INCREASING RUSSIA SANCTIONS

PLATTS - 21 Sep 2022 - Russia's declaration of a partial mobilization and plans for occupied areas of Ukraine to hold referenda on joining Russia have raised the risk that Western countries will introduce harsher sanctions.

"Mobilization would likely result in even greater Western unity on oil sector sanctions, and raise risks of tougher measures if crude prices weaken in the months ahead," said Paul Sheldon, chief geopolitical adviser at S&P Global Commodity Insights.

Russian President Vladimir Putin said that a partial mobilization order has been signed and measures will begin Sept. 21 in an address broadcast on Russian state TV.

Authorities in Russian-occupied Donetsk, Luhansk, Kherson and Zaporizhia said Sept. 20 that they will hold referenda on joining Russia between Sept. 23 and 27.

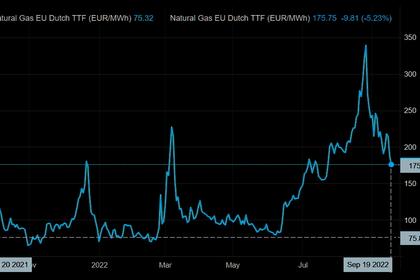

Western sanctions introduced against Russia over its invasion of Ukraine have had a major impact on commodity supplies and continue to cause major price volatility.

Analysts already expected further disruptions into 2023 as new sanctions come into force. Shipping insurance and EU seaborne crude import restrictions are due to take effect Dec. 5. Limits on refined products imports are due to take effect Feb. 5.

G7 countries have also agreed to finalize a price cap for Russian crude. The US Treasury has indicated that three separate price caps will be introduced -- for crude, high-value refined products and low-value refined products.

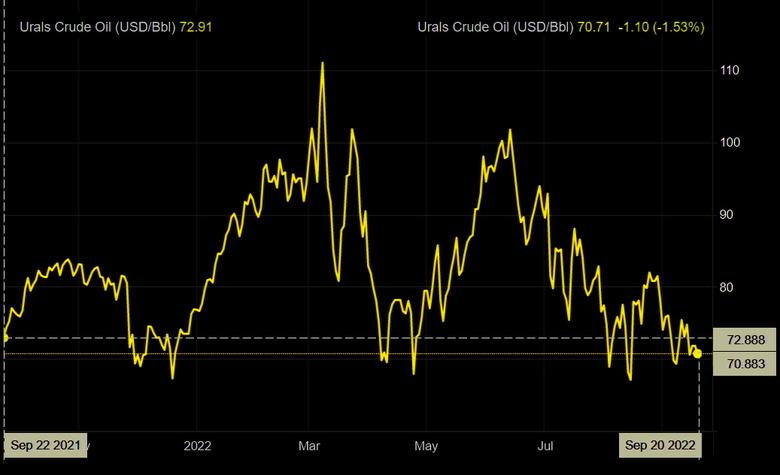

Sanctions have already hit prices for Russian oil. Platts assessed Urals at $66.66/b on Sept. 20, compared with Dated Brent at $89.30/b. Prior to Russia's invasion of Ukraine, Urals was trading at a discount of around $10/b to Dated Brent. Platts is part of S&P Global.

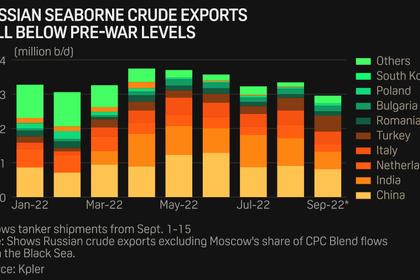

S&P Global forecasts that Russian oil disruptions will peak at 1.5 million b/d in the first quarter of 2023, or 1 million b/d below the August average.

"We believe a sizable portion of the 3.5 million b/d of crude and product that needs to be re-routed from Europe will find buyers not requiring Western shipping services, with or without a price cap, but the policy could further ease the trade flow shift by permitting Western insurance under a certain price level," S&P Global analysts said.

-----

Earlier: