GLOBAL RENEWABLES FROM CHINA

By ED REID Vice President, Marketing (Retired) / Executive Director (Retired) / President (Retired) Columbia Gas Distribution Companies / American Gas Cooling Center / Fire to Ice, Inc.

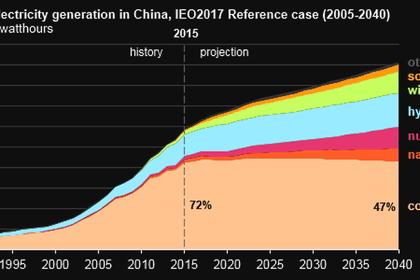

ENERGYCENTRAL - Sep 6, 2022 - China is aggressively pursuing economic development, including construction of numerous coal generating stations, steelmaking facilities and cement kilns. These actions, while inconsistent with the goal of the Paris Accords, are consistent with China’s Intended Nationally Determined Contributions (INDCs). China proposed to achieve maximum carbon intensity by about 2030 and to achieve carbon neutrality by 2060. The current construction programs are intended to massively increase carbon intensity by 2030, while the developed economies are aggressively reducing carbon intensity. China would thus become the globe’s primary producer of steel and cement.

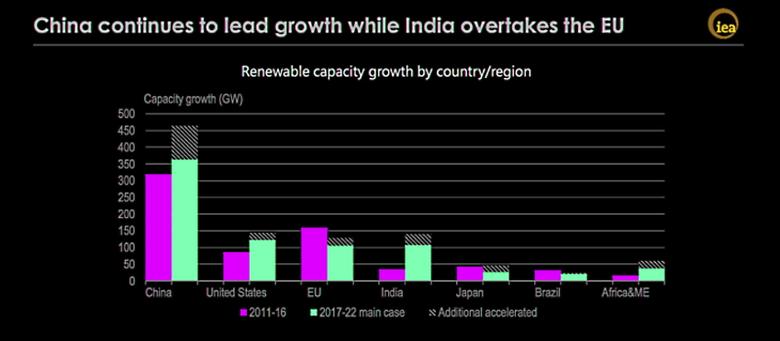

China has also positioned itself as the primary supplier of many of the rare earth minerals required for the fabrication of the renewable generation and battery storage equipment essential to the development of a renewable plus storage electric grid. They are also enhancing this position through their “Belt and Road” initiative, funding and building infrastructure projects across Asia and Africa, including countries which also possess large deposits of the same rare earth minerals.

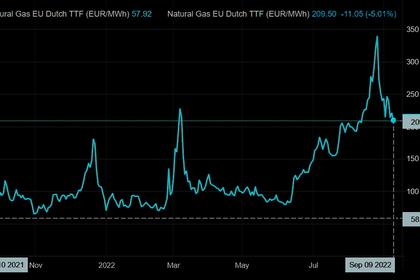

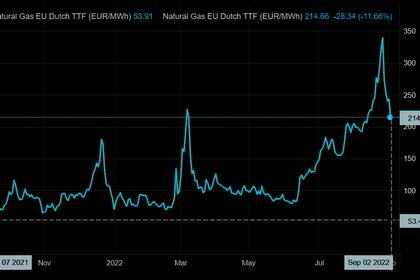

China would likely continue to be a willing supplier of critical raw materials, processed materials and finished renewable energy generation and storage equipment as the developed nations expand their dependence on these systems as they pursue Net Zero CO2 emissions by 2050. However, after about 2040, the developed nations will begin to face the necessity to replace wind turbines, solar collectors and electric storage batteries to keep their electric grids functioning. The greatly reduced availability of conventional electric generation capacity and the increased dependence on renewables and storage in the developed economies would provide China with substantial geopolitical leverage. (The approaches followed by Russia in dealing with energy supplies to Europe and the UK provide some indication of potential Chinese approaches to dealing with the renewable generation and storage materials and equipment needs of the developed nations.)

The developed nations of Europe and the UK have played into the hands of Russia by closing coal and nuclear generation facilities and becoming dependent on renewables and Russian natural gas, rather than developing their own natural gas reserves. They are currently paying the price for those decisions. Those nations, plus the US, Canada and Australia are playing into the hands of China by allowing themselves to become dependent on Chinese materials and equipment, rather than developing their own domestic resources and materials processing and equipment manufacturing capabilities.

The availability of lower-cost steel, glass and cement from China discourages investment in competing facilities in the developed nations. That availability, combined with energy shortages in Europe and the UK, is already leading to closures of heavy industry facilities in numerous European countries. Tightened CO2 emissions regulations in the developed nations will also discourage heavy industry continuation and expansion in those nations, leading to further dependence on China and other developing nations which are continuing to rely upon and expand coal consumption.

The US is currently playing into China’s hands by limiting domestic oil and gas exploration and production opportunities, thus squandering its energy independence.

China, meanwhile, can pursue its “long game”, developing geopolitical leverage to be used at its convenience. With sufficient leverage, it could simply choose to ignore its INDCs and assume global governance.

-----

Earlier: