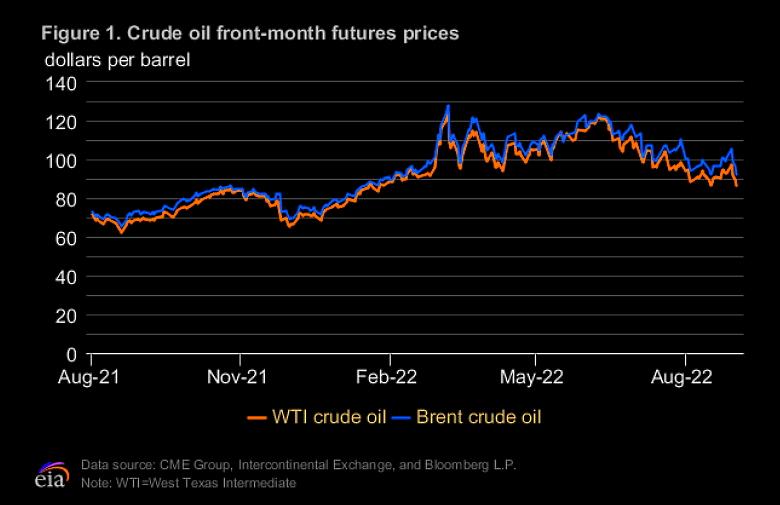

OIL PRICES 2022-23: $98 - $97

U.S. EIA - Sept. 7, 2022 - SHORT-TERM ENERGY OUTLOOK September 2022

Forecast Highlights

Global liquid fuels

The Brent crude oil spot price in our forecast averages $98 per barrel (b) in the fourth quarter of 2022 (4Q22) and $97/b in 2023. The possibility of petroleum supply disruptions and slower-than-expected crude oil production growth continues to create the potential for higher oil prices, while the possibility of slower-than-forecast economic growth creates the potential for lower prices.

U.S. crude oil production in our forecast averages 11.8 million barrels per day (b/d) in 2022 and 12.6 million b/d in 2023, which would set a record for the most U.S. crude oil production during a year. The current record is 12.3 million b/d, set in 2019.

We estimate that 99.4 million b/d of petroleum and liquid fuels was consumed globally in August 2022, up by 1.6 million b/d from August 2021. We forecast that global consumption will rise by an average of 2.1 million b/d for all of 2022 and by an average of 2.0 million b/d in 2023. As a result of high natural gas prices globally, we increased our forecast for oil consumption in 4Q22 and 1Q23 as electricity providers, particularly in Europe, may switch to oil-based generating fuels.

We expect retail gasoline prices will average $3.60 per gallon (gal) in 4Q22 and $3.61/gal in 2023. Retail diesel prices in our forecast average $4.90/gal in 4Q22 and $4.28/gal in 2023.

Natural gas

In August, the Henry Hub spot price averaged $8.80 per million British thermal units (MMBtu), up from $7.28/MMBtu in July. Natural gas prices rose in August because of continued strong demand for natural gas in the electric power sector, which has kept natural gas inventories below their five-year (2017–2021) average. We expect the Henry Hub price to average about $9/MMBtu in 4Q22 and then fall to an average of about $6/MMBtu in 2023 as U.S. natural gas production rises.

U.S. natural gas inventories ended August at 2.7 trillion cubic feet (Tcf), which was 12% below the five-year average. We forecast that inventories will end the injection season (April through October) at more than 3.4 Tcf, which would be 7% below the five-year average.

U.S. LNG exports in our forecast average 11.7 billion cubic feet per day (Bcf/d) in 4Q22, up 1.7 Bcf/d from 3Q22. Factors that will affect the volume of LNG exports in the coming months include the planned outage at Cove Point in October and Freeport LNG resuming partial operations by mid- to late-November. We forecast LNG exports will average 12.3 Bcf/d in 2023.

U.S. consumption of natural gas in our forecast averages 86.6 Bcf/d in 2022, up 3.6 Bcf/d from 2021, driven by increases across all consuming sectors. We expect consumption to fall by 1.9 Bcf/d in 2023 because of declines in consumption in the industrial and electric power sectors.

Dry natural gas production has been rising relatively steadily since 1Q22, when it averaged 94.6 Bcf/d. We forecast U.S. dry natural gas production to average 99.0 Bcf/d in 4Q22 and then rise to 100.4 Bcf/d for 2023.

Electricity, coal, renewables, and emissions

We expect U.S. sales of electricity to ultimate customers to rise by 2.6% in 2022, mostly because of more economic activity but also because of slightly hotter summer weather in than last year much of the country. We forecast U.S. sales of electricity to fall by 0.4% in 2023.

The largest increases in U.S. electricity generation in our forecast come from renewable energy sources, mostly solar and wind. We expect renewable sources will provide 22% of U.S. generation in 2022 and 24% in 2023, up from 20% in 2021.

Natural gas fuels 37% of U.S. electricity generation in 2022, a share similar to 2021, and we forecast it to fall to 36% in 2023. Coal-fired electricity generation in our forecast provides 21% of the U.S. total in 2022 and 19% in 2023. Growing generation from renewable sources limits growth in natural gas generation while coal’s generation share declines due to the expected retirement of coal-fired capacity.

We forecast the U.S. residential price of electricity will average 14.8 cents per kilowatthour in 2022, up 7.5% from 2021. Higher retail electricity prices largely reflect an increase in wholesale power prices driven by rising natural gas prices. The Southwest region has the lowest forecast wholesale prices in 2022, averaging $69 per megawatthour (MWh), up 25% from 2021. The highest forecast wholesale prices are at more than $100/MWh in ISO New England (up 96% from 2021) and New York ISO (up 124% from 2021).

U.S. coal production in the forecast increases by 22 million short tons (MMst) in 2022 to total 600 MMst for the year. We expect production will total 590 MMst in 2023.

We expect energy-related carbon dioxide (CO2) emissions in the United States to increase by 1.7% in 2022 and then to decrease 1.8% back to around 2021 levels in 2023.

-----

Earlier: