RUSSIAN DIESEL FOR EUROPE

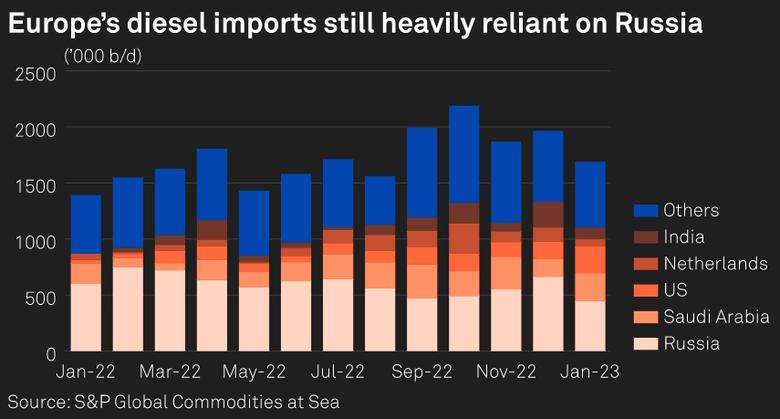

PLATTS - 19 Jan 2023 - Europe continues to source more than a quarter of its diesel imports from Russia, according to tanker-tracking data, weeks before the EU's latest embargo blocking flows of Russian oil products into the trade bloc.

Russian diesel exports both delivered and on route to the EU, Norway and the UK averaged 448,000 b/d during the first 18 days of January, down from 663,000 b/d in December and from pre-war levels of 670,000 b/d in early 2022, according to data from S&P Global Commodities at Sea.

As a result, Russian diesel makes up 27% of Europe's total 1.69 million b/d of imports in the period, the data showed.

Although still high, Europe's dependence on Russian diesel has almost halved from pre-war levels when the region sourced 46% of its diesel imports from Russia, the data showed.

The fall has come despite Russian diesel being up to $130/mt below non-Russian-origin diesel delivered into the Amsterdam, Rotterdam, Antwerp refining hub, according to traders.

With the EU's ban on imports of refined products from Russia set to go into effect Feb 5, regional fuel suppliers face a major challenge in sourcing alternative diesel, Russia's biggest single fuel export to the region.

Low diesel and gasoil stocks in the region add to the urgency for new sources of supply.

Middle distillate stocks in OECD Europe rose 800,000 barrels in December, according to Euroilstock data, but remained some 30 million barrels below the five-year average.

Alternative suppliers

The last post-EU Russia diesel loadings bound for Europe may have already taken place, according to some European oil traders, as both the delivery and payment for Russian products need to be completed ahead of the Feb. 5 sanctions.

That leaves 17 days for tankers to load, transport, discharge and for payment to be completed, notwithstanding the added complications to payment with Russian entities as a result of prior financial sanctions.

Since Russia's invasion of Ukraine, US refiners have become the biggest source of alternative diesel into Europe, the tanker data showed, shipping a record 237,000 b/d to the region so far in January, up from 34,000 b/d at the start of 2022.

Buyers have supplies have also lent on Saudi Arabia and the UAE to help plug the supply gap. Europe's dependence on Middle East diesel was expected to rise with the ramp-up of the Al Zour refinery in Kuwait, the Jazan plant in Saudi Arabia, Karbala in Iraq, and the Duqm refinery in Oman.

Europe's diesel imports have also come from further east since the war. Diesel flows from China and Malaysia rose sharply from December levels to a combined 77,000 b/d while India's diesel exports to the region stood at 105,000 b/d down from a record 230,000 b/d last month.

Together, Asian diesel flows to Europe were around 150,000 b/d higher than pre-war levels, the data showed.

Russian impact

Despite the urgent need to replace Russian diesel imports, the EU remains upbeat over filling any supply shortfall. EU energy chief Kadri Simson said Jan. 15 the trade has secured alternative fuel supplies and could draw on their strategic oil reserves to mitigate the impacts of the upcoming sanctions.

"We believe that we gave sufficient time for our markets to react and find alternative supplies," Simson said. "We have mapped all of those alternative supplies. We believe that we are prepared, and on top of that, we do have strategic oil reserves [which] gives us additional confidence."

Question marks remain over where the displaced Russian diesel might go and the extent that Russian refiners may be forced to cut runs as trade flows readjust to the latest EU import sanctions.

Noting that only 10% of Russia's oil product flows to Europe have been redirected ahead of the EU products ban, Goldman Sachs expected Russian production to drop 600,000 b/d by April given a lack of tankers to fully redirect oil flows.

Analysts at S&P Global Commodity Insights estimate Russian oil production volumes will dip 600,000 b/d after February as the EU import ban on products creates larger dislocations in market flows.

Russian supply losses could peak at 930,000 b/d below pre-war levels in March, however, due to pending sanctions on fuel exports before production rebounds 400,000 b/d by Q4 2023, according to S&P Global.

-----

Earlier: