U.S. FOSSIL FUELS CHOICE

By LLEWELLYN KING Executive Producer and Host, White House Media, LLC

ENERGYCENTRAL - Oct 26, 2023 - When you see a sleek new Tesla in a parking lot or hear an announcement of a utility committing to solar or that work is proceeding with converting steel-making from coal to electricity, you might think oil and natural gas are on the ropes, that coal has left the utility scene and the new, green world is at hand.

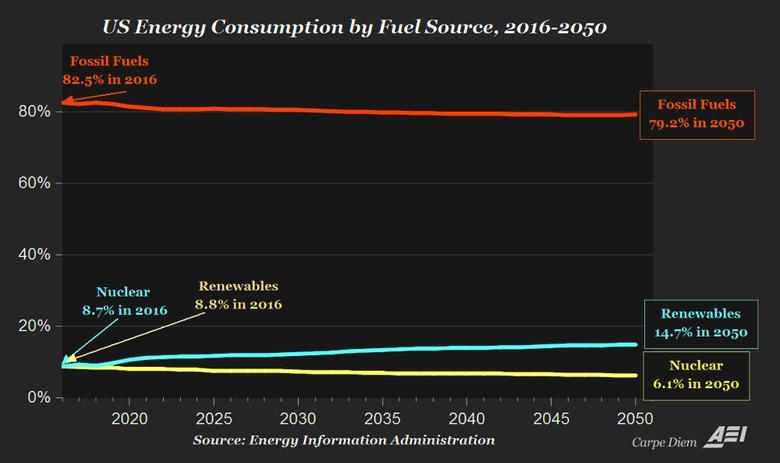

Yes, yes, yes, Herculean efforts are underway in advanced countries to curb the use of fossil fuels. But those fuels are still dominant and will remain so for a long time. World oil consumption is now at 97 million barrels a day. It is set to rise before it falls back.

In the United States last year, according to the Energy Information Administration, natural gas accounted for 39.9 percent of electricity production; coal, 19.7 percent; nuclear, 18.2 percent; and renewables, the rest, although these are coming on fast.

A study released this month by the International Energy Agency in Paris predicts world oil production will peak in 2030. Maybe. But one by the Organization of Petroleum Exporting Countries also released recently, says this won’t occur until 2045 or later.

One way or another, oil remains the big enchilada of fossil fuels. Gradually, it may yield to natural gas, which has become a vital part of the U.S. and global electricity scene. Eventually, it will become essential as a maritime fuel.

Oil has been phased out of U.S. electricity generation, except for emergencies. But natural gas has become the bridge, if you will, to the renewables, mainly wind and solar.

Though under threat, coal is still a vital part of U.S. electricity generation. In China and India, its share is 50 percent and rising.

Although oil may peak in 2030 or 15 years later, it is going to be the critical transportation fuel for decades. Even if electric cars take over, and light trucks and some buses do likewise, it will be a long time before ships, trains, inter-city trucks, and airplanes give it up.

New cruise ships will be powered with natural gas, and some of the larger, older ones are slated to make the conversion. But for the rest of the global maritime fleet, that isn’t going to happen.

There are about 55,000 merchant ships traversing the world’s oceans. Hardly any of them will convert to compressed natural gas, which is much less polluting than the oil now burned at sea, mostly residual or diesel.

The reason they won’t convert is prohibitive cost; bunkering is a problem, too. Major new infrastructure is needed to support compressed natural gas as a maritime fuel.

Aircraft have an acute problem of their own. It arises from the way jets spew pollution at altitude, making them a potent source of greenhouse gas emissions.

While it isn’t certain how many aircraft there are in the world, estimates put large aircraft at around 23,000, and if absolutely everything that is flyable with an engine is added, it may be close to double that number.

The airlines, airframe makers, and engine manufacturers are desperately seeking solutions, but so far, nothing viable has emerged. Batteries are heavy and draw down quickly; hydrogen doesn’t have the energy density and is highly flammable.

No new technology is on the horizon, but more people are flying, and that number appears to be exponential. Up, up, and away is now an expectation for even people of modest income.

The surviving usefulness of fossil fuels globally presents U.S. policy-makers with a dilemma: It is the world’s largest oil and natural gas producer. It has a surplus of natural gas for export as liquified natural gas (LNG). The United States produces 12 million-plus barrels of oil a day, but well short of the 19 million barrels a day the nation consumes. Ergo, there is a security advantage in increasing domestic oil production, which alarms the Biden administration.

LNG exports are important not only because of their profitability but also their stabilizing effect on world markets, as demonstrated by the Ukraine crisis.

It behooves the United States to up the production and export of natural gas while continuing downward pressure on domestic oil consumption. A simple enough proposition, except that environmentalists and the administration would like to reduce natural gas consumption and production.

New England, for example, tried to starve out gas by not installing delivery pipelines. Now, LNG that should be flowing overseas to stabilize and reduce coal consumption is going to the Northeast, a costly and futile attempt at curbing greenhouse gases.

Damn those fossils! You can’t live with them, and you can’t live without them.

-----

This thought leadership article was originally shared with Energy Central's Generation Professionals Group. The communities are a place where professionals in the power industry can share, learn and connect in a collaborative environment. Join the Generation Professionals Community today and learn from others who work in the industry.

-----

Earlier: