RUSSIAN OIL FOR CHINA, INDIA

PLATTS - 16 Jan 2023 - The insatiable appetite for discounted Russian cargoes from India and China has offered enough bandwidth to Middle Eastern suppliers to cater to the needs of other Asian oil importers that have that slashed their purchases from the largest non-OPEC supplier since the invasion of Ukraine last February.

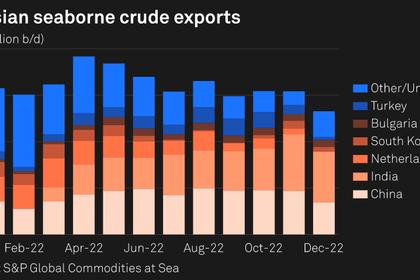

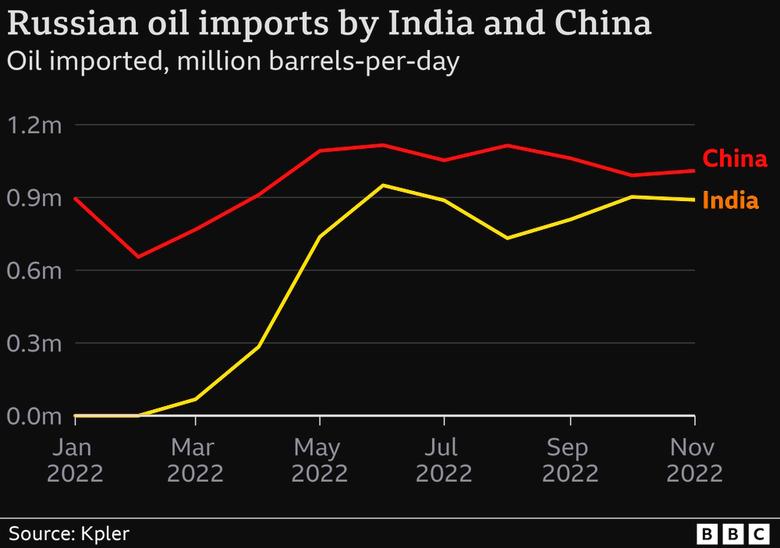

With India becoming the largest buyer of Russian crude in late 2022 and China posting close to double-digit growth in Russian inflows over January-November, refiners in South Korea, Japan and Thailand are finding it easier to procure term and spot crude supplies from Middle Eastern producers, refinery and trading sources told S&P Global Commodity Insights.

"The trends that we saw in Asia in 2022 are likely to continue this year, with China and India importing large volumes of crudes from Russia, while South Korea has cut back buying from the same supplier substantially and Japan not importing from that country," said Lim Jit Yang, adviser for Asia-Pacific oil markets at S&P Global Commodity Insights.

According to industry and some government officials, the big shift in focus of India and China toward Russian crude has softened the competition for Middle Eastern crude in Asia, leaving enough room for those oil producers to even cater to the needs of some European buyers.

"If India and China were also competing like crazy for Middle Eastern oil, the price of crude might have been much higher than where it is now," said an analyst with a leading global oil trading firm, echoing what some Indian government officials have said in recent months.

Surge in imports

Russian crude's share in the Indian crude basket in 2021 was only around 2.2%, according to S&P Global Commodity Insights. From that level, Russia became India's top crude supplier in November 2022, with the country receiving around 1 million b/d, and were on course to be even higher in December, estimated at 1.24 million b/d, due to competitive landed costs.

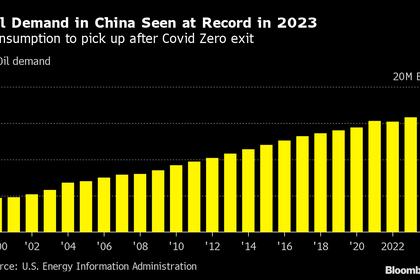

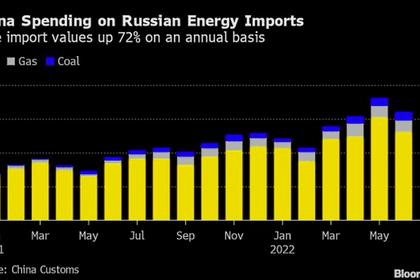

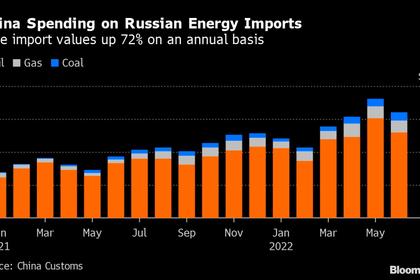

Over January-November, China's crude imports from Russia rose 10.2% year on year to 79.78 million mt, or 1.75 million b/d, customs data showed.

ESPO crude arrivals in Shandong ports for independent refineries soared 36.6% from November to a 31-month high of 2.6 million mt, or 614,774 b/d, in December, according to S&P Global data. The increase suggested Shandong refineries were confident in importing Russian barrels despite the price cap imposed Dec. 5.

Market sources said Middle Eastern sour crude procurement had been smooth due to Indian and Chinese refiners' willingness to take more Russian crude that has helped to meet the revival in demand after the lifting of pandemic restrictions. This has worked in favor of the region's overall crude supply security.

"It's actually possible to even request for incremental barrels and major suppliers like Aramco and ADNOC would approve these days as Asia's mega importers like India and China are absorbing as much Russian crudes as they want, leaving plenty of room for other key Asian buyers to take Middle Eastern term supplies," said a feedstock manager at a South Korean refiner.

South Korea's crude imports from Saudi Arabia rose on a year-on-year basis for the fifth straight month in November, gaining 15% to 29.59 million barrels, data from state-run Korea National Oil Corp. showed. Asia's third biggest crude importer received 309.15 million barrels from Saudi Arabia over January-November 2022, up 24% from the same period a year earlier.

Dubai market structure

The Dubai market structure has been trending lower rather sharply since the third quarter of 2022 as Indian and Chinese traders shift focus to cheap and attractive Russian barrels, tilting the Middle East-Asian market's supply-demand balance in favor of buyers, according to crude and condensate traders at PTT and another Thai refiner.

"Had Indian and Chinese refiners decided to also shun Russian crude and if they were to compete fiercely with other Asian buyers for the limited Middle Eastern supply, both outright prices, as well as Persian Gulf official selling price differentials, would remain high," a feedstock trader at a Thai refiner said.

Thailand secured plentiful light and medium sour crude from the UAE in 2022, receiving 360,000 b/d from the major Middle Eastern producer over January-November, up 73.3% from the same period a year earlier, Energy Policy and Planning Office data showed.

Meanwhile, Japan saw crude shipments in the first 11 months 2022 from its top supplier UAE jump 21.3% from a year earlier at 1.03 million b/d, latest data from the Ministry of Economy, Trade and Industry showed.

"Basically, India and China's strong focus on Russian barrels meant less mouths to feed within the Middle Eastern supply pool, which explains Japan's boost in Abu Dhabi sour crude shipments," a feedstock management source at ENEOS said.

-----

Earlier: