RUSSIAN, EUROPE OIL CAP

PLATTS - 17 Nov 2023 - The European Commission is proposing to tighten reporting requirements for shippers and their insurers as part of a clampdown on the circumvention of the G7 oil price cap on Russian oil exports and other sanctions measures against Moscow, according to reports.

According to a widely leaked proposal, the European Commission hopes to introduce a "requirement for attestations to also include itemized ancillary costs, such as insurance and freight," on top of a declaration on the price paid for the Russian oil.

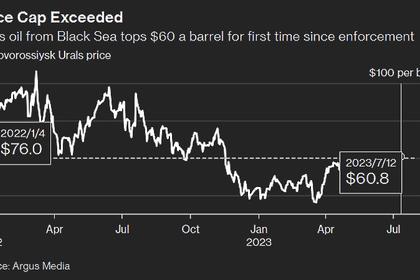

Under the current rules in place since December 2022, Western shippers and tanker charterers are required to declare they paid no more than $60/b to lift Russian crude cargoes. However, FOB spot prices for Russia's Urals crude have traded above $60/b since mid-July, while Russian export volumes remain robust, fueling concerns that some traders have been paying additional sums over the official reported crude price and claiming the total value included additional costs such as freight and insurance fees.

The EC last week said it will soon announce a 12th Russian sanctions package set to include measures to stop some shippers from "sanctions busting" amid rising concerns that Moscow is able to widely flout the G7's $60/b "price cap" on Russian crude exports.

A European Commission spokesperson declined to comment on the details of the proposals.

Prices for Urals crude have fallen sharply in recent weeks from a recent high of over $84/b in September due to a weakening in global oil prices on concerns over the pace of demand growth. Platts, part of S&P Global Commodity Insights, assessed FOB Urals Primorsk at $63.965/b on Nov. 16.

Danish blockade?

Political pressure on the US and the EU to rethink its oil sanctions on Russia has been growing due to shrinking discounts for Russian crude that have helped swell Moscow's oil revenues. Moscow has been also successful in redirecting its oil to non-Western customers through a growing 'shadow' tanker fleet transporting more than 60% of Russian crude exports.

EU lawyers last week reiterated calls for a complete closure of the EU market for Russian-origin fossil fuels, while non-governmental organizations said Lukoil may be skirting the oil curbs in Bulgaria. The US and the UK have already opened enforcement proceedings against some tanker owners and shippers which they say have cheated the price cap mechanism.

Meanwhile, a report that the EU is considering tasking Denmark with inspecting and potentially blocking Russian oil tankers sailing through its waters on safety grounds is being viewed with skepticism by industry experts.

EU member state Denmark would target tankers transiting the Danish Straits without Western insurance under laws permitting states to check vessels they fear pose environmental threats, the Financial Times reported Nov. 15, citing people with knowledge of the talks.

"The idea appears to reflect frustration that the price cap has perhaps fallen short of G7 expectations," vice president and head of research for Oil Markets, Energy and Mobility, S&P Global Commodity Insights Jim Burkhard said.

Russia exported 1.7 million b/d of crude from the Baltic in October, or 33% of its total seaborne exports, according to S&P Global Commodities at Sea data. Almost all of the crude is Russia's key medium sour Urals export grade shipped from the ports of Primorsk and Ust Luga. Russian product exports from the Baltic also totaled 740,000 b/d in November, 57% of Russia's total, CAS data showed.

Baltic shipments

Russia has responded to the report saying that any attempts to control shipping in the Danish straits would contravene international maritime law allowing all "innocent passage" on the high seas. But the measure would reportedly use powers allowing authorities to check tankers for perceived pollution risks.

"It remains unclear however whether action may be taken by coastal states in prevention of such incidents occurring," maritime risk consultancy Dryad Global's analyst, Noah Trowbridge, told S&P Global. "Given this fragile legal ground, the associated risk of escalation with Russia and the practical difficulties in enforcing this measure, its feasibility remains in serious doubt."

The European Commission declined official comment, but a source close to the commission's proposal said they are not aware of any new obligations for Denmark.

"In our opinion, this is a highly speculative report as it will be almost impossible for Denmark to stop some traffic from freely going through the Strait as it is the subject of a centuries-old agreement which permits unobstructed transit through it," Andrew Wilson, research head at shipbroker BRS said, referring to the Copenhagen Convention of 1857.

If checks on Russian tankers are implemented, however, Wilson said it could see Russia re-route more of its crude away from the Baltic and towards its Black Sea export terminal at Novorossiisk.

-----

Earlier: