate liquidity amid a continued increase in power prices and collateral requirements.

The liquidity facility is provided by Solidium Oy, the state’s holding company. Currently, Fortum has sufficient liquid funds to meet the collateral needs, it said. The arrangement cannot be used to cover collateral needs of its German subsidiary Uniper SE.

Goldman Sees 2 Trillion Euros Surge in Bills (8 a.m.)

The market continues to underestimate the depth and the structural repercussions of the unfolding energy crisis in Europe, Goldman Sachs analysts wrote in a note dated Sept. 4, saying they expect a EU2 trillion surge in energy bills for the bloc.

LNG Offers Rise After Price Spike (7:54 a.m.)

Liquefied natural gas suppliers are accelerating efforts to sell spot shipments in a bid to take advantage of a price spike after Russia shut a key pipeline. Australian, Malaysian and Egyptian exporters released LNG sale tenders this week for cargoes to be delivered in September and October, according to traders with knowledge of the matter. More shipments are being offered by majors including Shell Plc, they said.

German Toilet-Paper Maker Goes Insolvent (7:45 a.m.)

Hakle GmbH, a maker of toilet paper with a history dating back nearly a century, filed for insolvency because of higher energy and raw-material costs. The privately held company becomes one of the first consumer goods manufacturers to run into trouble because of the fallout from the crisis.

The restructuring, filed this month, will be overseen by the Dusseldorf-based company’s current management, Hakle said in a statement on its website.

German Factory Orders Fall for Sixth Month (7 a.m.)

German factory orders fell for a sixth month and by more than economists expected as inflation and uncertainty about energy supplies undermine Europe’s largest economy. Demand slipped 1.1% from June, driven by a slump in consumer goods, particularly pharmaceutical products, government data showed. Germany is reeling from a sudden increase in energy costs that’s weighing on manufacturing and derailing the services sector’s rebound from pandemic restrictions.

Swiss Government Grants Axpo Credit Line (7 am)

The Swiss government has granted energy company Axpo a credit line of up to CHF 4 billion ($4.1 billion). The company, which produces and trades renewable energy, asked for the credit line but hasn’t used it yet.

-----

Earlier: