BRITAIN RENEWABLES PRICES UP

BLOOMBERG - Nov 9, 2023 - The ceiling for bids from offshore wind companies in the next auction round is likely to be considerably more than this year’s £44 ($54) of guaranteed revenue per megawatt-hour of power produced, according to people familiar with the matter. The price, due to be published later this month, is likely to be set at about £70-75, one of the people said.

The ceiling for bids from offshore wind companies in the next auction round is likely to be considerably more than this year’s £44 ($54) of guaranteed revenue per megawatt-hour of power produced, according to people familiar with the matter. The price, due to be published later this month, is likely to be set at about £70-75, one of the people said.

Shares of wind-farm developers including SSE Plc and RWE AG rose on the news. Orsted A/S, the world’s largest offshore wind builder, closed up 5.3% in Copenhagen, its largest jump in a week.

A substantial hike may help attract developers — none of which bid into the latest auction round because the price was too low for offshore wind to be viable. It would also come as Orsted plans to decide by December whether to proceed with a UK development, and as Sweden’s Vattenfall AB mulls what to do with a giant project off the English coast that it shelved earlier this year in response to soaring costs.

An auction limit of £75 a megawatt-hour will mark a reversal from previous tenders, where prices have fallen steadily in recent years and some deals hit a record-low £37 in 2022. The prices are based to 2012 levels, meaning the resulting contracts may be more expensive.

“I don’t see why at £75 you shouldn’t be able to build out offshore,” said Henrik Andersen, the chief executive officer of turbine-maker Vestas Wind Systems A/S, in an interview Thursday. “Right now you see it in the UK there is an inflationary development and that still triggers some price development upwards.”

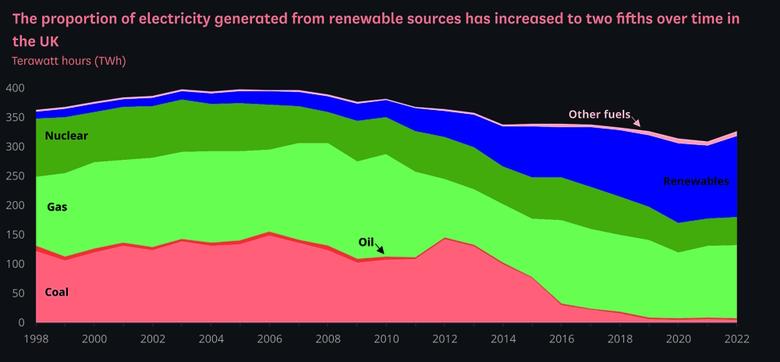

Britain’s Contracts for Difference program ensures wind developers receive a fixed price for each megawatt-hour of power their turbines produce, usually on 15-year contracts that lock in revenue certainty, funded by consumer bills. It’s been a key pillar to secure clean-energy investment in the UK, which is targeting 50 gigawatts of offshore wind capacity by 2030, up from about 14 gigawatts now.

While higher subsidies in the next auction round, known as AR6, may well reinvigorate offshore wind development, it will likely feed through to increased electricity costs for consumers still burdened with sky-high bills in the wake of last year’s energy crisis.

Energy Secretary Claire Coutinho said last month that her department was prepared to hike the price. “I am committed to a successful AR6, a round that includes offshore wind in which sustainably-priced projects will be able to compete,” she said in a speech.

It’s not just the cost of building renewables that’s rising. The capacity market, which helps secure investment in gas-fired power plants among other assets, saw prices soar in the last auction to levels far higher than expected.

-----

Earlier: