GLOBAL OIL DEMAND WILL UP BY 2.5 MBD

OPEC - 13 Nov, 2023 - OPEC MONTHLY OIL MARKET REPORT

Oil Market Highlights

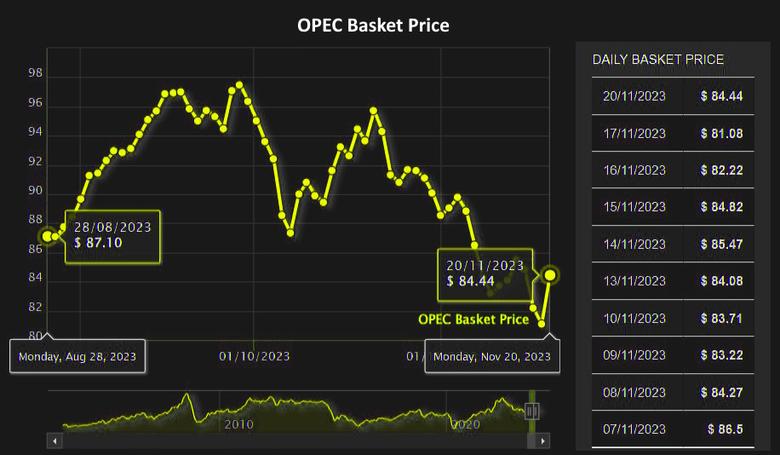

Crude Oil Price Movements

In October, the OPEC Reference Basket (ORB) fell by $2.82, or 3.0%, m-o-m, to an average of $91.78/b. The ICE Brent front-month contract fell by $3.89, or 4.2%, m-o-m, to $88.70/b, and the NYMEX WTI front-month contract fell by $3.96, or 4.4%, m-o-m, to average $85.47/b. The DME Oman front-month contract fell by $4.06, or 4.3%, m-o-m, to settle at $89.31/b. The front-month ICE Brent/NYMEX WTI spread widened in October by 7¢ to average $3.23/b. The market structure strengthened further as the front end of futures forward curves for ICE Brent, NYMEX WTI and DME Oman steepened on concerns over geopolitical tensions in the Middle East. Hedge funds and other money managers heavily cut bullish positions, fuelling price volatility and contributing to the drop in futures prices.

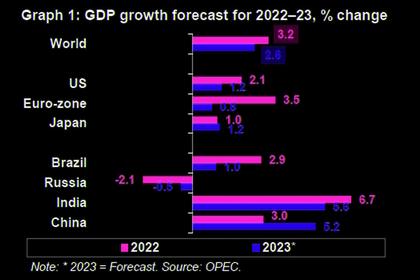

World Economy

The forecast for world economic growth remains unchanged at 2.8% for 2023 and 2.6% for 2024. US economic growth is revised up to 2.3% for 2023 and 0.9% for 2024. Eurozone economic growth is revised down for both 2023 and 2024 to stand at 0.2% and 0.5%, respectively. Japan’s economic growth forecast for 2023 is revised up to 1.9%, while growth in 2024 remains at 1.0%. The forecast for China remains unchanged at 5.2% for 2023 and 4.8% for 2024. India’s growth forecast remains unchanged at 6.2% for 2023 and 5.9% for 2024. Brazil’s forecast also remains unchanged at 2.5% in 2023 and 1.2% in 2024. Russia’s economic growth forecast is revised up to 1.9% for 2023 and 1.2% for 2024.

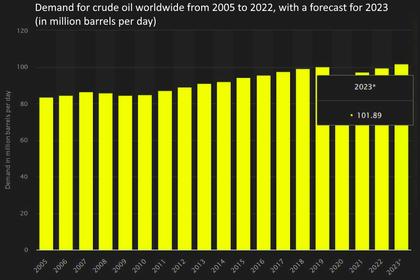

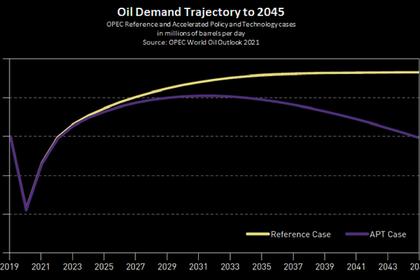

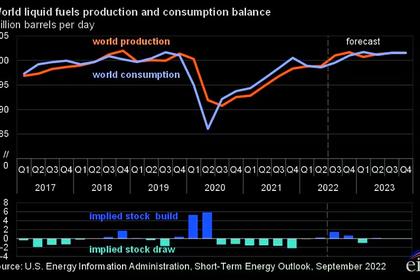

World Oil Demand

The world oil demand growth forecast for 2023 is revised up marginally from the previous month’s assessment to 2.5 mb/d. Revisions to data for the OECD countries throughout the first three quarters largely offset each other. In the non-OECD, the upward revisions to China’s oil demand in both 3Q23 and 4Q23 outpaced the downward revisions in the non-OECD region in 3Q23. In 2023, OECD oil demand is expected to rise by around 0.1 mb/d, while non-OECD oil demand is expected to increase by 2.4 mb/d. For 2024, world oil demand is expected to grow by a healthy 2.2 mb/d, unchanged from the previous month’s assessment. The OECD is expected to expand by about 0.3 mb/d in 2024, with OECD Americas contributing the largest increase. The non-OECD is set to drive next year’s growth, increasing by about 2.0 mb/d, with China, the Middle East, Other Asia and India contributing the most.

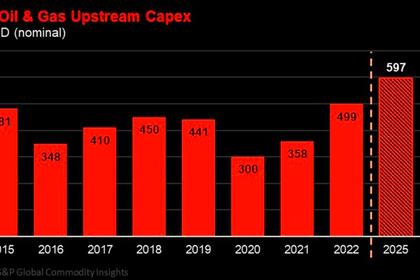

World Oil Supply

Non-OPEC liquids supply growth forecast is revised up to 1.8 mb/d in 2023. Main drivers of liquids supply growth for 2023 include the US, Brazil, Kazakhstan, Norway, Guyana, Mexico and China. For 2024, non-OPEC liquids production is expected to grow by 1.4 mb/d, broadly unchanged from the previous month’s assessment. Main drivers for liquids supply growth next year are set to be the US, Canada, Guyana, Brazil, Norway and Kazakhstan. OPEC NGLs and non-conventional liquids are forecast to grow by around 50 tb/d in 2023 to average 5.4 mb/d and by another 65 tb/d to average 5.5 mb/d in 2024. OPEC-13 crude oil production in October increased by 80 tb/d m-o-m to average 27.90 mb/d, according to available secondary sources.

Product Markets and Refining Operations

In October, refinery margins remained strong but declined slightly, continuing the downward trend registered in the previous month. In the Atlantic Basin, the vast majority of the observed downturn is attributed to gasoline, as markets for the product weakened following the end of the summer season, amid reports of significant gasoline stock builds. In Singapore, the relatively weaker performance was also led by gasoline, although the weakness was more evenly distributed across the barrel, with naphtha seeing the smallest decline. Global refinery intake continued to decrease m-o-m in October, showing a 1.4 mb/d decline to an average of 80.1 mb/d. Y-o-y, however, intakes were 2.2 mb/d higher. In the coming months, refinery intakes are expected to start to recover as offline capacities begin to subside with the conclusion of a heavy autumn maintenance season.

Tanker Market

Dirty spot freight rates began to recover in October as refiners started preparing for winter demand following maintenance. Gains were strongest in the smaller class vessels. Suezmax spot freight rates surged to a five-month high during the month, with rates on the US Gulf Coast to Europe route increasing by 98%, m-o-m. Aframax spot freight rates also saw a significant increase, with rates around the Mediterranean up by around 74%, m-o-m. In contrast, VLCC spot freight rates saw a more moderate increase, with rates on the Middle East-to-East route up 26%, m-o-m, amid a return of long-haul demand from Asia. Meanwhile, clean rates saw mixed movement. East of Suez rates were broadly flat m-o-m, supported by an increase on the Middle East-to-East route, while West of Suez rates fell 19%, m-o-m, as margins weakened in the Atlantic basin amid high inventories of key products.

Crude and Refined Products Trade

Preliminary data shows US crude imports falling by around 10%, m-o-m, in October to stand at the lowest since December 2022. US crude exports increased to 4.6 mb/d, the highest since March 2023. China’s crude imports fell back to 11.2 mb/d in September, after surging to the second-highest level on record the month before. China’s product exports slipped 5% in September after reaching a six-month high, as product export quotas are constrained. India’s crude imports fell further to an average of 4.3 mb/d in September, the lowest in a year, although are expected to recover with the start of 4Q23. India’s product imports rose to a ten-month high ahead of the festive season, while exports fell from a five-month high the month before, on an expected return of domestic demand. Japan’s crude imports rose further to an average of 2.6 mb/d in September. Product exports jumped 39%, m-o-m, to a seven-month high of 596 tb/d, with gains seen across all major products, except kerosene. Preliminary estimates show OECD Europe crude imports remaining relatively stable at the start of 3Q23, while product imports are expected to trend lower.

Commercial Stock Movements

Preliminary September 2023 data sees total OECD commercial oil stocks down by 15.6 mb, m-o-m. At 2,783 mb, they were 184 mb below the 2015–2019 average. Within the components, crude and products stocks fell by 9.3 mb and 6.3 mb, respectively, m-o-m. OECD commercial crude stocks stood at 1,336 mb in September, which is 99 mb lower than the 2015–2019 average. Total product stocks fell by 6.3 mb to stand at 1,447 mb in September, which is 84 mb below the 2015–2019 average. In terms of days of forward cover, OECD commercial stocks fell by 0.3 days, m-o-m, in September to stand at 60.6 days, which is 1.9 days below the 2015–2019 average.

Balance of Supply and Demand

Demand for OPEC crude in 2023 remained unchanged from the previous month’s assessment to stand at 29.1 mb/d, which is 0.6 mb/d higher than in 2022. Demand for OPEC crude in 2024 is also remained unchanged from the previous month’s assessment to stand at 29.9 mb/d, 0.8 mb/d higher than the estimated level in 2023.

-----

Earlier: