VAST SUBSIDIES FOR GREEN HYDROGEN

By STEVE GOREHAM Speaker, Author, and Researcher, New Lenox Books

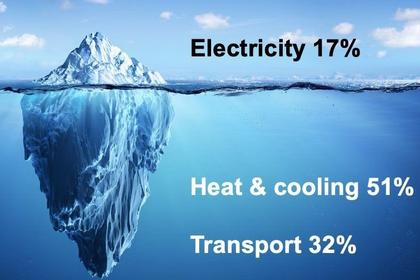

ENERGYCENTRAL - Oct 19, 2023 - World leaders tout “green hydrogen” as an essential fuel in the renewable energy transition. Today, heavy industries use huge amounts of coal and natural gas to produce products needed by society. Governments propose to replace hydrocarbon fuels with hydrogen fuel, using hundreds of billions of dollars in subsidies. But vast subsidies won’t be enough to overcome the insurmountable problems with green hydrogen fuel.

Four big industries—ammonia, cement, plastics, and steel—are powered by natural gas and coal, also called hydrocarbon fuels, while emitting large amounts of carbon dioxide (CO2). The world’s ammonia industry produced almost 200 million tons of ammonia in 2020, primarily for agricultural fertilizer, using natural gas and coal as fuel and feedstock. About 4.3 billion tons of cement, the essential material for concrete, were output that same year, while exhausting CO2 and burning hydrocarbons in furnaces. Over 300 million tons of plastic are produced each year using gas for feedstock and fuel. Annually, 1.9 billion tons of steel are produced using coal and gas.

To reduce CO2 emissions, world leaders call for heavy industry to switch from natural gas and coal to hydrogen fuel. When hydrogen burns, the only combustion product is water vapor.

Most hydrogen in nature exists in compounds, such as water (H2O) or methane (CH4). But hydrogen is not expensive. When produced from hydrocarbons, it costs only about a dollar a kilogram. About 99 percent of the world’s 70 million tons of annual hydrogen production comes from gas, using steam methane reforming, or from coal, using coal gasification. But advocates propose to produce green hydrogen from electrolysis of water, using electricity from wind, solar, and other renewable sources.

Electrolysis uses electricity to decompose water into hydrogen and oxygen gas. Industrial electrolyzers use complex cell structures, catalysts, and electrolytes to maximize efficiency and reduce cost. But few electrolyzers operate today because the hydrogen they produce is very expensive. Hydrogen from electrolysis, called green hydrogen, typically costs more than $5 per kilogram, or more than five times the price when produced from natural gas.

Electrolysis is expensive because it uses huge amounts of electricity. Production of one kilogram of hydrogen from electrolysis requires about 50─55 kilowatt-hours (kWh) of electricity, or almost double the daily power consumed by a US home. In 2022, the industrial price of electricity was about six cents per kWh in the United States and about 12 cents per kWh in Germany. To produce a kilogram of hydrogen, the electricity alone costs about $3 in the US and $6 in Germany, or three and six times the price of hydrogen produced by natural gas.

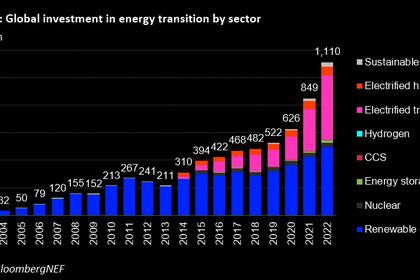

Nations plan to pour vast amounts of subsidy money into hydrogen production to try to overcome the cost problem. This month President Biden announced $7 billion in subsidies for regional hydrogen hubs to try to rein in climate change. Announced hydrogen subsidies have passed $280 billion globally, with the US expected to provide $137 billion over the next ten years.

The US Inflation Reduction Act offers an astounding subsidy of $3 to produce a kilogram of green hydrogen, three times the market price. Imagine a subsidy of $150,000 to purchase a $50,000 electric car or a subsidy of $12 to produce a $4 gallon of gasoline. There appears to be no end to the cash governments will pay to try to establish a hydrogen economy.

Most hydrogen produced today from gas or coal is used on site to produce ammonia to make synthetic nitrogen fertilizer. There are no regional markets for hydrogen because hydrogen is very difficult to transport. Transportation adds additional costs to the already exorbitant price of green hydrogen.

Advocates propose that gas pipelines be used to transport hydrogen. But hydrogen is very reactive and degrades metal by a process known as hydrogen embrittlement. Embrittlement can cause cracks, leaks, and even explosions in metal pipelines. The US National Renewable Energy Laboratory recommends that pipeline blends be less than 20 percent hydrogen to minimize embrittlement.

Transporting hydrogen by ship is also costly. Liquefaction of hydrogen to -253oC requires energy equal to about 25─35 percent of the hydrogen itself, compared to the 10 percent needed to liquify natural gas. Hydrogen can be transported in the form of ammonia, which liquifies at 35oC, but must then be converted back to hydrogen, requiring energy equal to up to 30 percent of the energy content of hydrogen itself.

For hydrogen to be green, electrolyzers must use electricity from renewable or nuclear sources. But most electricity still comes from coal, oil, and natural gas, including 61% of US power in 2021, and most of the power in China (66%), India (78%), and Japan (65%). Only 37 percent of Europe’s electricity comes from hydrocarbons, but today Europe hardly has enough electricity to keep the lights on, and little to spare for electrolysis.

Converting industry to use green hydrogen fuel would require vast amounts of renewable electricity. For example, the average European steel plant produces about four million tons of crude steel per year. Hydrogen Europe, a hydrogen advocacy group, estimates that running one average plant on hydrogen would require about five GW of solar-array capacity to drive the electrolyzers. This is more than 13 times the output of California’s Ivanpah solar facility. A solar facility that could generate this much electricity would cover more than 70 square miles. To convert the world’s steel industry to run on green hydrogen, over 5,000 TWh of electricity from renewables would be needed to drive electrolyzers. This is more than the world’s total output of renewable electricity today.

Alternatively, to power electrolyzers for the steel industry, the world would need to build 600 nuclear plants, added to the 437 nuclear plants operating today. This isn’t going to happen. There won’t be enough renewables to produce green hydrogen for heavy industry.

Advocates appear to believe that a landslide of money can create a new green fuel industry. But a hydrogen fuel industry, if created, will be small and based entirely on government subsidies, not sound economics.

-----

This thought leadership article was originally shared with Energy Central's Energy Collective Group. The communities are a place where professionals in the power industry can share, learn and connect in a collaborative environment. Join the Energy Collective Group today and learn from others who work in the industry.

-----

Earlier: