EUROPEAN ENERGY MARKET GAP

FT - Sep 1 2022 - European Commission president Ursula von der Leyen used her first post-summer break speech to promise measures to curb soaring wholesale electricity prices in Europe that are shredding the finances of households and companies across the bloc.

She vowed a short-term intervention — something that could be “triggered very quickly, in weeks perhaps” — and announced a longer-term “structural reform of the energy market”.

How does the EU’s energy market work and why are prices so high?

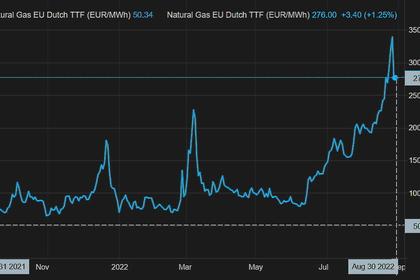

European energy prices are set through a so-called marginal pricing system in which the most expensive power plant called on to meet demand on any given day sets the wholesale electricity price for all suppliers. This means gas-fired power stations, which are still needed to keep the lights on in many countries, tend to dictate the wholesale electricity price for the rest of the market even though renewable power can be produced more cheaply.

Historically, there was little desire to overhaul the system, even as the proportion of clean power in the energy mix increased. It was hoped that higher wholesale electricity prices would incentivise the development of green energy by increasing the profit margin for lower cost renewables projects.

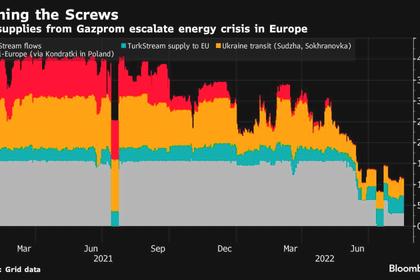

But as gas prices have soared to record levels this year — largely due to Moscow’s decision to reduce supplies to Europe — the cost of electricity has been dragged up too. More policymakers are therefore calling for a new approach that would allow cheaper renewable energy to be sold at a lower price. Polish prime minister Mateusz Morawiecki said on Tuesday that proposals to change the market structure “are falling on increasingly fertile ground”.

The UK government in July launched a consultation on decoupling the prices of gas and renewable power. Pressure is now mounting in Brussels.

What can the EU do to cut costs for consumers and industry?

Commission officials say that options under discussion include a price cap on gas, detailed guidance pushing EU capitals to impose windfall taxes on energy companies that could be used to support vulnerable consumers, and a temporary separation of gas and electricity prices ahead of more long-term uncoupling.

Another option is to require cuts to electricity demand in line with what is currently a voluntary 15 per cent cut to gas consumption agreed by EU energy ministers in July.

These measures would come in addition to efforts to find alternative supplies — the bloc has replaced around a fifth of its natural gas supply from Russia with fuel from other countries — and turbocharge investment in renewables.

What are the risks?

The EU’s energy agency, Acer, has warned against tearing up the market structure. In a report in April, it said that the EU’s wholesale electricity markets work well under normal conditions, ensuring secure electricity supply.

Instead of ripping up the present arrangements, it suggested there could be a “temporary relief valve”. This would limit electricity prices automatically if there are sudden spikes, under predefined conditions — for example, unusually high price rises in a short period of time.

William Peck, power market analyst at ICIS, a commodity analytics firm, also cautioned against overhauling a mechanism that had functioned well for decades and still served as an incentive for much-needed investment in clean power.

Politicians were focusing on power market reform because they had been unable to find a quick and sufficient alternative to Russian gas, he said. “If it was me, I’d really be focusing my energy on the gas supply part of this equation and not ripping up a 20- to 30-year-old market.”

What can we learn from Spain and Portugal’s price cap experiment?

Portugal and Spain reached a political agreement with the European Commission in April allowing them to cap the price of natural gas used in power plants, thus decoupling electricity and gas prices. The measure came into effect in May and will run for a year with the cap averaging €48.80 per megawatt hour.

The €8.4 billion subsidy the Iberian countries will pay to gas companies will be largely recouped by charges on the electricity distributors that the price cap benefits.

The European Commission granted what has become known as “the Iberian exception” from state aid rules because their electricity bills are strongly linked to wholesale energy prices. They have limited energy connections with the rest of the EU, making the Iberian Peninsula “an energy island”. Brussels has also argued that the measure will allow the two countries to expand green energy production.

Spain claims that between June 15th and August 15th the price of electricity had been €49.85 per megawatt hour cheaper than it would have been had the price cap mechanism not been in place, saving consumers around €1.4 billion.

But the amount of gas used for electricity had increased 17 per cent between January and July 2021 to 23 per cent in the same period this year. Madrid said this was due to the summer drought, which has hit hydropower plants.

Mr Peck at ICIS said that expanding such a mechanism Europe-wide could similarly increase gas demand by making it artificially cheap. “That’s the exact opposite of what we needed to be doing.”

What is next?

While Ms von der Leyen said that the commission would come up with solutions “in a matter of weeks”, officials say proposals are unlikely to be made in time for a meeting of EU energy ministers on September 9 but may be outlined in her state of the union address to EU parliament on September 14th.

Georg Zachmann at the Bruegel think-tank said it was difficult to envisage a solution to quickly lower wholesale prices without causing chaos in the markets. “There are a lot of things you can undermine by tinkering with the market design,” he said.

The taxation system was a better mechanism to address the short-term issue of high prices, he argued, like a windfall tax on electricity producers that could be channelled to consumers.

-----

Earlier: