NORWAY'S GAS TO EUROPE GROWTH

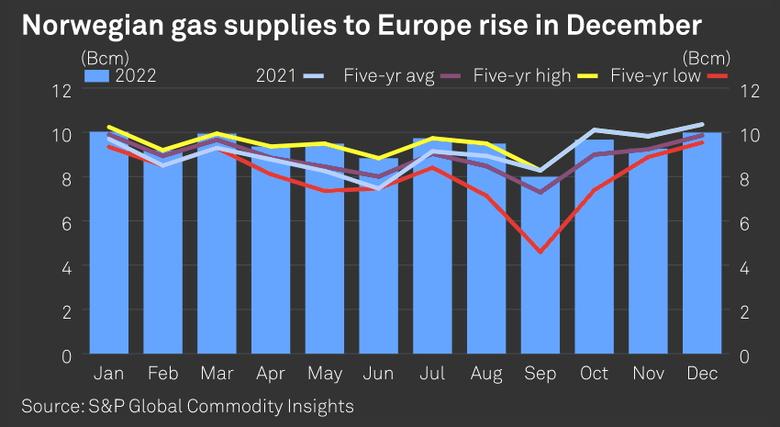

PLATTS - 10 Jan 2023 - Norwegian pipeline gas exports to continental Europe and the UK rose to an 11-month high in December, with flows second only to deliveries in January in 2022, an analysis of data from S&P Global Commodity Insights showed Jan. 10.

Norwegian gas deliveries totaled 9.99 Bcm in December, up by 8% on the month, although supplies were 4% lower than in December 2021 when exports hit a multi-year high at 10.35 Bcm as European gas prices surged.

Norway has pledged to do as much as it can to boost gas deliveries to Europe to help counter record high gas prices triggered by the war in Ukraine and much lower Russian supplies.

For 2022 as a whole, Norwegian pipeline exports totaled 113 Bcm, up by almost 4.5 Bcm year on year, the data showed, with Norway now Europe's biggest single gas supply source.

On Jan. 9, the Norwegian Petroleum Directorate said gas production last year -- which also includes gas from the Snohvit field that is fed into the Hammerfest LNG plant and gas used domestically -- totaled 122 Bcm.

The NPD said production was set to remain flat in 2023 and hit a new peak of 122.5 Bcm in 2025.

Norwegian gas producers were incentivized to maximize exports through 2022 on the back of record European gas prices.

Platts, part of S&P Global Commodity Insights, assessed the benchmark Dutch TTF month-ahead price at an all-time high of Eur319.98/MWh on Aug. 26.

Prices have weakened since amid healthy storage levels and demand curtailments but remain relatively high with Platts assessing the TTF month-ahead price on Jan. 9 at Eur74.75/MWh.

The NPD said Norway continued to enjoy a "high degree" of operational stability, and there was limited unplanned maintenance on Norwegian gas assets in December other than short-lived outages at the Aasta Hansteen and Oseberg fields.

Baltic Pipe flows

Norwegian piped gas flows have traditionally landed at terminals in the UK, Belgium, France, the Netherlands and Germany.

However, since the start of November gas has also been entering the Danish grid at Nybro as part of the 10 Bcm/year Baltic Pipe project to Poland, which reached its full design capacity on Nov. 30.

According to S&P Global data, a total of 0.46 Bcm flowed into Nybro in December, or an average of 15 million cu m/d.

Baltic Pipe began commercial operations on Oct. 1, but gas initially flowed to Poland only from Europe via Denmark, while commissioning work at Nybro continued.

Poland's PGNiG has reserved more than 80% of Baltic Pipe's capacity and has contracted imports of up to 6.5 Bcm in 2023 and up to 7.7 Bcm in 2024.

Flows in Baltic Pipe take from Norwegian gas exports to the other landed terminals, with diversions away from France especially notable in December.

The French energy regulator on Dec. 14 called for changes to the country's gas congestion management mechanisms after lower imports from Norway led to gas deficits in northern France.

The CRE said it was necessary to modify the congestion management mechanisms in two stages -- one for immediate implementation and a second for the longer term.

Gas flows from Norway to France via the Franpipe to Dunkirk fell sharply in early December, likely as a result of Norwegian operators diverting gas to other higher-priced European markets.

"This situation has triggered a gas deficit in northern France and a surplus in the south, which is well supplied with LNG and pipeline gas from Spain," the CRE said.

For most of November, Norwegian gas exports to France via Franpipe averaged close to 50 million cu m/d, according to data from S&P Global.

However, flows fell sharply last month to as low as 14 million cu m/d, averaging just 24 million cu m/d over Nov. 29-Dec. 13, the data showed.

The regulator said the sudden decrease in flows to France was "probably explained" by an increase in Norwegian gas exports to the UK and Denmark.

The situation appeared to have largely resolved itself later in December, however, with imports from Norway back up to an average of 42 million cu m/d from Dec. 18 until Jan. 8, 2023.

German, UK highs

Meanwhile, Norwegian deliveries to Germany remain at historic highs as it looks to replace lost Russian gas.

In December supply to Germany totaled 3.83 Bcm, the third highest volume in 2022 after deliveries in October and November.

Gas from Norway helped Germany -- which has the biggest gas storage capacity in the EU -- to fill its gas storage sites to 100% of capacity in November.

Supplies to the UK also remained robust in December at 2.73 Bcm, but the Netherlands saw its Norwegian imports stay low at just 0.64 Bcm after it began importing more LNG into a new terminal at Eemshaven in September.

-----

Earlier: