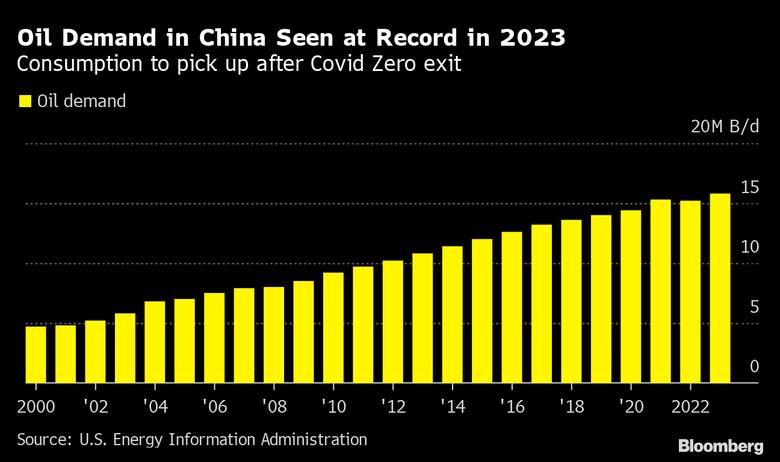

CHINA OIL DEMAND WILL UP TO 16 MBD

BLOOMBERG - Jan 13, 2023 - Chinese oil consumption is expected to hit a record this year as the world’s biggest importer leaves the straitjacket of Covid Zero behind, bolstering the global demand outlook and aiding prices.

Daily demand — which contracted last year — will climb by 800,000 barrels a day in 2023, according to the median estimate of 11 China-focused consultants surveyed by Bloomberg News. That would take consumption to an all-time high of about 16 million barrels a day, the survey showed.

Crude’s fortunes over the coming year hinge to a major extent on China, as well as on decisions by OPEC+, the impact of sanctions on Russian flows, and the arc of monetary policy. Oil’s bulls, of which there are many, have built a large part of their outlook on growth in Chinese demand, with Goldman Sachs Group Inc.’s Jeffrey Currie saying that crude is the “best reopening play”.

“Demand recovery is expected to accelerate from the second quarter onward as traffic rebounds and the number of flights, especially international flights, gradually recovers,” said Yitian Lin, research associate of oils and refineries at Wood Mackenzie Ltd., who estimates daily demand will rise by 970,000 barrels.

Other market watchers have also flagged prospects for a sharp rebound in consumption. The International Energy Agency, which advises major economies, forecasts that global demand will grow by 1.7 million barrels a day in 2023, citing expansion in China as well as India, according to its December outlook.

Brent crude — the global benchmark — traded above $83 a barrel Friday, well down from a peak near $140 following Russia’s invasion of Ukraine. Goldman’s Currie expects prices to hit $110 by the third quarter.ING Group NV, and UBS Group AG are also positive on oil.

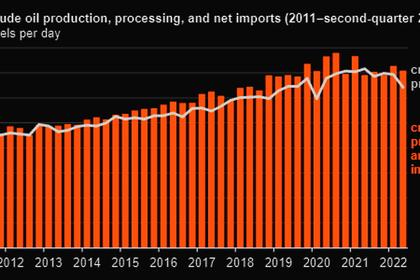

Data Friday showed that China’s crude imports hit a record for the month of December as shipments in the final quarter of last year came in almost a fifth higher than the preceding three months. At the same time, Chinese buyers have been tapping markets in North America, West Africa, the North Sea and Mediterranean looking for oil for arrival in March and April.

The expected rebound will likely be felt starting from next quarter after early waves of Covid-19 subside, and as greater mobility lifts pent-up consumption of transport fuels - especially gasoline and jet fuel — while petrochemical demand also recovers.

Stronger second-quarter demand from China could “offset the usual seasonal weakness in crude that comes with refinery maintenance and the absence of seasonal demand uplift given a warmer-than-average January so far,” Energy Aspects Ltd. analysts including Amrita Sen wrote in a Jan. 9 note. The expected uptick could even offset lower Russian exports, they added.

Still, the immediate road ahead may not be smooth as the swift dropping of curbs and surge in mobility initially bring a surge in infections.

Looking at “waves in places like Hong Kong and Japan, usually mobility would have a big spike after the first wave,” said Gao Mingyu, chief energy analyst at SDIC Essence Futures Co. “However, as more outbreaks followed, mobility levels would then slow and fail to return to its peaks.”

-----

Earlier: